Summary

Volatility will be heightened as we head into 2025, but this can still lead to positive equity outcomes. Meanwhile, although the Fed is unlikely to adjust its easing policy based on actions that have yet to materialise, recent strong US economic data, and the risks of potential tariffs suggest that expectations of a weaker USD and a terminal rate of 3% feel long gone.

What’s top of investors’ minds

1. All roads point to volatility

It isn’t all bad. The last few months of 2024 have proved that volatility/uncertainty will be heightened as we continue into 2025, but this could still lead to positive equity outcomes.

In Asia, the case for Japan remains broadly intact in our view, albeit the gyrations of the yen have created alternating headwinds and tailwinds for companies. In August this was manifested in a tumultuous 48 hours of stock price movement, yet those who ‘sat on their hands’ no doubt continued to see the benefit of a stronger Japan equity market with good further upside.

Recent stimulus in China has seen equity markets rally spectacularly from the third quarter into the fourth, although this followed a pretty disappointing preceding couple of years for stock prices. While many observers are keen for more fiscal stimulus from the government to try and encourage a stubbornly saving consumer into the market, this focus does ensure that China remains part of the ‘Asia dialogue’, critical given its size in the Asia and Emerging Market indices. The imposition of further tariffs looks to be ‘when’ and not ‘if’, but China has diversified it’s trade towards Europe and Asia since the first Trump presidency. Perhaps the bigger ‘what if’ is really around the opportunity for the markets if geopolitics ignites a much greater focus on their own domestic economy.

The second largest economy in Asia, India, in contrast has been racking up month on month equity gains for the last 3 years, however the most recent quarter saw the largest foreign outflows in over 3 years and the Indian market down around 8% in October. That said, domestic mutual fund flows still stood at USD4bn and are an increasingly recurrent bulwark for the market. Of course, you could argue that a correction to Indian equities, given previously lofty valuations, coupled with moderate economic growth in coming quarters could offer further runaway for stock prices to improve. The economy still looks in decent health and a stronger domestic focus could potentially insulate the economy from the incoming President Trump. India also retains the advantage of being a beneficiary of the China + 1 policy.

2. It’s all a matter of style

Whilst the author might be able to remember the days when price discovery was not ubiquitous, investing for the journey – whether via passive, active, value, growth, low volatility strategies and more – sits at the heart of many asset allocation decisions.

It could be counter intuitive but selecting a passive index brings with it certain risks as indices are price and size based so for better or worse, have their own biases. This means that the macro-economic cycle can have an impact on simply allocating to ‘the index’ and geopolitical events can exaggerate this further, within the context where there is decent global growth.

With a second Trump presidency imminent, which will include policies that impact companies around the world, plenty of uncertainty surrounding the course of the Chinese economy and interest rate trajectories in various economies may well support diversity.

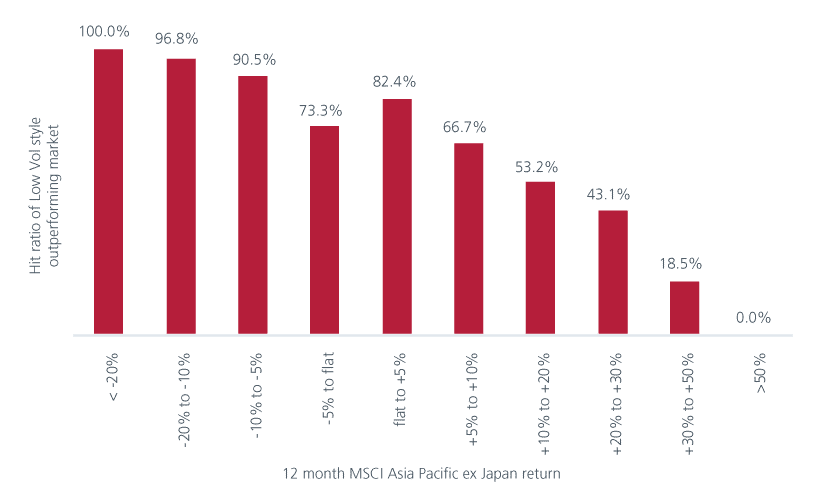

Equity market valuations in Asia and the Emerging markets look attractive although a clear understanding of company fundamentals and likely macro impacts would be key. Low volatility strategies may provide portfolios with a nice downside cushion, as may incorporating a multifactor lens to investing into markets to reduce the momentum and large cap biases of indices.

