Executive Summary

- Our pulse survey of 150 senior executives across North America, Europe and Asia reveals that supply chain rebalancing is among the top priorities for businesses. As global supply chains evolve, businesses are rebalancing to not only mitigate risks but also capture opportunities.

- High costs and a lack of capabilities are the biggest obstacles to rebalancing. While rebalancing is costly, inaction is costlier.

- The markets that are expected to grow in importance for future supply chains have only small weightings in the global and regional equity market indices. Investors may need to take a more focused approach to exploit the alpha potential from the global rebalancing theme.

Supply chains matter for investors. We have seen how semiconductor chip shortages affected the share prices of automakers in 2022. We have also seen how global supply chain shifts have impacted economies and markets in recent years. The rebalancing of global supply chains is a long-term theme. Our whitepaper provides useful information for global investors looking to learn more about the evolving supply chain landscape and the new investment opportunities arising from these shifts.

We developed a survey-based whitepaper to highlight how business leaders in the automotives, electronics manufacturing, and pharmaceuticals and medical equipment sectors across North America, Europe, and Asia are rebalancing their priorities between driving growth and navigating supply chain issues.

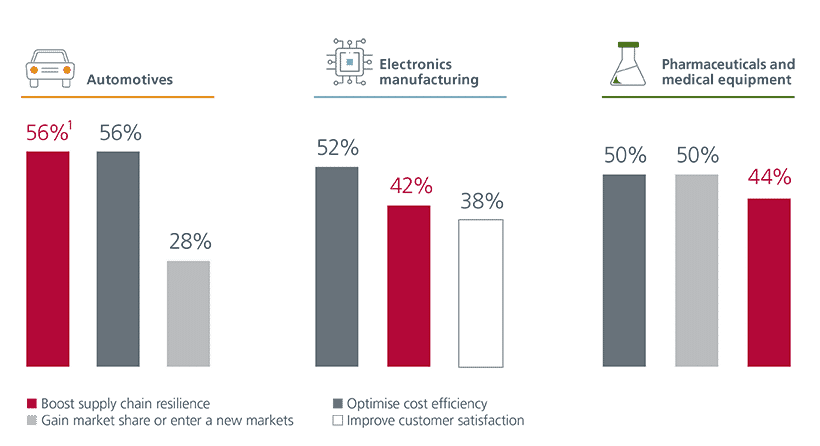

Boosting supply chain resilience is among the top priorities for business leaders across the three sectors

Q. Please rank the following business priorities from the highest to the lowest.

Source of chart: Whitepaper report – The rebalancing roadmap (Pg 19). 1. Percentages indicate the share of business leaders who ranked the given priority among the first or second priorities.

Source of chart: Whitepaper report – The rebalancing roadmap (Pg 19). 1. Percentages indicate the share of business leaders who ranked the given priority among the first or second priorities. Global supply chain shifts are being driven by key structural factors such as geopolitics, trade disruptions, climate events, and costs. The series of disruptive events since 2020 has however accelerated these shifts and forced businesses to reevaluate their strategic priorities to stay resilient and competitive. Businesses are reevaluating their dependencies on single-supplier or single-market sourcing strategies, which, historically, were cost-effective but have become increasingly fragile.

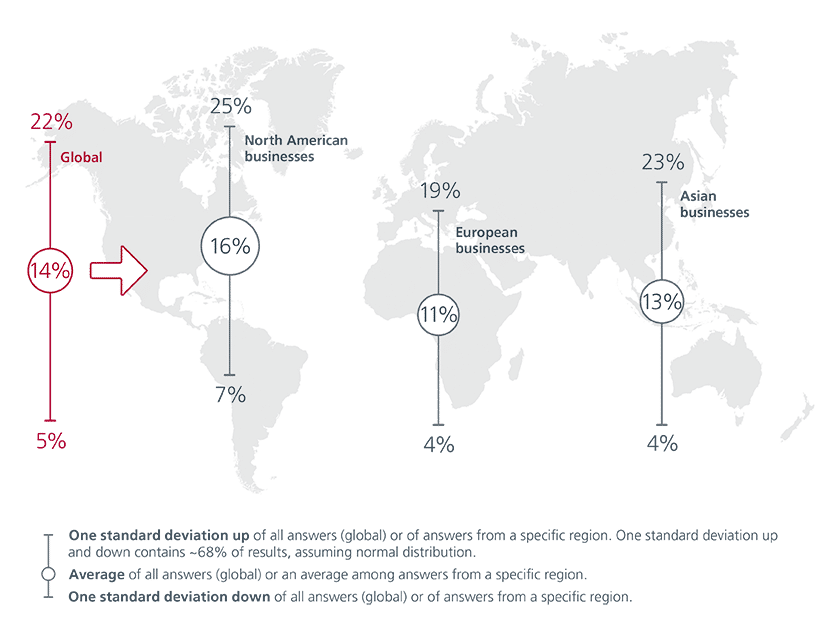

Across the three regions surveyed, rebalancing will be the most expensive for North American businesses

Q. Relative to your company’s average annual revenue over the past 3 years, what percentage must be invested over the medium term (3-5 years) to diversify/rebalance?

