Summary

- India remains one of the fastest-growing economies, with IMF projecting 6.5% growth in FY26 and FY27, outpacing other large economies

- India's 2025-26 budget and RBI's rate cut aim to boost consumption and capex, supporting fiscal discipline and sustainable growth

- India's political stability ensures policy continuity while strong demand for Indian equities by institutional and retail investors will underpin the market

India’s economy is projected to grow by 6.4% in the financial year ending March 2025, the slowest in four years. This downturn can be attributed to weak consumer demand, sluggish private investment, and lower government expenditure due to election-related spending curbs. While the slowing growth has dented confidence and highlighted India’s vulnerabilities, it is crucial to assess India’s future growth in the global context instead of focusing on the most recent performance.

India continues to be one of the fastest growing economies of the world. According to IMF estimates, the Indian economy is likely to grow at 6.5% in FY26 and FY27. No other economy of comparable size is likely to grow faster than India over the next few years.

Slowdown appears to be transient

This moderation in growth should also be seen in the light of an unfavourable base effect post the Covid. As the pandemic restrictions were removed, pent up demand for services and higher production turbocharged India’s economic growth. The Indian government also ran higher deficits during and post pandemic which fostered the government capex-led growth. Hence to a certain extent, it can be said the economy is reverting to trend growth.

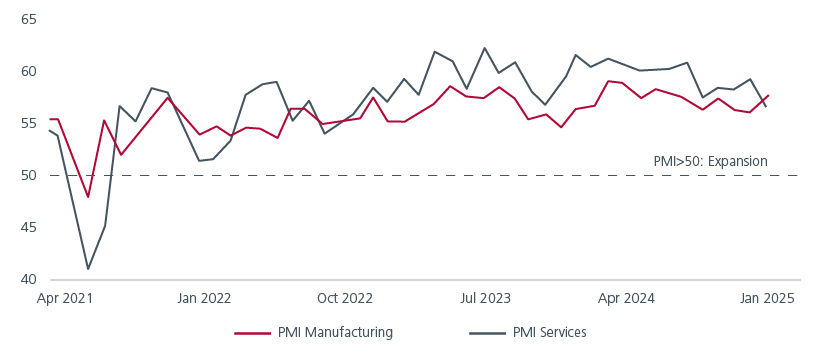

There are also signs of improvement in manufacturing activity; the Purchasing Managers Index rose to 57.7 in January, up from 56.4 in December and 56.5 in November. The services PMI however declined. With regards to consumption the recovery in rural demand is being supported by improved agriculture indicators. Meanwhile urban demand is expected to get a fillip from the latest budget.

Fig 1: Manufacturing PMI shows improvement

Source: BofA Global Research, Haver, Jan 2025

Consumption and capex get a boost

India’s 2025-26 budget offers policy continuity and outlines a roadmap to attain sustainable growth. It incentivises job creation, supports discretionary incomes and provides a blueprint to navigate through rapidly changing global macroeconomic conditions and business environment. The tax savings will offer a boost to discretionary consumption while real estate investment across micro-markets may benefit from tailwinds. The rejig in customs duties is also positive for India’s manufacturing ecosystem.

Despite the focus on accelerating consumption, allocations to key capex intensive sectors such as railways and road transportation remain high. The next leg of growth will be driven by state owned enterprises and private capex. A sustainable rise in consumption bodes well for private sector capex over the medium term. It is also worth noting the government has adhered to its fiscal consolidation stance, hinting at greater fiscal discipline.

Close on the heels of the budget and the Reserve Bank of India’s (RBI) recent liquidity injections into the system, the RBI has for the first time in nearly five years cut the key repo rate by 25 bps from 6.5 per cent to 6.25 per cent, to provide additional stimulus to the sluggish economy. The combined fiscal and monetary stimulus should spur consumption and credit creation going forward.

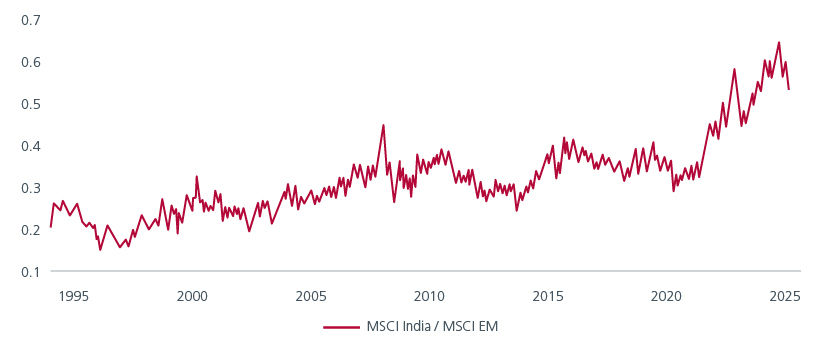

The equity premium justification

Lured by the country’s high economic and superior earnings growth in the post Covid period, investors piled into Indian equities. As a result, India’s outperformance versus Emerging Markets (EMs) became more pronounced since late 2020. See Fig 2. However, since September 2024, foreign investors started to pull out, spooked by the slowdown in the economy.

