Executive Summary

- DeepSeek’s breakthrough underscores the immense potential of China’s AI ecosystem, where many companies are trading at much more attractive valuations compared to their US counterparts, even after the recent correction in the US equity market.

- Concerns of a global oversupply of AI infrastructure and hardware appear misplaced, and we see exciting investment opportunities emerging within Asia’s tech and AI supply chains, and even extending beyond the tech sector.

- A value approach does not shy away from growth opportunities but helps us avoid chasing the most obvious but overvalued beneficiaries amid the AI fervour.

The rapid advancements in Artificial Intelligence (AI), especially the breakthrough in generative AI had sparked significant investor interest in AI-related stocks. The exceptional performance of the Magnificent 7 stocks in 2024 was partly fuelled by the AI boom. However, the AI landscape potentially changed forever in early 2025.

On 24th January 2025, DeepSeek, China’s startup AI lab, burst into the mainstream media with their R1 model, purportedly surpassing Open AI’s O1 model at a fraction of the development cost. DeepSeek’s usage of model techniques like Multi Latent Head Attention (MLA) and Mixture of Experts (MoE) lowered the cost of AI inference, reducing the amount of compute and memory needed.

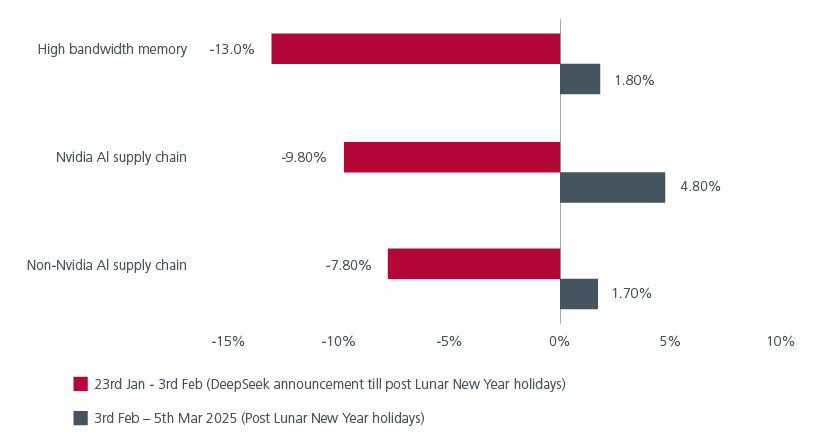

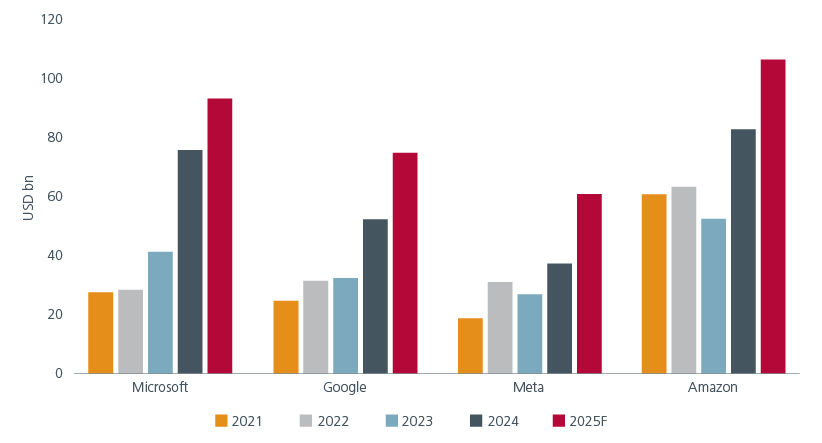

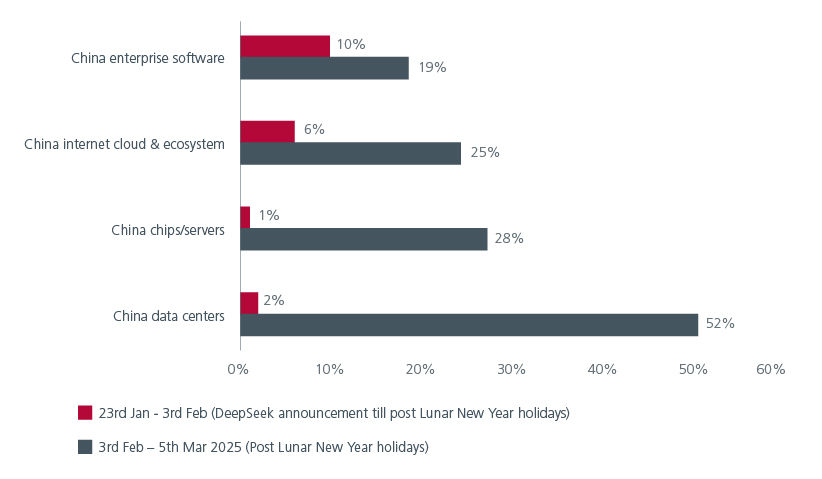

The breakthrough announcement caused a significant sell-off in the AI chip supply chain as investors questioned the need for more AI infrastructure and hardware. However, the supply chain names quickly rebounded after the Lunar New Year period when major US hyperscalers’ (large-scale data centers) guided higher than expected capital expenditure plans for 2025. See Fig. 1. And 2. Our research indicates that major AI frontier model creators were indeed copying DeepSeek techniques but with more powerful compute and memory resources to achieve even faster advancements.

