Summary

Markets are pricing in the impact of Trump's tariff war on US growth. This implies US equity underperformance, while countries like China, India, and Japan implement expansionary policies to offset tariffs.

What’s top of investors’ minds

Look for outperformance from policy stimulus

Markets have begun trying to price the extent to which US President Trump’s tariff war will slow economic growth, damage earnings, and perhaps lead to Fed rate cuts. Complicating matters is Trump’s daily and at times intra-day vacillations about which countries and products will be affected and when. However, Trump’s rhetoric increasingly suggests that he will go through with significant and broad tariffs despite stock market weakness and risks to growth. We judge this commitment to tariffs to combine with his tighter immigration policy to point to US GDP growth slowing from 2.5% last year to 1.6% - 1.8% this year with risk to the downside if he follows through with reciprocal tariffs in early April.

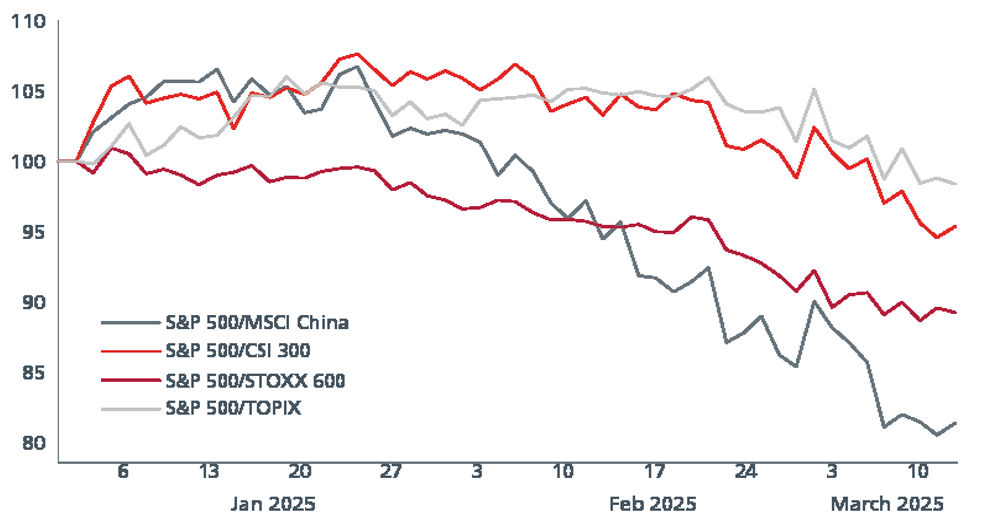

For markets this implies continued US equity underperformance particularly relative to countries where policy is turning expansionary to offset the impact of tariffs. In Asia, China stands out, just having confirmed a fiscal stimulus worth about 2% of GDP. We expect India to increasingly qualify as the Reserve Bank of India accelerates interest rate cuts in the coming months. Japan’s pro-wage growth policy should also work to insulate Japan’s domestic economy from weaker exports to some extent. Further afield, Germany’s new government has proposed a large new fiscal stimulus, although this faces political challenges for passage.

The US Federal reserve is likely to be slow to respond to any weakening of US growth because tariffs are likely to be inflationary. This implies that although the directional bias for US Treasury yields will be down, duration is likely to remain volatile. A mix of rising concerns about growth and higher equity volatility is likely to introduce pressure to US credit products in favour of EM credit where central banks will likely be faster to cut rates.