Fig. Hit ratio of low volatility style beating the market –12-month rolling periods between May 2001 and August 2024.

Data source: Eastspring Investments, LSEG Datastream. * Bloomberg, data from May 2001 to August 2024. The use of indices as proxies for the past performance of any asset class/sector is limited and should not be construed as being indicative of the future or likely performance of the Fund.

3. Can we ‘carry on’ in 2025?

Divergent economies, bouts of inflation and the paths of interest rates could create an intriguing backdrop for the fixed income markets.

A post-election risk-positive backdrop supports narrower credit spreads. The “Goldilocks” scenario—a benign growth outlook with potential stimulus-driven upside surprises, coupled with moderating inflation—creates favourable conditions for carry trades. The era of ultra-low interest rates and quantitative easing may be some way past, yet one only needs to look at the volatile reaction of markets to a stronger Yen in early August to appreciate that the hope of picking up simple returns form interest rate differentials and avoiding FX-related speed bumps remains an attractive way of earning returns, though the unwinding of this can have consequences.

Positive technicals also support credit markets, with limited issuance, elevated base yields, and strong demand from cash-rich investors amid falling cash yields. Prospects of Chinese policy stimulus currently outweigh concerns about US policies targeting China, enhancing the constructive outlook on the Asia credit complex. Recent price action reflects this sentiment. However, given strong year-to-date performance, some participants may seek to lock in gains, potentially leading to minor near-term corrections. The time may be right to rotate out of some Chinese credits with tightened spreads in favour of other geographies less exposed to US policies targeting China.

The potential for inflation from tariffs and increased government spending—leading to a steeper US Treasury curve—cannot be ignored. However, implementing these policies under a new administration could take months to over a year, even with Congressional support, suggesting that positioning for this may be premature. We observe strong market interest in buying duration following the recent yield spike post the US elections, reflecting early-stage biases toward a rate-cutting cycle.

4. What’s next for the Fed in 2025?

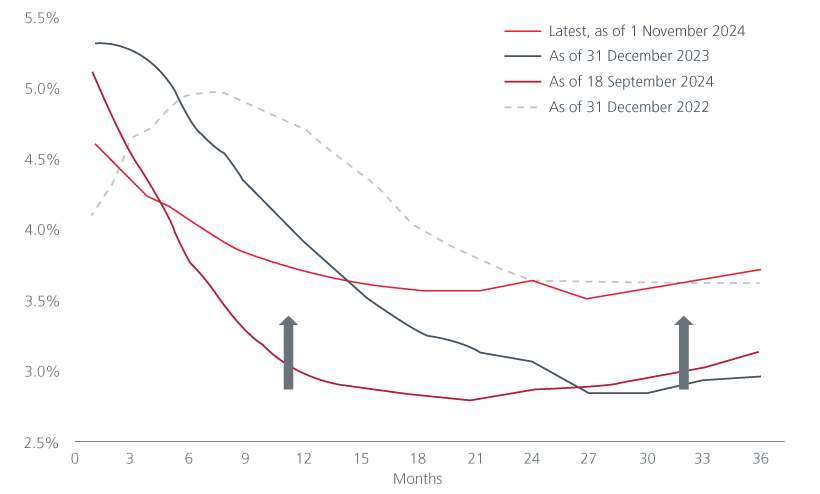

Expectations of a weaker US dollar and a terminal rate of 3% feel long gone.

At present, expectations surrounding tariffs and additional fiscal spending remain speculative. The Federal Reserve is unlikely to adjust its easing policy based on actions that have yet to materialise, therefore adhering to the path set since September.

