Summary

Asia remains a high growth region led by two of its largest emerging economies, China and India. Both countries are expected to contribute about half of global growth in 20231 . Singly, either one of these dominant markets offers a range of investment opportunities but together their complementary strengths reveal a deeper and wider pool of stock choices.

China is already a major economic powerhouse, having grown at around 9% per year since it began to reform its economy in 1978. Recognising that its high growth model based on investments, low-cost manufacturing and exports has mostly reached its limits, the government is accelerating the pivot towards domestic consumption and innovation to sustain long-term economic development.

On the other hand, India is still a rising economic power. As its development model focused on domestic demand and services, India’s growth has been more moderate than China. Nevertheless, it is now the fastest-growing economy in the world and has reached a stage where it is too big to ignore. To add, it is the world’s most populous country with one of the largest percentages of working age population.

On a standalone basis, these Asian giants already offer plenty of diverse investment opportunities. However, given that both are at a different stage of economic growth and development, their investment universes differ. As such investors who would like to get exposure to the biggest emerging economies in Asia can gain more from the combined and complementary strengths of China and India.

Expanding opportunity set

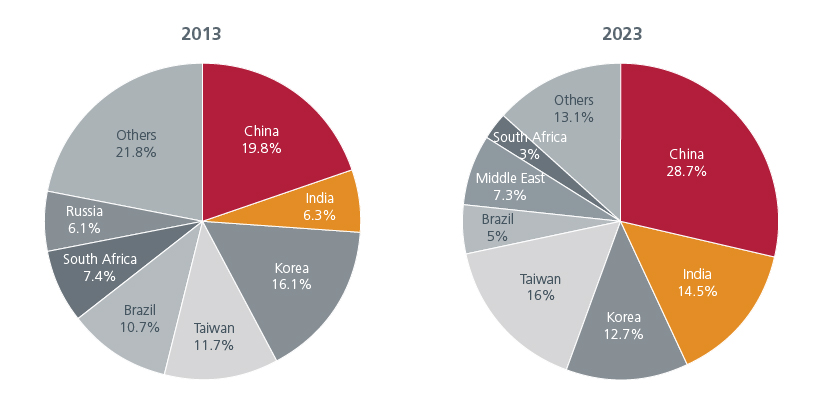

Within the MSCI Emerging Markets (EM) index, the weights of China and India have grown to 28.7% and 14.5% respectively as of May 2023. Ten years ago, their combined weight was only 26%. Fig 1. Likewise, within the MSCI Asia ex Japan index, they make up almost half the index weight. The rising dominance of China and India in the indices is a result of their rapid economic progress. We expect their combined weight in regional indices to continue its uptrend in the medium term driven by further A-share inclusion (China) and more initial public offerings (IPOs) in both markets.

Fig 1: Growing importance of China and India

Source: Eastspring Investments and MSCI Emerging Markets Index (USD), 31 May 2023

A supportive regulatory environment is also underpinning Chinese and Indian capital markets. Over the years, India’s capital markets regulator, Sebi, has undertaken several enhancements; their latest proposal to reduce timelines for IPOs to three days from the six days at present when implemented will benefit issuers and investors. Likewise, earlier in the year, China relaxed the rules for IPO listings which will speed up listings and corporate fundraising.

Distinct sector strengths

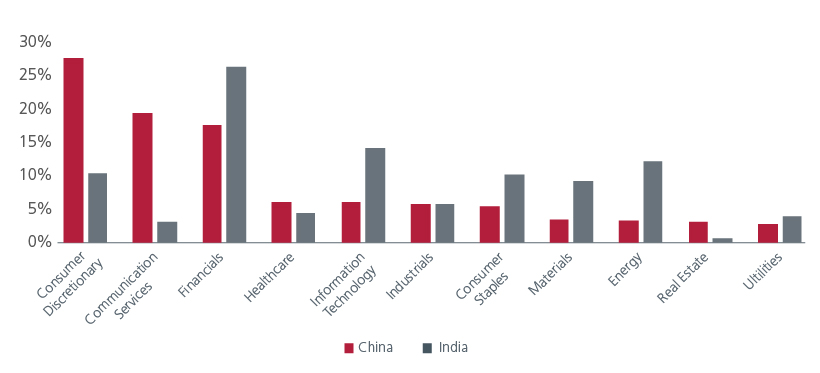

Another reason to invest in both markets is the opportunity to pick out the best ideas across a diversified range of sectors. The consumer discretionary sector has the highest weight in the MSCI China index while the financial sector is the largest in the MSCI India index. Fig 2. China’s consumer discretionary market is among the largest in the world and highly diversified into retail, e-commerce, travel, and luxury segments. On the other hand, India is the topmost offshoring destination for global information technology (IT) companies; the IT sector is expected to contribute to 10% of GDP by 2025. 2

Fig 2: Sector weights vary across both markets

Source: Eastspring Investments and MSCI China and MSCI India indices (USD) as of 31 May 2023

Even within the same sector, the companies are distinct which allows active investors to maximise the stock picking diversity and focus on the best ideas. China’s banking sector is dominated by policy-driven state-owned enterprises while it is the private banks in India that are gaining market share from their state-owned counterparts.

