Summary

US growth is strong but faces policy uncertainty, especially around tariffs. China's growth is volatile but supported by policy measures. Japan is experiencing sustainable reflation, and India is moving towards monetary easing to boost GDP growth.

What’s top of investors’ minds

The year opens with strong US growth, but high uncertainty over policy.

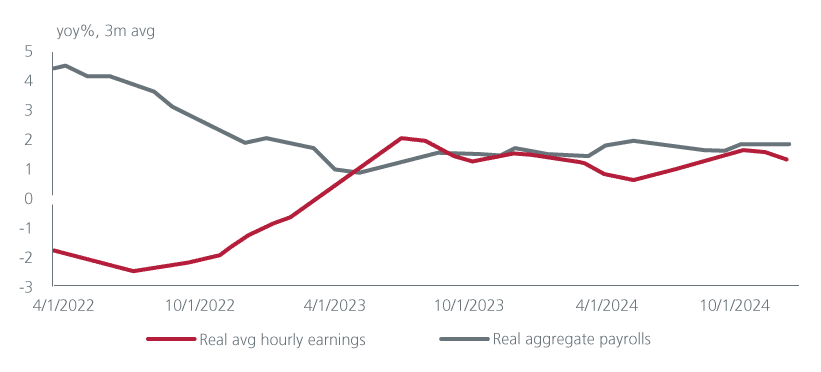

We expect US growth of about 2.5% in Q4 to sustain above 2% in H1. Aggregate payroll growth of 5.4% supports robust consumption growth and the Fed’s Beige Book suggests corporate hiring and investment plans have improved. However, much of this “US Exceptionalism” is already in lofty US valuations. This leads us to look for relative performance hedges in the form of less expensive markets. We also think that with the rise in yields incorporating some Fed rate hike risk that we think is unlikely, some elements of fixed income also offer interesting risk-return distributions.

A key uncertainty in this otherwise benign background is about what tariff policy President-elect Trump will announce following his January 20 inauguration. The market expectation for smaller, targeted, and phased in tariffs would likely pose only a small impact on US growth and inflation. In contrast, a broad, aggressive approach – for example 60% on most imports from China and 10% - 20% on most other countries - would be more negative for US and global growth and would risk higher inflation and global rates. Our concern is that Trump’s history and choice of advisors points toward higher and broader tariffs than the market expects. However, uncertainty is so high that positioning is probably better via hedges than directional trades.

US payroll earnings

China’s growth is likely to remain volatile.

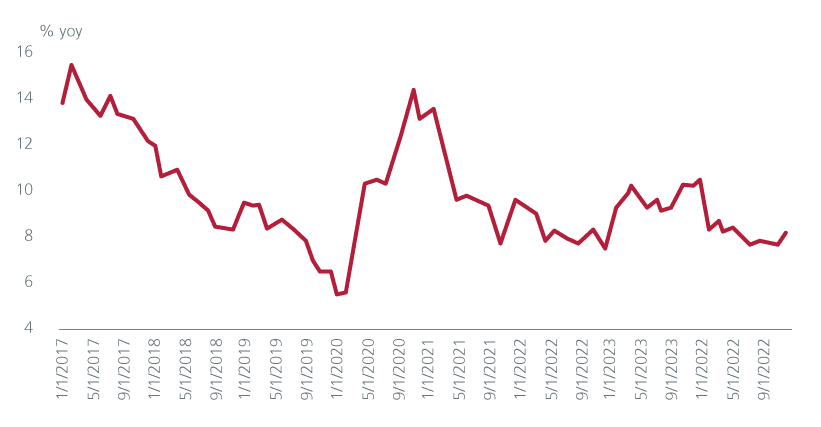

Policy, however, is committed to its target of close to 5% GDP growth this year. The export jump of Q4 may sustain in Q1 as companies try to front run US tariffs, but the consumption bounce from subsidies for consumer goods trade-ins is likely to fade. Property prices are continuing to fall, depressing household wealth, and employment income growth is weak. The collapse in credit growth suggests low-capacity utilisation rates are restraining investment.

China’s government has announced a framework to counter this likely slowing but appears to be taking a reactive rather than proactive approach. The Ministry of Finance’s January press gave rhetorical support for press reports that the government will increase the budget deficit to 4% of GDP, increase ultra-long term bond issuance by about 2tn yuan, increase the local government special bond quota, and issue bonds to fund some recapitalisation of large state banks. These lead us to expect China’s augmented fiscal deficit to increase by an economically meaningful 1.5% - 1.8% of GDP. However, officials have made clear that formal specifics will wait for the “dual sessions” government meetings in March. This implies a delay in spending until Q2.

Crucially, the government has still not suggested it will embark on a widespread carve out of the excess housing inventory that is driving China’s balance sheet deflation. We expect bouts of growth weakness to trigger temporary fiscal stimulus aimed at getting close to the 5% GDP growth target but are less optimistic that policy will reverse deflationary pressures.

China real social financing

What’s next for the Indian economy?

