Summary

Asia’s sustainable bond market is growing rapidly but it is still a small percentage of the overall Asia bond universe. Investing in sustainable bonds together with conventional bonds that have attractive E, S and G characteristics is an effective way for investors to meet both their investment and sustainability objectives.

While investor concerns over the US economy, China’s recovery momentum, global inflation and the pace of rate hikes have ebbed and flowed, environmental, social and governance (ESG) considerations remain at the forefront of government and business leaders’ minds.

In a global survey of 100 C-suite executives included in Eastspring’s whitepaper Asia 2.0: Investing in an era of new opportunities, 57% of the business leaders indicated that their choice of suppliers over the next few years will be determined by ESG-related factors. Meanwhile, 69% of the business leaders highlighted that the limited awareness about current ESG exposures across their supply chains was a key risk for their businesses in Asia. Asian companies’ approach to ESG considerations will impact their market shares and revenues.

Asia’s sustainable bond landscape

The size of the sustainable1 bond market in ASEAN +32 reached USD589.3 billion at the end of 2022. The market grew 37% over the previous year, faster than the global sustainable bond market which grew 27%. It is the second largest regional sustainable bond market in the world, accounting for 17.7% of the global sustainable bond market.

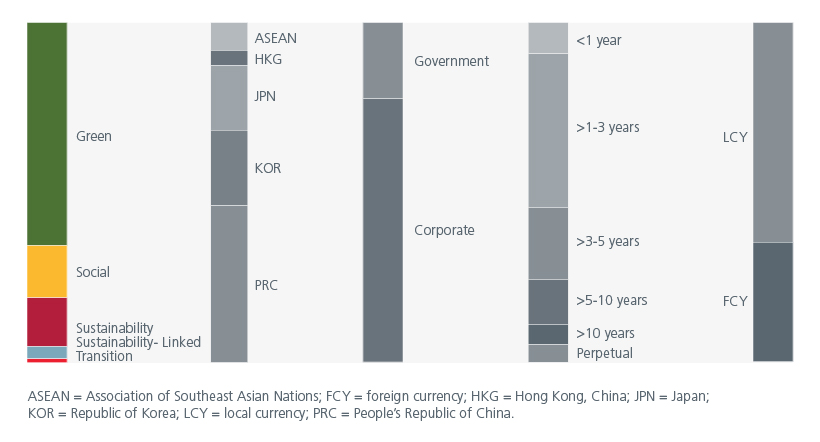

Fig. 1. shows that the ASEAN +3 sustainable bond market is dominated by green bonds and has an average weighted tenor of 4.5 years. More than 50% of the bonds outstanding are issued by the private sector, suggesting that there is room for greater public sector issuance. To support Singapore’s decarbonisation efforts and to deepen its green finance market, the government has announced that the public sector will issue up to SGD35 billion of Green Bonds by 2030.

Fig. 1. Profile of the ASEAN+3 sustainable bond market

Source: AsiaBondsOnline computations based on Bloomberg LP data as end 2022. FCY= Foreign currency. LCY = Local currency. ASEAN+3 is defined to include ASEAN, Hong Kong, China, Japan and South Korea.

Beyond ASEAN+3, India is also a significant issuer of sustainable bonds3. The Indian government issued its first green bond in January 2023. The two local currency tranches of USD500 million-equivalent each obtained a greenium (cheaper financing costs), reflecting strong domestic demand. In line with India’s ambitious decarbonisation goal of increasing non-fossil fuel electricity generation capacity to 500GW and sourcing 50% of India’s energy requirement through non–fossil-fuel sources by 2030, India’s renewable energy sector has been increasing capital investments and tapping the sustainable bond market to support this transition. The presence of a supportive regulatory mechanism and the fact that renewable projects in India have achieved grid-parity 4 have helped the sector grow strongly by a CAGR of 15.5%5 between 2016 and 2021.

The role of ESG in credit ratings

While the sustainable labelled bond market is growing rapidly in Asia, it is still a small percentage of the entire Asia bond universe. Besides labelled bonds, investors can also invest sustainably while tapping on the broader Asia bond universe.

With the rising focus on sustainability, international credit rating agencies including Moody’s, S&P Global and Fitch have started to produce indicators to communicate to investors how different ESG factors drive the final credit ratings.