The property sector is yet another example of this contrast; China faces an extended downcycle while India appears to be at the initial stage of a multi-year upcycle. Within healthcare, China’s big pharma companies are experiencing persistent price cuts domestically while India’s generic pharma manufacturers are fast diversifying from the challenging US generic market into new verticals such as innovative drugs.

Capitalising on differences

Having been the world’s factory for the past few decades, China is now transitioning to higher-quality growth and moving up the manufacturing value chain with a focus on innovation and higher-end equipment and industrial goods. Meanwhile India which has been well-known for being the world’s back office, is now establishing an additional pillar of growth in manufacturing by accelerating its infrastructure build-out and upskilling talents. This coincides with several multi-nationals’ “China plus-one” strategy. Data from US-based Reshoring Institute3 indicates that India is amongst the lowest-cost manufacturing hubs along with Mexico and Vietnam.

Likewise, the consumer sector is another clear example of the differences that can be exploited. Although India has pipped China to become the world’s most populous nation, the country’s consumer class (defined as those spending more than USD12 a day in 2017 PPP) is only half of China’s. However, China’s consumers are older and mostly live in cities. In contrast, India is on track to become the world’s biggest youth consumer market by 2030; yet the consumer class is both urban and rural.4 Consumption patterns which are usually dictated by affordability and lifestyle preferences will differ in both markets.

By investing in both markets, one will gain exposure to a wider spectrum of companies; their complementary nature implies investors get the best of both worlds.

The investment rationale

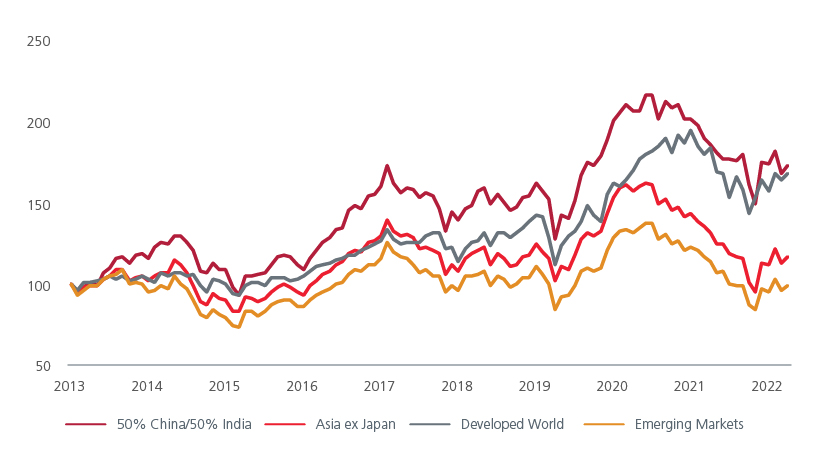

One could argue that investing in only China and India offers narrow diversification benefits. As both markets already form a big part of the MSCI EM and MSCI Asia ex Japan indices, investing in a broader emerging market or Asia strategy not only offers meaningful exposure to these markets but also diversification benefits from other countries. True, but whether such regional diversification dilutes one’s return is worth considering. Interestingly, empirical data reveals that a combined 50-50 China-India portfolio has outperformed the regional indices over the past eight years.

Fig 3: A combined China + India strategy has outperformed

Source: Bloomberg, Eastspring Investments; as of 31 March 2023. Rebased to 100 on 31 December 2013. All returns in USD terms using following data series. 50% China/50% India (50% MSCI China + 50% MSCI India Gross Div TR), Asia ex Japan (MSCI AC Asia ex Japan Index), Developed World (MSCI World Index), Emerging Markets (MSCI Emerging Markets Index).

