Executive Summary

- In view of the market developments following the US tariff announcements on 2nd April, we believe that the regular income streams from income investing can add an element of stability to portfolios amid volatility.

- The Asia Pacific ex Japan equity markets still offer a vast array of growth and yield opportunities given their depth, breadth and heterogeneity. In other words, these present as useful levers for active managers to navigate the ongoing geopolitical uncertainty. It is key to look for opportunities across the entire 'dividend journey', as companies’ capital allocation strategies shift.

- A differentiated approach to income investing can help navigate the tariffs, whilst taking fuller advantage of Asia’s dynamism, and deliver total returns – dividend and capital growth.

We have written earlier this year about the strong investment case for a total return dividend-focused approach to investing in Asian equities. That thesis remains very much intact if not stronger following the US tariff announcements on 2nd April. Many Asian companies have domestic focuses that are relatively more insulated from tariffs, and Asia also has a higher proportion of companies with net cash balance sheets, which provides financial buffer under any earnings pressure. Higher free cash flow yields and rising dividend payouts provide a buffer against declining earnings, suggesting tariff pressures may not directly impact dividends. In this article, we delve a little deeper into the unique opportunity set we see across Asian equity markets for this approach.

Asian equities are often thought of primarily as growth markets where immense potential lies among the fastest growing stocks in the region. However, in reality, Asian equity markets are deep, wide and varied. Hence, capturing the return opportunity from Asian equities requires a differentiated approach when picking from the heterogeneous stocks from across countries and sectors. A differentiated approach can help to capture returns from both dividend payments and share price appreciation.

Where are the opportunities?

Simply put, they are all around us! When we look across the Asia Pacific ex Japan region today, we see opportunities across the markets:

Australia -A mature developed equity market which is relatively stable given its domestic focus and lower impact from global trade. The high quality and high yielding Australian banks provide attractive opportunities, as do the globally competitive commodities companies that can provide yields during recoveries. Additionally, the varied small and mid-cap companies can also provide opportunities for capital appreciation and alpha generation.

Hong Kong and China – While this market is front and centre of geopolitical tensions with the United States, it is worth remembering that China also has a deep and domestically driven universe that offers a wide suite of opportunities across sectors and investment styles. Many Financials, such as banks and insurers, provide stable yield, and capture market beta, particularly in response to policy announcements. Meanwhile, the new economy China internet or electric vehicle companies can deliver both dividend and capital growth. Even old economy sectors like the Industrials sector, which is experiencing a cyclical recovery, offers promising investment opportunities.

India – Despite being perceived as a lower yielding market, India presents yield opportunities in the Communications Services sector, via infrastructure plays as well as in the Utilities sector which can offer growth upside as energy consumption rises. Besides yield, Indian Financials provide exposure to rapid loan growth, while IT service stocks offer exposure to the rising outsourcing trend.

Indonesia – Remains a high yielding market even though there are some near-term headwinds from investor outflows. The Banks and Telecoms sectors are interesting yield opportunities that benefit from Indonesia’s favourable demographics and rising middle-class income.

South Korea –Its Value Up programme, a government initiative that enhances shareholder return by improving corporate governance and capital efficiency, presents a structural tailwind. More positively, even at a company level ahead of this programme, corporates were already showing steps in the direction of enhancing corporate value and shareholder return. We find a wide range of interesting opportunities within the auto manufacturers, the many world-class Technology companies that offer dividend growth, and stable dividend players such as Telecoms.

Singapore - A market with a strong domestic focus, offering a diverse range of opportunities and robust yields. These include domestic Banks that have been improving their capital returns, Telecom companies with exposure not only to Singapore but also to the broader Asian market, and REITS that offer access to the Artificial Intelligence (AI)/Cloud theme via datacentres.