Source of chart: Whitepaper report – The rebalancing agenda (Pg 12).

Source of chart: Whitepaper report – The rebalancing agenda (Pg 12).

From investing in new plants to nurturing strategic partnerships with new suppliers, businesses globally are putting in significant efforts to rebalance their supply chains and boost resilience. This structural rewiring of global supply chains is, however, an expensive endeavour. According to our survey, business leaders believe that on average 14% of their company’s annual revenues will have to be invested into rebalancing over the medium term.

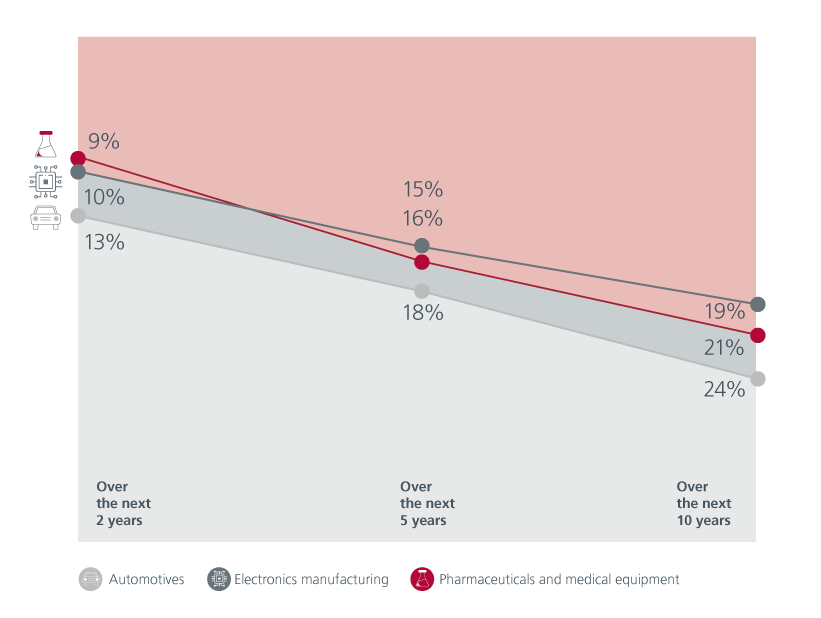

Failure to rebalance will have a significant impact on profits

Q. If your company’s current supply chain remains unchanged, what percentage of profit could be negatively impacted / at risk over the following time periods?

Source of chart: Whitepaper report – The rebalancing roadmap (Pg 20). Percentages indicate the average profit at risk for the sector indicated.

Source of chart: Whitepaper report – The rebalancing roadmap (Pg 20). Percentages indicate the average profit at risk for the sector indicated.Although the cost of rebalancing is high, 75% of business leaders believe that inaction will cost more than rebalancing. Depending on the sector, failure to rebalance could put 19 –24% of profits at risk over the next 10 years. The biggest obstacles to rebalancing are high costs and a lack of capabilities. Additionally, bureaucratic hurdles, lack of technology, trade rules and supply scarcities also hinder the process.

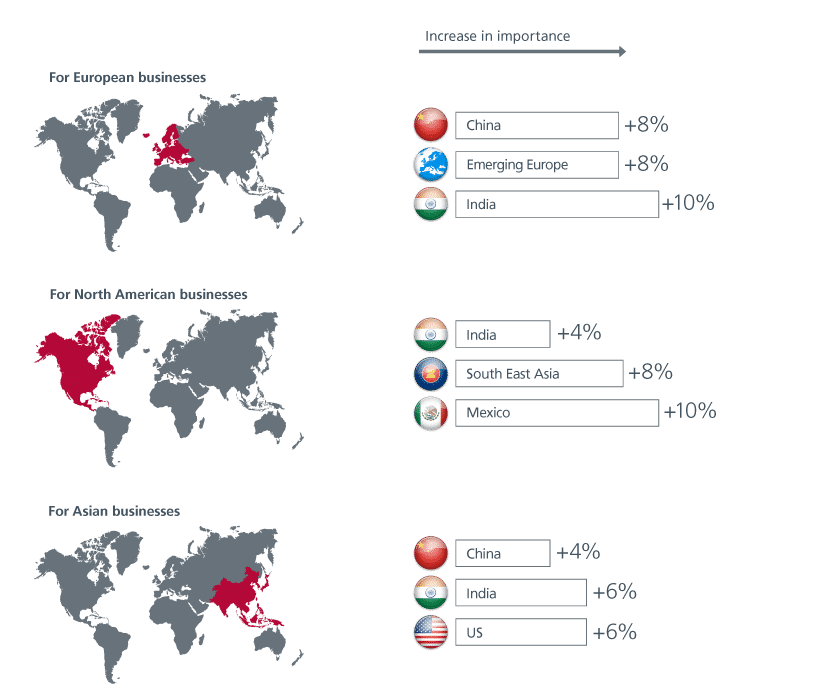

Supply chain networks are shifting – European businesses are still bullish on Asia

Q. Which are the supply chain locations with the largest increase in importance for businesses (currently and in 5 to 10 years)?