Fig 2: India outperforms EMs in the long term

Source: LSEG Datastream, MSCI indices, 4 Feb 2025

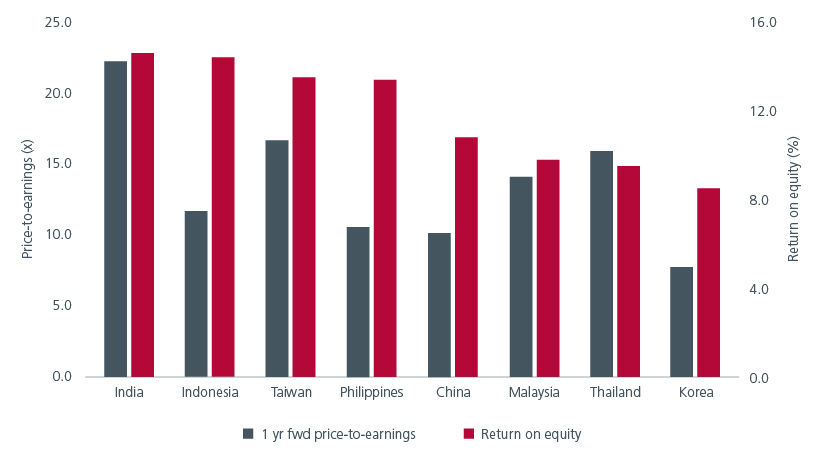

Global headwinds and high equity valuations too affected foreign investors’ sentiment. That said, India’s valuation premium can be justified if one considers a few factors. A key point is that India’s return on equity (ROE) is amongst the highest. See Fig 3. India also ranks second worldwide, just behind the US, in the number of companies that have consistently achieved a ROE exceeding 20% for over a decade.1

Fig 3: India is expensive for a reason

Source: PruICICI, Morgan Stanley, 31 Dec 2024

Consistent ROE performance typically reflects the underlying financial health of companies. Still, companies with high valuations have to continue to deliver better earnings. After being in the fast lane for three years, earnings numbers saw some deceleration in Q1 and Q2 FY25.

The recent Q3FY25 numbers suggest a mixed bag. Out of the 242 companies, better earnings were reported by companies in the financial sector. Amongst the non-financial companies, revenue and profit after growth remains weak on a year-on-year basis but the quarter-on-quarter data is encouraging and suggests that an earnings recovery might be already underway.

All said, India offers a huge domestic market where there is under penetration of consumer goods as well as well-regulated capital markets that offer depth, diversification, and liquidity. So, this is where an active investment strategy is best placed to pick the potential winners. For now, the risk return trade-off favours large caps over mid and small caps.

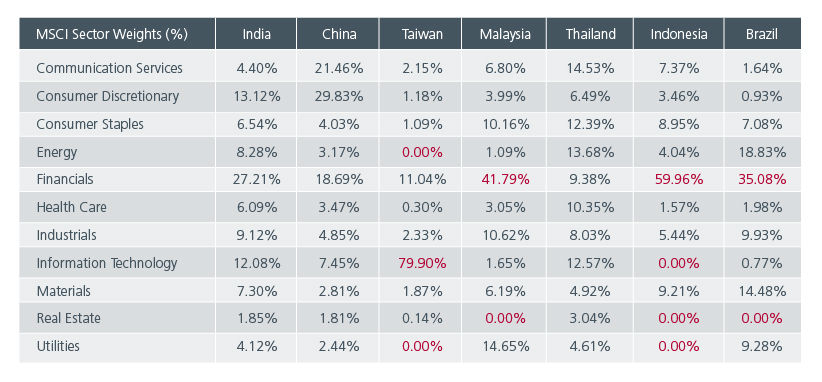

Fig 4: India remains one of the most diversified markets in EMs

Source: MSCI factsheets, 31 Dec 2024

Considerable potential to be harnessed

2025 will undoubtedly be a challenging year. US President Trump’s transactional approach to trade can impact global growth and the US administration’s policies are likely to trigger intermittent market volatility as seen in the recent market movements to tariff announcements. Nonetheless India is unlikely to see major dislocations. The country should continue on a growth path with occasional cyclical blips.