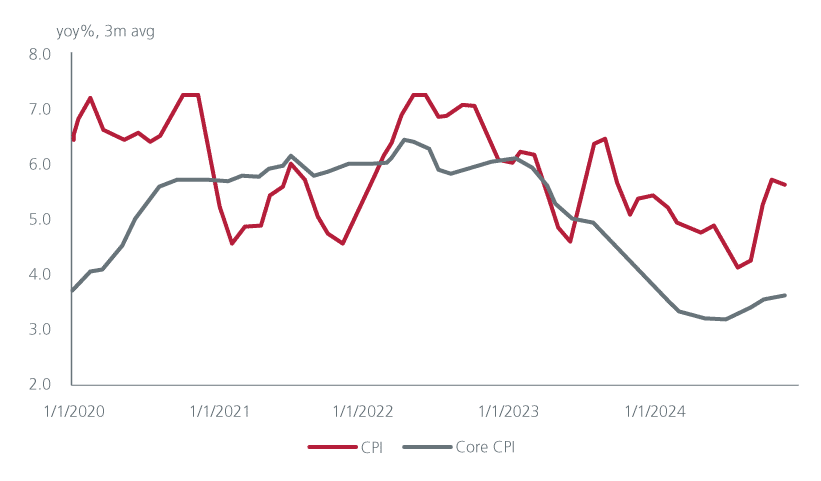

We think India is approaching a turn in monetary policy toward easing that should drive a cyclical recovery in GDP growth and better conditions for asset prices from H2. Headline inflation softened to 5.2% yoy in December a second consecutive month below the Reserve Bank of India’s (RBI) 6% ceiling while the core inflation run rate fell to 3.9% yoy from a high of 4.6% yoy earlier in the year. Credit growth, a key RBI concern early last year, has also slowed sharply. Importantly, the worst of the unexpected contraction in the government’s budget deficit is close to over.

India inflation

Higher wage growth to sustain real incomes in Japan.

Japan looks more sustainably reflationary with an outlook for real GDP growth to accelerate to about 1% this year from a contraction of about 0.2 in 2024. Wage growth is turning household income growth positive in real terms. This year’s Shunto is likely to give labour a 3% - 3.5% wage increase, sustaining growth in real incomes. This should stimulate consumption growth and keep inflation gradually rising, justifying the Bank of Japan hiking rates in Q1 and again in late Q2 or Q3. These hikes should combine with the Fed returning to rate cuts to create room for the yen to recover somewhat. Importantly, higher wage growth and a return to growth should support continued corporate reform to improve RoEs.

The information and views expressed herein do not constitute an offer or solicitation to deal in shares of any securities or financial instruments and it is not intended for distribution or use by anyone or entity located in any jurisdiction where such distribution would be unlawful or prohibited. The information does not constitute investment advice or an offer to provide investment advisory or investment management service or the solicitation of an offer to provide investment advisory or investment management services in any jurisdiction in which an offer or solicitation would be unlawful under the securities laws of that jurisdiction.

Past performance and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the strategies managed by Eastspring Investments. An investment is subject to investment risks, including the possible loss of the principal amount invested. Where an investment is denominated in another currency, exchange rates may have an adverse effect on the value price or income of that investment. Furthermore, exposure to a single country market, specific portfolio composition or management techniques may potentially increase volatility.

Any securities mentioned are included for illustration purposes only. It should not be considered a recommendation to purchase or sell such securities. There is no assurance that any security discussed herein will remain in the portfolio at the time you receive this document or that security sold has not been repurchased.

The information provided herein is believed to be reliable at time of publication and based on matters as they exist as of the date of preparation of this report and not as of any future date. Eastspring Investments undertakes no (and disclaims any) obligation to update, modify or amend this document or to otherwise notify you in the event that any matter stated in the materials, or any opinion, projection, forecast or estimate set forth in the document, changes or subsequently becomes inaccurate. Eastspring Investments personnel may develop views and opinions that are not stated in the materials or that are contrary to the views and opinions stated in the materials at any time and from time to time as the result of a negative factor that comes to its attention in respect to an investment or for any other reason or for no reason. Eastspring Investments shall not and shall have no duty to notify you of any such views and opinions. This document is solely for information and does not have any regard to the specific investment objectives, financial or tax situation and the particular needs of any specific person who may receive this document.

Eastspring Investments Inc. (Eastspring US) primary activity is to provide certain marketing, sales servicing, and client support in the US on behalf of Eastspring Investment (Singapore) Limited (“Eastspring Singapore”). Eastspring Singapore is an affiliated investment management entity that is domiciled and registered under, among other regulatory bodies, the Monetary Authority of Singapore (MAS). Eastspring Singapore and Eastspring US are both registered with the US Securities and Exchange Commission as a registered investment adviser. Registration as an adviser does not imply a level of skill or training. Eastspring US seeks to identify and introduce to Eastspring Singapore potential institutional client prospects. Such prospects, once introduced, would contract directly with Eastspring Singapore for any investment management or advisory services. Additional information about Eastspring Singapore and Eastspring US is also is available on the SEC’s website at www.adviserinfo.sec. gov.

Certain information contained herein constitutes "forward-looking statements", which can be identified by the use of forward-looking terminology such as "may", "will", "should", "expect", "anticipate", "project", "estimate", "intend", "continue" or "believe" or the negatives thereof, other variations thereof or comparable terminology. Such information is based on expectations, estimates and projections (and assumptions underlying such information) and cannot be relied upon as a guarantee of future performance. Due to various risks and uncertainties, actual events or results, or the actual performance of any fund may differ materially from those reflected or contemplated in such forward-looking statements.

Eastspring Investments companies (excluding JV companies) are ultimately wholly-owned / indirect subsidiaries / associate of Prudential plc of the United Kingdom. Eastspring Investments companies (including JV’s) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America.