Source of chart: Whitepaper report – The rebalancing agenda (Pg 9). Percentages indicate the changes between now and the future, in the share of business leaders within their respective geography who ranked these markets as either the first or second most important locations for their supply chains.

Source of chart: Whitepaper report – The rebalancing agenda (Pg 9). Percentages indicate the changes between now and the future, in the share of business leaders within their respective geography who ranked these markets as either the first or second most important locations for their supply chains.Although the markets that currently dominate global supply chains i.e. US and China are expected to remain important in the future, their relative importance to different regions will change, mirroring the shift in geopolitical considerations. Our survey shows that India, Mexico, and markets in South East Asia, Emerging Europe and South America are expected to grow in importance for future supply chains.

Investment implications

The markets that are likely to benefit from the global supply chain shifts only have small weightings in the global and regional equity market indices. Emerging Markets (EMs) have a 10% weight in the MSCI AC World Index, while ASEAN accounts for only 1%. Meanwhile, India and ASEAN make up 13% and 6% respectively of the MSCI EM Index.

As such, these market capitalisation-weighted indices only provide modest exposure to the countries that are expected to benefit most from the global supply chain rebalancing. These indices also tend to be biased towards the widely held, larger capitalisation stocks, which potentially reduces diversification and alpha benefits in a portfolio. Therefore, investors may want to consider a more focused approach to exploit the alpha potential from the global rebalancing theme.

This is an extract from our whitepaper “New anchors reshaping supply chains: Opportunities for investors”. Please click here to download the full report.

The information and views expressed herein do not constitute an offer or solicitation to deal in shares of any securities or financial instruments and it is not intended for distribution or use by anyone or entity located in any jurisdiction where such distribution would be unlawful or prohibited. The information does not constitute investment advice or an offer to provide investment advisory or investment management service or the solicitation of an offer to provide investment advisory or investment management services in any jurisdiction in which an offer or solicitation would be unlawful under the securities laws of that jurisdiction.

Past performance and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the strategies managed by Eastspring Investments. An investment is subject to investment risks, including the possible loss of the principal amount invested. Where an investment is denominated in another currency, exchange rates may have an adverse effect on the value price or income of that investment. Furthermore, exposure to a single country market, specific portfolio composition or management techniques may potentially increase volatility.

Any securities mentioned are included for illustration purposes only. It should not be considered a recommendation to purchase or sell such securities. There is no assurance that any security discussed herein will remain in the portfolio at the time you receive this document or that security sold has not been repurchased.

The information provided herein is believed to be reliable at time of publication and based on matters as they exist as of the date of preparation of this report and not as of any future date. Eastspring Investments undertakes no (and disclaims any) obligation to update, modify or amend this document or to otherwise notify you in the event that any matter stated in the materials, or any opinion, projection, forecast or estimate set forth in the document, changes or subsequently becomes inaccurate. Eastspring Investments personnel may develop views and opinions that are not stated in the materials or that are contrary to the views and opinions stated in the materials at any time and from time to time as the result of a negative factor that comes to its attention in respect to an investment or for any other reason or for no reason. Eastspring Investments shall not and shall have no duty to notify you of any such views and opinions. This document is solely for information and does not have any regard to the specific investment objectives, financial or tax situation and the particular needs of any specific person who may receive this document.

Eastspring Investments Inc. (Eastspring US) primary activity is to provide certain marketing, sales servicing, and client support in the US on behalf of Eastspring Investment (Singapore) Limited (“Eastspring Singapore”). Eastspring Singapore is an affiliated investment management entity that is domiciled and registered under, among other regulatory bodies, the Monetary Authority of Singapore (MAS). Eastspring Singapore and Eastspring US are both registered with the US Securities and Exchange Commission as a registered investment adviser. Registration as an adviser does not imply a level of skill or training. Eastspring US seeks to identify and introduce to Eastspring Singapore potential institutional client prospects. Such prospects, once introduced, would contract directly with Eastspring Singapore for any investment management or advisory services. Additional information about Eastspring Singapore and Eastspring US is also is available on the SEC’s website at www.adviserinfo.sec. gov.

Certain information contained herein constitutes "forward-looking statements", which can be identified by the use of forward-looking terminology such as "may", "will", "should", "expect", "anticipate", "project", "estimate", "intend", "continue" or "believe" or the negatives thereof, other variations thereof or comparable terminology. Such information is based on expectations, estimates and projections (and assumptions underlying such information) and cannot be relied upon as a guarantee of future performance. Due to various risks and uncertainties, actual events or results, or the actual performance of any fund may differ materially from those reflected or contemplated in such forward-looking statements.

Eastspring Investments companies (excluding JV companies) are ultimately wholly-owned / indirect subsidiaries / associate of Prudential plc of the United Kingdom. Eastspring Investments companies (including JV’s) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America.