India's near-term political stability ensures policy continuity and certainty. The country is beginning to integrate more into global supply chains, with significant potential yet to be utilised. Over the next 5-10 years, India is expected to scale up production and export of electronics goods. Key sectors like automobiles, chemicals, and pharmaceuticals are also part of the global supply chain. Additionally, logistics costs in India are likely to decrease, making them globally competitive. This indicates a strong growth potential for India's participation in the global supply chain.

Meanwhile India’s thrust on startups and innovations makes it a unique place for global players looking to diversify their manufacturing base. Startups contribute ~15% to Indian economy. India’s start up ecosystem is the third largest in the world, valued at ~USD 349bn.2 In 2024, India was Asia Pacific’s bright spot for initial public offerings (IPOs), delivering a 152% increase in IPO proceeds to USD16.8bn.3

Last but not least, Indian markets remain firmly underpinned by domestic inflows. The continued strong demand for Indian equities by institutional investors and retail investors are soaking up the outflow of foreign capital. This should continue to provide support for India’s equity market.

The article includes insights from ICICI Prudential Asset Management

Sources:

1 https://www.ibef.org/news/india-second-only-to-u-s-in-number-of-consistent-high-performing-companies-report

2 https://assets.kpmg.com/content/dam/kpmgsites/in/pdf/2024/12/exploring-indias-dynamic-start-up-ecosystem.pdf

3 https://www.pwc.co.uk/services/audit/insights/global-ipo-watch.html

The information and views expressed herein do not constitute an offer or solicitation to deal in shares of any securities or financial instruments and it is not intended for distribution or use by anyone or entity located in any jurisdiction where such distribution would be unlawful or prohibited. The information does not constitute investment advice or an offer to provide investment advisory or investment management service or the solicitation of an offer to provide investment advisory or investment management services in any jurisdiction in which an offer or solicitation would be unlawful under the securities laws of that jurisdiction.

Past performance and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the strategies managed by Eastspring Investments. An investment is subject to investment risks, including the possible loss of the principal amount invested. Where an investment is denominated in another currency, exchange rates may have an adverse effect on the value price or income of that investment. Furthermore, exposure to a single country market, specific portfolio composition or management techniques may potentially increase volatility.

Any securities mentioned are included for illustration purposes only. It should not be considered a recommendation to purchase or sell such securities. There is no assurance that any security discussed herein will remain in the portfolio at the time you receive this document or that security sold has not been repurchased.

The information provided herein is believed to be reliable at time of publication and based on matters as they exist as of the date of preparation of this report and not as of any future date. Eastspring Investments undertakes no (and disclaims any) obligation to update, modify or amend this document or to otherwise notify you in the event that any matter stated in the materials, or any opinion, projection, forecast or estimate set forth in the document, changes or subsequently becomes inaccurate. Eastspring Investments personnel may develop views and opinions that are not stated in the materials or that are contrary to the views and opinions stated in the materials at any time and from time to time as the result of a negative factor that comes to its attention in respect to an investment or for any other reason or for no reason. Eastspring Investments shall not and shall have no duty to notify you of any such views and opinions. This document is solely for information and does not have any regard to the specific investment objectives, financial or tax situation and the particular needs of any specific person who may receive this document.

Eastspring Investments Inc. (Eastspring US) primary activity is to provide certain marketing, sales servicing, and client support in the US on behalf of Eastspring Investment (Singapore) Limited (“Eastspring Singapore”). Eastspring Singapore is an affiliated investment management entity that is domiciled and registered under, among other regulatory bodies, the Monetary Authority of Singapore (MAS). Eastspring Singapore and Eastspring US are both registered with the US Securities and Exchange Commission as a registered investment adviser. Registration as an adviser does not imply a level of skill or training. Eastspring US seeks to identify and introduce to Eastspring Singapore potential institutional client prospects. Such prospects, once introduced, would contract directly with Eastspring Singapore for any investment management or advisory services. Additional information about Eastspring Singapore and Eastspring US is also is available on the SEC’s website at www.adviserinfo.sec. gov.

Certain information contained herein constitutes "forward-looking statements", which can be identified by the use of forward-looking terminology such as "may", "will", "should", "expect", "anticipate", "project", "estimate", "intend", "continue" or "believe" or the negatives thereof, other variations thereof or comparable terminology. Such information is based on expectations, estimates and projections (and assumptions underlying such information) and cannot be relied upon as a guarantee of future performance. Due to various risks and uncertainties, actual events or results, or the actual performance of any fund may differ materially from those reflected or contemplated in such forward-looking statements.

Eastspring Investments companies (excluding JV companies) are ultimately wholly-owned / indirect subsidiaries / associate of Prudential plc of the United Kingdom. Eastspring Investments companies (including JV’s) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America.