That said, credit rating agencies only consider ESG factors that may materially affect the probability of default of the issuer or single issue. For example, they will consider the carbon intensity of an issuer if it was operating in a jurisdiction where there is carbon pricing or tight regulations over carbon emissions. In such a scenario, higher carbon intensity will incur additional costs and could affect the probability of an issuer’s default in the foreseeable future. ESG ratings on the other hand measure a company's commitment to environmental, social, and governance investing standards. The time horizons underpinning both credit and ESG ratings may also vary.

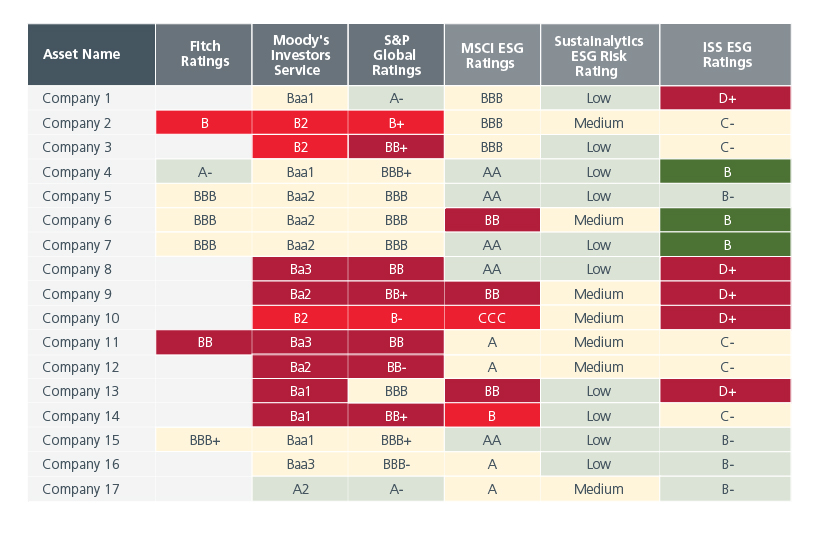

Given that the ESG rating industry is still at a nascent stage, historical data is usually not easily available, complete, or accurate. As such, it is still early days to establish strong and definitive links between an issuer’s credit and ESG ratings. A study by the Institute for Energy Economics and Financial Analysis (IEEFA) of more than 700 companies with credit ratings from Fitch Ratings, Moody’s and S&P Global showed that there was little relationship between credit and ESG ratings. Data from the United Nations Principles for Responsible Investment (UNPRI) that compares the credit and ESG ratings of approximately 120 companies across a range of sectors concur with the IEEFA’s findings. A sample of the ratings for 17 companies in the communications sector in Fig. 2. shows little correlation between the companies’ credit and ESG ratings.

Fig. 2. Comparison of credit and ESG ratings

Source: This spreadsheet is for illustrative purpose only and provides the credit ratings and ESG ratings for 17 entities in the communications sector. The entities were selected because credit ratings and ESG ratings were both publicly available in most cases. Some credit rating agencies (CRAs) or ESG information providers may not cover a particular entity. The data presented in the table was correct at the time of its compilation (July 2022) but may not be valid after that time as both CRAs and ESG information providers can and do revise their ratings.

There is hence room for active managers to add value by incorporating their own ESG analysis. Eastspring fixed income team’s proprietary ESG scoring framework categorises issuers according to their ESG risk exposures and preparedness. By adopting an ESG lens, active managers can enhance returns by avoiding “future losers” – issuers with medium to high-risk exposures and low ESG preparedness. Active managers can also take advantage of fresh opportunities by identifying issuers that are making efforts to minimise their ESG risk exposures and that are addressing the potential ESG risks which their businesses face. For example, buildings currently account for 39% of global carbon emissions but developers are increasingly greening their real estate portfolios. Green buildings can achieve energy savings of 50% or more and can help meet nine out of 17 of the UN’s Sustainable Development Goals. Singapore for example has set a goal to have 80% of its building stock certified with its Green Mark tool by 2030, reinforcing its desire to build a low carbon and energy-efficient city-state.