Nonetheless, recent US economic data, including strong labour market indicators, could prompt an upward adjustment in the Fed’s policy trajectory, both in terms of pace and terminal rate. This would, in turn, support front-end yields.

With Trump in the White House in 2025, market expectations have shifted to consider if inflation may once again be a force to contend with, given talk of import tariffs, tax cuts and a crackdown on migrant labour.

Fig. Fed funds futures forward curves

Data source: LSEG Datastream, Eastspring Investments (Singapore) Limited. The use of indices as proxies for the past performance of any asset class/sector is limited and should not be construed as being indicative of the future or likely performance of the Fund. The latest data provided is as of 1 November 2024.

Please download full report to read more.

The information and views expressed herein do not constitute an offer or solicitation to deal in shares of any securities or financial instruments and it is not intended for distribution or use by anyone or entity located in any jurisdiction where such distribution would be unlawful or prohibited. The information does not constitute investment advice or an offer to provide investment advisory or investment management service or the solicitation of an offer to provide investment advisory or investment management services in any jurisdiction in which an offer or solicitation would be unlawful under the securities laws of that jurisdiction.

Past performance and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the strategies managed by Eastspring Investments. An investment is subject to investment risks, including the possible loss of the principal amount invested. Where an investment is denominated in another currency, exchange rates may have an adverse effect on the value price or income of that investment. Furthermore, exposure to a single country market, specific portfolio composition or management techniques may potentially increase volatility.

Any securities mentioned are included for illustration purposes only. It should not be considered a recommendation to purchase or sell such securities. There is no assurance that any security discussed herein will remain in the portfolio at the time you receive this document or that security sold has not been repurchased.

The information provided herein is believed to be reliable at time of publication and based on matters as they exist as of the date of preparation of this report and not as of any future date. Eastspring Investments undertakes no (and disclaims any) obligation to update, modify or amend this document or to otherwise notify you in the event that any matter stated in the materials, or any opinion, projection, forecast or estimate set forth in the document, changes or subsequently becomes inaccurate. Eastspring Investments personnel may develop views and opinions that are not stated in the materials or that are contrary to the views and opinions stated in the materials at any time and from time to time as the result of a negative factor that comes to its attention in respect to an investment or for any other reason or for no reason. Eastspring Investments shall not and shall have no duty to notify you of any such views and opinions. This document is solely for information and does not have any regard to the specific investment objectives, financial or tax situation and the particular needs of any specific person who may receive this document.

Eastspring Investments Inc. (Eastspring US) primary activity is to provide certain marketing, sales servicing, and client support in the US on behalf of Eastspring Investment (Singapore) Limited (“Eastspring Singapore”). Eastspring Singapore is an affiliated investment management entity that is domiciled and registered under, among other regulatory bodies, the Monetary Authority of Singapore (MAS). Eastspring Singapore and Eastspring US are both registered with the US Securities and Exchange Commission as a registered investment adviser. Registration as an adviser does not imply a level of skill or training. Eastspring US seeks to identify and introduce to Eastspring Singapore potential institutional client prospects. Such prospects, once introduced, would contract directly with Eastspring Singapore for any investment management or advisory services. Additional information about Eastspring Singapore and Eastspring US is also is available on the SEC’s website at www.adviserinfo.sec. gov.

Certain information contained herein constitutes "forward-looking statements", which can be identified by the use of forward-looking terminology such as "may", "will", "should", "expect", "anticipate", "project", "estimate", "intend", "continue" or "believe" or the negatives thereof, other variations thereof or comparable terminology. Such information is based on expectations, estimates and projections (and assumptions underlying such information) and cannot be relied upon as a guarantee of future performance. Due to various risks and uncertainties, actual events or results, or the actual performance of any fund may differ materially from those reflected or contemplated in such forward-looking statements.

Eastspring Investments companies (excluding JV companies) are ultimately wholly-owned / indirect subsidiaries / associate of Prudential plc of the United Kingdom. Eastspring Investments companies (including JV’s) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America.