Markets tend to punish bad policy and reward good policy

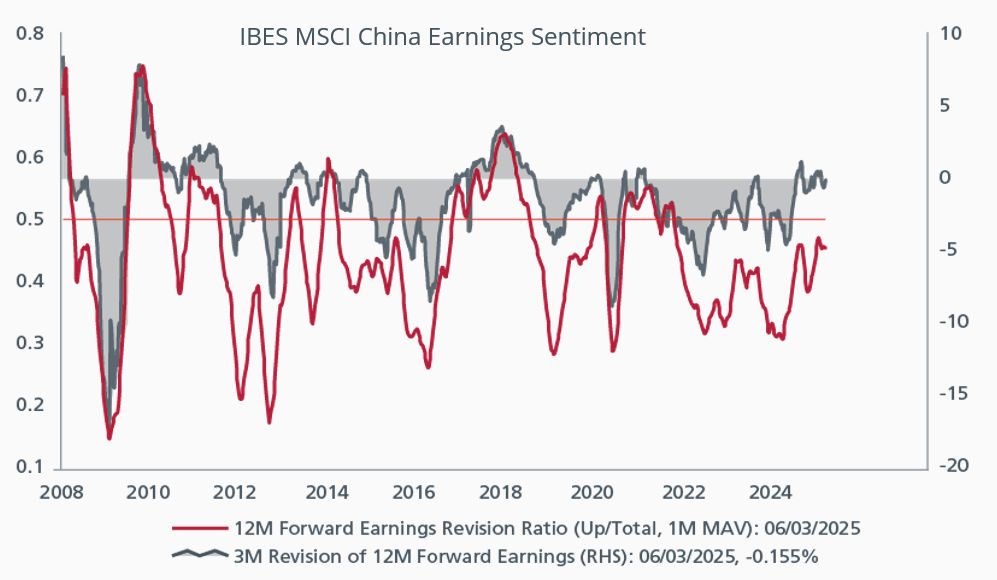

Chinese policy shifts to stimulus

China’s NPC ushered in an important policy shift back towards stimulus that will support China’s markets, in our view. Policy announced so far points to an increase in the in-budget deficit of 2.2% of GDP to about 9.9% on a cash basis and an increase in the broad, “augmented” deficit of about 1.7%-1.8% of GDP to roughly 15% of GDP. Although that was in-line with well expectations, officials suggested that the government had further policy measures in reserve if necessary. Local governments appear likely to gain new discretion over the amount of their bond quota they can use to buy excess housing and land inventory and, crucially, the price at which they can bid.

Officials suggested new support for private sector businesses in terms of cracking down on local government tax farming, increased pressure on local governments to settle arrearages to private companies and granting greater access to government contracts. China’s central bank also appears likely to cut interest rates and bank reserve requirements at least 50bps. This should boost liquidity and improve the attractiveness of property relative to interest rate products.

In sum, we expect that Beijing will spend whatever it takes to keep GDP growth above 4.5% in all but worst-case scenarios of the US raising its tariff rates on China to 50% - 60%.

Fiscal and monetary stimulus should support earnings revisions

The information and views expressed herein do not constitute an offer or solicitation to deal in shares of any securities or financial instruments and it is not intended for distribution or use by anyone or entity located in any jurisdiction where such distribution would be unlawful or prohibited. The information does not constitute investment advice or an offer to provide investment advisory or investment management service or the solicitation of an offer to provide investment advisory or investment management services in any jurisdiction in which an offer or solicitation would be unlawful under the securities laws of that jurisdiction.

Past performance and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the strategies managed by Eastspring Investments. An investment is subject to investment risks, including the possible loss of the principal amount invested. Where an investment is denominated in another currency, exchange rates may have an adverse effect on the value price or income of that investment. Furthermore, exposure to a single country market, specific portfolio composition or management techniques may potentially increase volatility.

Any securities mentioned are included for illustration purposes only. It should not be considered a recommendation to purchase or sell such securities. There is no assurance that any security discussed herein will remain in the portfolio at the time you receive this document or that security sold has not been repurchased.

The information provided herein is believed to be reliable at time of publication and based on matters as they exist as of the date of preparation of this report and not as of any future date. Eastspring Investments undertakes no (and disclaims any) obligation to update, modify or amend this document or to otherwise notify you in the event that any matter stated in the materials, or any opinion, projection, forecast or estimate set forth in the document, changes or subsequently becomes inaccurate. Eastspring Investments personnel may develop views and opinions that are not stated in the materials or that are contrary to the views and opinions stated in the materials at any time and from time to time as the result of a negative factor that comes to its attention in respect to an investment or for any other reason or for no reason. Eastspring Investments shall not and shall have no duty to notify you of any such views and opinions. This document is solely for information and does not have any regard to the specific investment objectives, financial or tax situation and the particular needs of any specific person who may receive this document.

Eastspring Investments Inc. (Eastspring US) primary activity is to provide certain marketing, sales servicing, and client support in the US on behalf of Eastspring Investment (Singapore) Limited (“Eastspring Singapore”). Eastspring Singapore is an affiliated investment management entity that is domiciled and registered under, among other regulatory bodies, the Monetary Authority of Singapore (MAS). Eastspring Singapore and Eastspring US are both registered with the US Securities and Exchange Commission as a registered investment adviser. Registration as an adviser does not imply a level of skill or training. Eastspring US seeks to identify and introduce to Eastspring Singapore potential institutional client prospects. Such prospects, once introduced, would contract directly with Eastspring Singapore for any investment management or advisory services. Additional information about Eastspring Singapore and Eastspring US is also is available on the SEC’s website at www.adviserinfo.sec. gov.

Certain information contained herein constitutes "forward-looking statements", which can be identified by the use of forward-looking terminology such as "may", "will", "should", "expect", "anticipate", "project", "estimate", "intend", "continue" or "believe" or the negatives thereof, other variations thereof or comparable terminology. Such information is based on expectations, estimates and projections (and assumptions underlying such information) and cannot be relied upon as a guarantee of future performance. Due to various risks and uncertainties, actual events or results, or the actual performance of any fund may differ materially from those reflected or contemplated in such forward-looking statements.

Eastspring Investments companies (excluding JV companies) are ultimately wholly-owned / indirect subsidiaries / associate of Prudential plc of the United Kingdom. Eastspring Investments companies (including JV’s) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America.