Fig. 1. AI-related stocks fell then rebounded

Source: Bloomberg. As of 5th March 2025. Shows performance of representative baskets of stocks in local currency terms.

Fig. 2. US hyper-scalers are still spending

Source: Visible Alpha 5th March 2025.

Notably, DeepSeek’s advancements underscore the immense potential of China’s AI ecosystem, where many companies are not only innovating rapidly but also trading at much more attractive valuations compared to their US counterparts. We believe that Deepseek’s advancements have far-reaching and enduring implications for Asia, creating exciting investment opportunities within the region’s AI and tech supply chains as well as beyond the tech sector.

A boost for Asian semiconductor and server industries

We expect Taiwan and Korea, home to majority of the AI chip supply chain, to get a significant boost from DeepSeek's advancements. Foundry, backend Integrated Circuit (IC) design, high bandwidth memory (HBM), Chip-on-Wafer-on-Substrate (CoWoS) packaging, Ajinomoto Build-up Film (ABF) substrate, IC testing, server original design manufacturing (ODM), multi-layer printed circuit boards (PCB), liquid cooling are all vital steps and components needed to produce AI servers to meet compute needs.

Advancing China's AI ecosystem

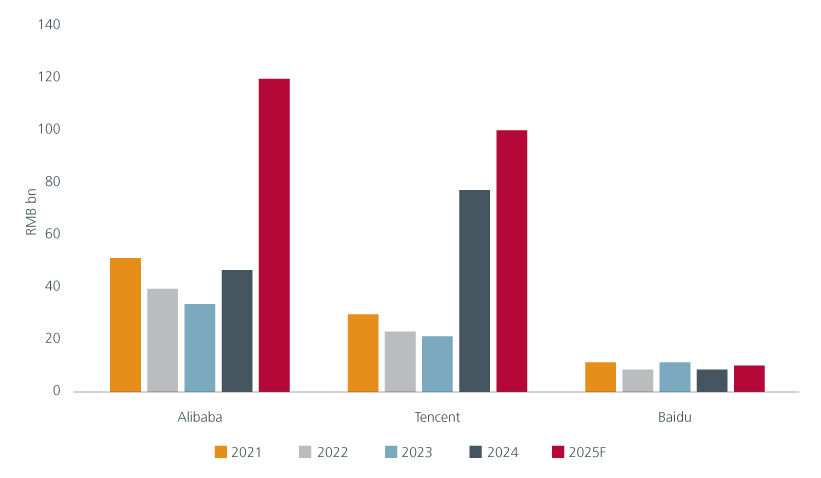

We see Chinese data centers as the immediate beneficiaries of DeepSeek’s breakthrough. China’s cloud service providers have begun offering DeepSeek’s R1 model to both personal and enterprise users. This is sparking widespread experimentation of new software AI features that make use of the R1 models for inferencing. In February, Alibaba stunned the market by forecasting that its AI capital expenditures over the next 3 years will surpass its total spend in the last decade. It is likely that other Chinese hyperscalers will follow suit and significantly increase their capital expenditures to advance their frontier models. See Fig. 3.

Fig. 3. Alibaba announces ambitious AI investment plans

Source: Visible Alpha 5th March 2025, Company guidance. Dotted lines represent Eastspring’s forecast.

China’s semiconductor and server industries, previously limited by US export restrictions, will also gain increasing relevance. These industries had relied on lagging wafer fabrication techniques, but DeepSeek’s model innovations enable the use of less compute-intensive AI chips, potentially giving these industries a new lease of life.

Prior to the DeepSeek breakthrough, Chinese AI development had been lacklustre as it relied on less advanced frontier models trained by inferior chips below US-specified thresholds. This hindered advancements in new applications and AI-aided productivity. DeepSeek’s techniques have removed these barriers and importantly, its AI models are open source - available for all to download, modify and build upon. This openness encourages collaboration and innovation, as users can contribute to improving the models. As a result, Chinese software companies are busy in search of the next killer application/product.

Fig. 4. China AI supply chain players rally

Source: Bloomberg. As of 5 March 2025. In local currency terms. Shows median returns of representative baskets of stocks.

Beneficiaries from edge AI and beyond

The limited compute power of smartphones and PCs has historically kept AI models on these devices to around 7bn parameters in size. DeepSeek however has found a way to use 8-bit floating point (FP8) calculations instead of the usual FP16/FP32, which reduces the computing load without losing too much accuracy. This means we can have larger AI models on our devices and therefore smarter devices.