Bond investing with an ESG lens

The global community remains strongly focused on ESG and how companies incorporate ESG considerations into their business models presents risks and opportunities for investors. We believe that companies that adopt sustainable practices are more likely to deliver better value in the long term. While Asia’s sustainable bond market is growing rapidly and becoming more diverse, ASEAN+3’s sustainable bond market only makes up 1.7% of all the bonds outstanding in these markets. While the issuance of sustainable bonds is likely to rise going forward, investing in sustainable bonds together with conventional bonds that have attractive E, S and G characteristics in Asia is an effective way for investors to meet both their investment and sustainability objectives.

If you would like to find out how our investment teams engage with companies on ESG issues, please read our Responsible Investment Report 2022.

Sources:

1 Defined to be green, social, sustainable, sustainability linked and transition bonds (GSS+)

2 Defined as ASEAN plus China, Hong Kong, Japan and South Korea.

3 India is the sixth largest issuer of green, social, sustainable, sustainability linked and transition bonds (GSS+) in the Asia Pacific Region, according to unpublished data from Climate Bonds.

4 Grid parity occurs when use of alternative energies costs less than, or equal to, the price of using power from conventional sources.

5 Department of Commerce, Ministry of Commerce and Industry,

Government of India, January 2021. LHS Source: CEA, JP Morgan, September 2020.

The information and views expressed herein do not constitute an offer or solicitation to deal in shares of any securities or financial instruments and it is not intended for distribution or use by anyone or entity located in any jurisdiction where such distribution would be unlawful or prohibited. The information does not constitute investment advice or an offer to provide investment advisory or investment management service or the solicitation of an offer to provide investment advisory or investment management services in any jurisdiction in which an offer or solicitation would be unlawful under the securities laws of that jurisdiction.

Past performance and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the strategies managed by Eastspring Investments. An investment is subject to investment risks, including the possible loss of the principal amount invested. Where an investment is denominated in another currency, exchange rates may have an adverse effect on the value price or income of that investment. Furthermore, exposure to a single country market, specific portfolio composition or management techniques may potentially increase volatility.

Any securities mentioned are included for illustration purposes only. It should not be considered a recommendation to purchase or sell such securities. There is no assurance that any security discussed herein will remain in the portfolio at the time you receive this document or that security sold has not been repurchased.

The information provided herein is believed to be reliable at time of publication and based on matters as they exist as of the date of preparation of this report and not as of any future date. Eastspring Investments undertakes no (and disclaims any) obligation to update, modify or amend this document or to otherwise notify you in the event that any matter stated in the materials, or any opinion, projection, forecast or estimate set forth in the document, changes or subsequently becomes inaccurate. Eastspring Investments personnel may develop views and opinions that are not stated in the materials or that are contrary to the views and opinions stated in the materials at any time and from time to time as the result of a negative factor that comes to its attention in respect to an investment or for any other reason or for no reason. Eastspring Investments shall not and shall have no duty to notify you of any such views and opinions. This document is solely for information and does not have any regard to the specific investment objectives, financial or tax situation and the particular needs of any specific person who may receive this document.

Eastspring Investments Inc. (Eastspring US) primary activity is to provide certain marketing, sales servicing, and client support in the US on behalf of Eastspring Investment (Singapore) Limited (“Eastspring Singapore”). Eastspring Singapore is an affiliated investment management entity that is domiciled and registered under, among other regulatory bodies, the Monetary Authority of Singapore (MAS). Eastspring Singapore and Eastspring US are both registered with the US Securities and Exchange Commission as a registered investment adviser. Registration as an adviser does not imply a level of skill or training. Eastspring US seeks to identify and introduce to Eastspring Singapore potential institutional client prospects. Such prospects, once introduced, would contract directly with Eastspring Singapore for any investment management or advisory services. Additional information about Eastspring Singapore and Eastspring US is also is available on the SEC’s website at www.adviserinfo.sec. gov.

Certain information contained herein constitutes "forward-looking statements", which can be identified by the use of forward-looking terminology such as "may", "will", "should", "expect", "anticipate", "project", "estimate", "intend", "continue" or "believe" or the negatives thereof, other variations thereof or comparable terminology. Such information is based on expectations, estimates and projections (and assumptions underlying such information) and cannot be relied upon as a guarantee of future performance. Due to various risks and uncertainties, actual events or results, or the actual performance of any fund may differ materially from those reflected or contemplated in such forward-looking statements.

Eastspring Investments companies (excluding JV companies) are ultimately wholly-owned / indirect subsidiaries / associate of Prudential plc of the United Kingdom. Eastspring Investments companies (including JV’s) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America.