Taiwan – A market where technology exposure to structural growth themes such as AI provides the potential for robust capital returns. With dividend yields very much in focus, most companies try to prioritise dividends alongside structural growth, hence benefiting shareholders from both an income and growth perspective

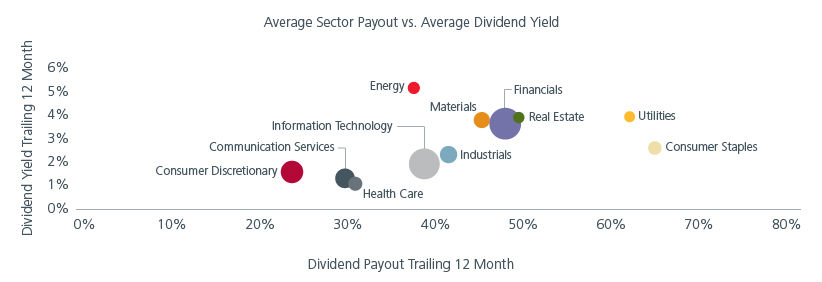

Fig. 1. Average sector payout vs average dividend yield

Source: Eastspring Investments, as at 31 December 2024. Axes represent the average yield and payout of the MSCI AC Asia Pacific ex Japan index (MSCI APXJ) over a 12-month trailing period. Past performance is not necessarily indicative of the future or likely performance.

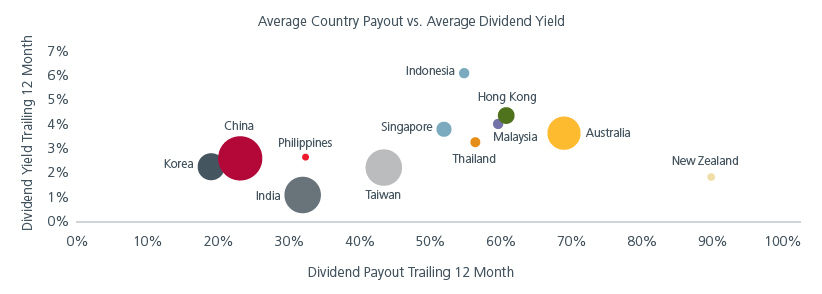

Fig. 2. Average country payout vs average dividend yield

Source: Eastspring Investments, as at 31 December 2024. Axes represent the average yield and payout of the MSCI AC Asia Pacific ex Japan index (MSCI APXJ) over a 12-month trailing period. Past performance is not necessarily indicative of the future or likely performance.

A total return dividend-focused approach

As described above, Asia is overflowing with great investment opportunities, but also some dangerous ones. The challenge is to capture the good and avoid the bad.

We believe that having a disciplined investment process that incorporates quantitative and qualitative analysis can help to identify the companies with the greatest potential. Additionally, deep forensic research on companies can build conviction of investment opportunities, thereby lowering risks.

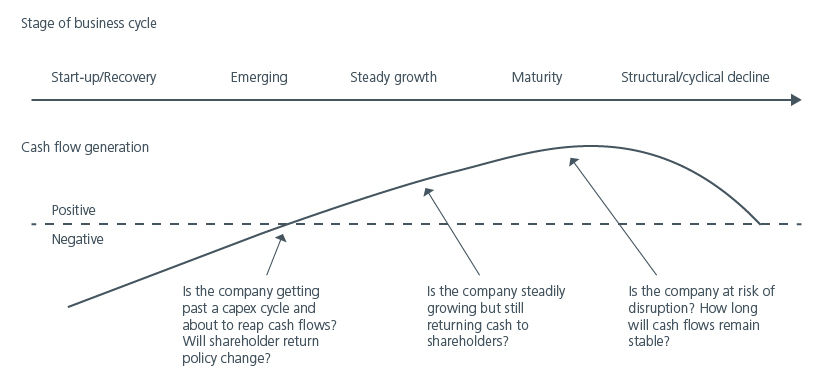

We believe that it is important to look for opportunities across the ‘dividend journey’. See Fig. 3. Companies are dynamic and typically move through different stages of capital allocation as they evolve from start-up to maturity. Companies at the early stages of this journey typically prioritise reinvesting in their business and growth. As these companies mature, they may shift towards providing sustainable healthy dividends to shareholders. Along this journey, we look to identify opportunities and risks to the investment thesis - for example is the company about to move through an inflection point in their capital allocation and change their shareholder return policy as cash flows increase? For companies that are at the mature stage, we aim to confirm that dividends are indeed sustainable and supported by cash flows, and not at risk of being disrupted.