As such, Chinese smartphone, Taiwanese PC brands and their Asian supply chains should benefit from this development. Lagging edge chips like microcontroller units, power management ICs, Dynamic Random-Access Memory (DRAM) should also enjoy more demand because of this new wave for edge AI devices .1

As AI technology proliferates, the demand for data center resources will rise across the region. Malaysia has already seen significant demand from Chinese companies looking to build presence in ASEAN. Meanwhile, Japan and Korean data center providers are likely to attract interest too, as they are the only 2 Asian countries categorised as Tier 1 in the US AI Diffusion Framework, a set of guidelines and regulations introduced by the US government to manage the global distribution of advanced AI technology. Tier 1 countries have no restrictions for importing advanced AI technology. Meanwhile, the significant energy requirements to operate data centers should also spell opportunities for manufacturers of power generator sets, grid transformers as well as utility companies.

Actively seeking opportunities

Active investing would be required to exploit the opportunities arising from the DeepSeek breakthrough. The stellar returns enjoyed by AI beneficiaries in the US since OpenAI gained widespread attention in early 2023 provide a viable playbook for Asia. To date, selected stocks and sectors have already rallied significantly amid the AI fervour. Against such a backdrop, a value lens helps us to avoid chasing the most obvious but overvalued beneficiaries. Value investing does not shy away from growth opportunities but looks to take advantage of attractively priced growth. Outside of the tech sector, the rising adoption of AI and the large increases in productivity that follow would impact multiple industries, potentially creating new leaders. Deep research and strong industry knowledge would be needed to identify them.

The mention of individual securities or companies in this article is for illustration purposes only and does not imply a recommendation to buy or sell any specific security or financial instrument.

Sources:

1 Edge AI refers to running artificial intelligence (AI) algorithms directly on devices like smartphones, cameras, or other gadgets, rather than relying on a central server or cloud. This allows the device

to process data and make decisions quickly, without needing to send information back and forth to a remote server.

The information and views expressed herein do not constitute an offer or solicitation to deal in shares of any securities or financial instruments and it is not intended for distribution or use by anyone or entity located in any jurisdiction where such distribution would be unlawful or prohibited. The information does not constitute investment advice or an offer to provide investment advisory or investment management service or the solicitation of an offer to provide investment advisory or investment management services in any jurisdiction in which an offer or solicitation would be unlawful under the securities laws of that jurisdiction.

Past performance and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the strategies managed by Eastspring Investments. An investment is subject to investment risks, including the possible loss of the principal amount invested. Where an investment is denominated in another currency, exchange rates may have an adverse effect on the value price or income of that investment. Furthermore, exposure to a single country market, specific portfolio composition or management techniques may potentially increase volatility.

Any securities mentioned are included for illustration purposes only. It should not be considered a recommendation to purchase or sell such securities. There is no assurance that any security discussed herein will remain in the portfolio at the time you receive this document or that security sold has not been repurchased.

The information provided herein is believed to be reliable at time of publication and based on matters as they exist as of the date of preparation of this report and not as of any future date. Eastspring Investments undertakes no (and disclaims any) obligation to update, modify or amend this document or to otherwise notify you in the event that any matter stated in the materials, or any opinion, projection, forecast or estimate set forth in the document, changes or subsequently becomes inaccurate. Eastspring Investments personnel may develop views and opinions that are not stated in the materials or that are contrary to the views and opinions stated in the materials at any time and from time to time as the result of a negative factor that comes to its attention in respect to an investment or for any other reason or for no reason. Eastspring Investments shall not and shall have no duty to notify you of any such views and opinions. This document is solely for information and does not have any regard to the specific investment objectives, financial or tax situation and the particular needs of any specific person who may receive this document.

Eastspring Investments Inc. (Eastspring US) primary activity is to provide certain marketing, sales servicing, and client support in the US on behalf of Eastspring Investment (Singapore) Limited (“Eastspring Singapore”). Eastspring Singapore is an affiliated investment management entity that is domiciled and registered under, among other regulatory bodies, the Monetary Authority of Singapore (MAS). Eastspring Singapore and Eastspring US are both registered with the US Securities and Exchange Commission as a registered investment adviser. Registration as an adviser does not imply a level of skill or training. Eastspring US seeks to identify and introduce to Eastspring Singapore potential institutional client prospects. Such prospects, once introduced, would contract directly with Eastspring Singapore for any investment management or advisory services. Additional information about Eastspring Singapore and Eastspring US is also is available on the SEC’s website at www.adviserinfo.sec. gov.

Certain information contained herein constitutes "forward-looking statements", which can be identified by the use of forward-looking terminology such as "may", "will", "should", "expect", "anticipate", "project", "estimate", "intend", "continue" or "believe" or the negatives thereof, other variations thereof or comparable terminology. Such information is based on expectations, estimates and projections (and assumptions underlying such information) and cannot be relied upon as a guarantee of future performance. Due to various risks and uncertainties, actual events or results, or the actual performance of any fund may differ materially from those reflected or contemplated in such forward-looking statements.

Eastspring Investments companies (excluding JV companies) are ultimately wholly-owned / indirect subsidiaries / associate of Prudential plc of the United Kingdom. Eastspring Investments companies (including JV’s) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America.