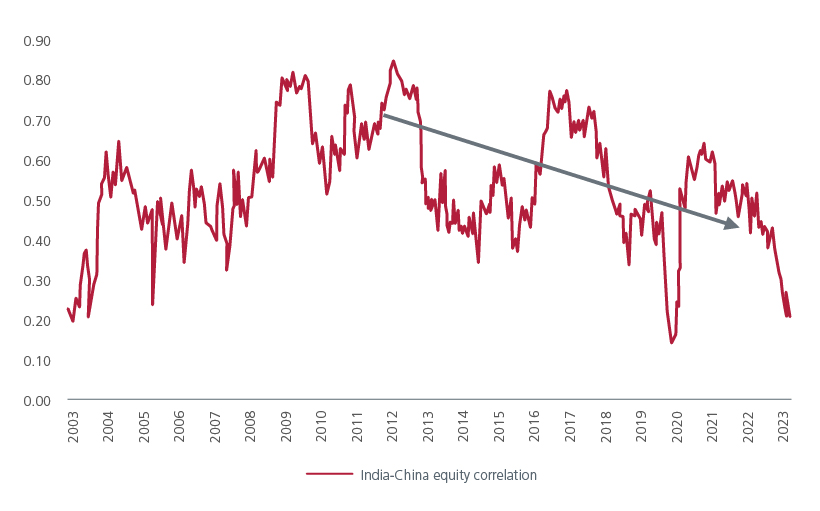

It is also encouraging to note the decreasing correlation between the two countries across multiple fronts –market performance, macro, and foreign flows. Fig 4. Differing valuations is an additional aspect; China is still cheap at one standard deviation below its 20-year average on a price-to-book basis while India is trading just above its average.5 The contrasting valuations offer active investors a dynamic pool of stocks to capitalise on mispriced opportunities in each market.

Fig 4 Decreasing correlation of the equity markets’ performance

Source: JP Morgan, April 2023

All in, a combined China-India approach has its unique counter-cyclical benefits, providing a positive backdrop for bottom-up stock-pickers through market cycles.

Sources:

1

https://www.weforum.org/agenda/2022/10/comparing-the-speed-of-u-s-interest-rate-hikes-1988-2022/

1 IMF report, May 2023

2 https://www.ibef.org/industry/information-technology-india

3 https://thefederal.com/business/india-among-lowest-cost-manufacturing-hubs-beating-china-report/

4 https://www.brookings.edu/blog/future-development/2023/04/14/china-and-india-the-future-of-the-global-consumer-market/

5 Refinitiv Datastream, MSCI, 31 May 2023

The information and views expressed herein do not constitute an offer or solicitation to deal in shares of any securities or financial instruments and it is not intended for distribution or use by anyone or entity located in any jurisdiction where such distribution would be unlawful or prohibited. The information does not constitute investment advice or an offer to provide investment advisory or investment management service or the solicitation of an offer to provide investment advisory or investment management services in any jurisdiction in which an offer or solicitation would be unlawful under the securities laws of that jurisdiction.

Past performance and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the strategies managed by Eastspring Investments. An investment is subject to investment risks, including the possible loss of the principal amount invested. Where an investment is denominated in another currency, exchange rates may have an adverse effect on the value price or income of that investment. Furthermore, exposure to a single country market, specific portfolio composition or management techniques may potentially increase volatility.

Any securities mentioned are included for illustration purposes only. It should not be considered a recommendation to purchase or sell such securities. There is no assurance that any security discussed herein will remain in the portfolio at the time you receive this document or that security sold has not been repurchased.

The information provided herein is believed to be reliable at time of publication and based on matters as they exist as of the date of preparation of this report and not as of any future date. Eastspring Investments undertakes no (and disclaims any) obligation to update, modify or amend this document or to otherwise notify you in the event that any matter stated in the materials, or any opinion, projection, forecast or estimate set forth in the document, changes or subsequently becomes inaccurate. Eastspring Investments personnel may develop views and opinions that are not stated in the materials or that are contrary to the views and opinions stated in the materials at any time and from time to time as the result of a negative factor that comes to its attention in respect to an investment or for any other reason or for no reason. Eastspring Investments shall not and shall have no duty to notify you of any such views and opinions. This document is solely for information and does not have any regard to the specific investment objectives, financial or tax situation and the particular needs of any specific person who may receive this document.

Eastspring Investments Inc. (Eastspring US) primary activity is to provide certain marketing, sales servicing, and client support in the US on behalf of Eastspring Investment (Singapore) Limited (“Eastspring Singapore”). Eastspring Singapore is an affiliated investment management entity that is domiciled and registered under, among other regulatory bodies, the Monetary Authority of Singapore (MAS). Eastspring Singapore and Eastspring US are both registered with the US Securities and Exchange Commission as a registered investment adviser. Registration as an adviser does not imply a level of skill or training. Eastspring US seeks to identify and introduce to Eastspring Singapore potential institutional client prospects. Such prospects, once introduced, would contract directly with Eastspring Singapore for any investment management or advisory services. Additional information about Eastspring Singapore and Eastspring US is also is available on the SEC’s website at www.adviserinfo.sec. gov.

Certain information contained herein constitutes "forward-looking statements", which can be identified by the use of forward-looking terminology such as "may", "will", "should", "expect", "anticipate", "project", "estimate", "intend", "continue" or "believe" or the negatives thereof, other variations thereof or comparable terminology. Such information is based on expectations, estimates and projections (and assumptions underlying such information) and cannot be relied upon as a guarantee of future performance. Due to various risks and uncertainties, actual events or results, or the actual performance of any fund may differ materially from those reflected or contemplated in such forward-looking statements.

Eastspring Investments companies (excluding JV companies) are ultimately wholly-owned / indirect subsidiaries / associate of Prudential plc of the United Kingdom. Eastspring Investments companies (including JV’s) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America.