Fig. 3. The dividend journey

Source: Eastspring Investments. April 2025.

Embracing dividend income and capital growth

Given their depth, breadth and heterogeneity, the Asia Pacific ex Japan equity markets offer investors a vast array of opportunities.

Embracing the 'dividend journey' approach can help to identify companies that are able to pay out robust dividends and deliver potential capital growth, offering a balanced strategy for total returns. As companies evolve and their capital allocation strategies shift, investors can capitalise on these transitions to maximise returns while minimising risks. The dynamic nature of the Asian markets, bolstered by varying economic, demographic and structural trends, provides a rewarding investment landscape for investors, allowing them to enjoy total returns – dividend and capital growth.

The information and views expressed herein do not constitute an offer or solicitation to deal in shares of any securities or financial instruments and it is not intended for distribution or use by anyone or entity located in any jurisdiction where such distribution would be unlawful or prohibited. The information does not constitute investment advice or an offer to provide investment advisory or investment management service or the solicitation of an offer to provide investment advisory or investment management services in any jurisdiction in which an offer or solicitation would be unlawful under the securities laws of that jurisdiction.

Past performance and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the strategies managed by Eastspring Investments. An investment is subject to investment risks, including the possible loss of the principal amount invested. Where an investment is denominated in another currency, exchange rates may have an adverse effect on the value price or income of that investment. Furthermore, exposure to a single country market, specific portfolio composition or management techniques may potentially increase volatility.

Any securities mentioned are included for illustration purposes only. It should not be considered a recommendation to purchase or sell such securities. There is no assurance that any security discussed herein will remain in the portfolio at the time you receive this document or that security sold has not been repurchased.

The information provided herein is believed to be reliable at time of publication and based on matters as they exist as of the date of preparation of this report and not as of any future date. Eastspring Investments undertakes no (and disclaims any) obligation to update, modify or amend this document or to otherwise notify you in the event that any matter stated in the materials, or any opinion, projection, forecast or estimate set forth in the document, changes or subsequently becomes inaccurate. Eastspring Investments personnel may develop views and opinions that are not stated in the materials or that are contrary to the views and opinions stated in the materials at any time and from time to time as the result of a negative factor that comes to its attention in respect to an investment or for any other reason or for no reason. Eastspring Investments shall not and shall have no duty to notify you of any such views and opinions. This document is solely for information and does not have any regard to the specific investment objectives, financial or tax situation and the particular needs of any specific person who may receive this document.

Eastspring Investments Inc. (Eastspring US) primary activity is to provide certain marketing, sales servicing, and client support in the US on behalf of Eastspring Investment (Singapore) Limited (“Eastspring Singapore”). Eastspring Singapore is an affiliated investment management entity that is domiciled and registered under, among other regulatory bodies, the Monetary Authority of Singapore (MAS). Eastspring Singapore and Eastspring US are both registered with the US Securities and Exchange Commission as a registered investment adviser. Registration as an adviser does not imply a level of skill or training. Eastspring US seeks to identify and introduce to Eastspring Singapore potential institutional client prospects. Such prospects, once introduced, would contract directly with Eastspring Singapore for any investment management or advisory services. Additional information about Eastspring Singapore and Eastspring US is also is available on the SEC’s website at www.adviserinfo.sec. gov.

Certain information contained herein constitutes "forward-looking statements", which can be identified by the use of forward-looking terminology such as "may", "will", "should", "expect", "anticipate", "project", "estimate", "intend", "continue" or "believe" or the negatives thereof, other variations thereof or comparable terminology. Such information is based on expectations, estimates and projections (and assumptions underlying such information) and cannot be relied upon as a guarantee of future performance. Due to various risks and uncertainties, actual events or results, or the actual performance of any fund may differ materially from those reflected or contemplated in such forward-looking statements.

Eastspring Investments companies (excluding JV companies) are ultimately wholly-owned / indirect subsidiaries / associate of Prudential plc of the United Kingdom. Eastspring Investments companies (including JV’s) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America.