Executive Summary

- The Matching Adjustment (MA) mechanism can reduce capital requirements for insurers by increasing the discount rates at which liabilities are valued, under specific conditions.

- The myriad of constraints and objectives faced by insurers makes the cashflow matching portfolio construction process an optimisation problem.

- The portfolio construction process produces an ideal set of bonds that is transformed into the actual portfolio with implementation oversight from asset managers.

Insurance companies in Singapore are obliged to meet regulatory metrics1 termed Capital Adequacy Ratio (“CAR”) and Fund Solvency Ratio (“FSR”) by holding sufficient capital against their calculated risks known as the Total Risk Requirement (“TRR”)2. The TRR can be further broken down into liabilities (insurance) and asset risk requirements, referred to as C1 and C2 pillars respectively within the directive3. To reduce their risk requirements, insurers can apply a Matching Adjustment (“MA”) to a defined set of liabilities using eligible assets.

The MA is a mechanism that was introduced under the Risk-Based Capital 2 Framework (“RBC 2”) in March 2020 by the Monetary Authority of Singapore (“MAS”) for Singapore-based insurers.4 Designed in part to acknowledge insurers’ intent and ability to hold assets to maturity in order to match long-term insurance liabilities, the MA allows them to reduce the amount of capital they are required to hold against their long-term obligations. Consequently, insurers can enhance capital efficiency and improve profitability, whilst safeguarding the interests of the policyholders.

Matching Adjustment and asset & liability valuation

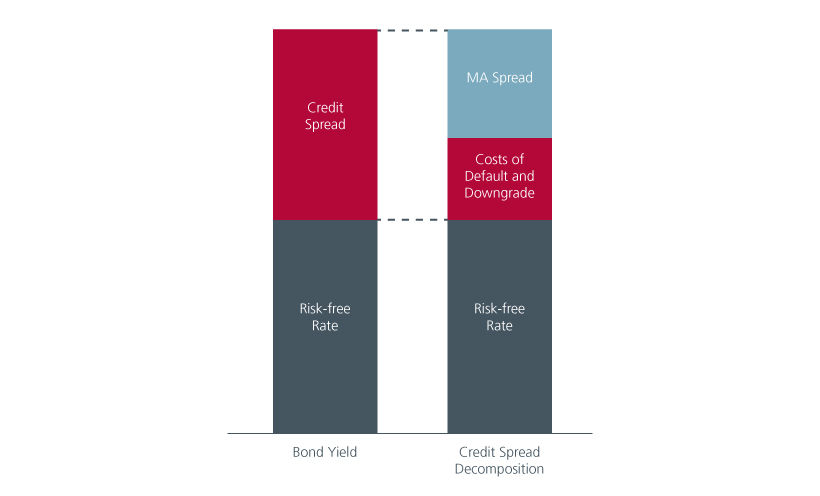

While assets are valued at market value, the valuation of the liabilities and its corresponding risk figures are determined by discounting the liability cashflows by the risk-free rate5. The MA allows for a positive adjustment (“MA spread”) to this spot risk-free discount rate, bringing down the ascribed value of the liabilities and by extension, the capital requirements6.

One of the tenets of MA is to recognise the economic reality of asset-liability management where assets purchased to back the liabilities are expected to be held to maturity, and that there is reasonable7 expectation for the assets to not default. The cashflow of these assets – usually bonds – are exact and predictable8 like their projected liability counterparts. Unlike liabilities however, the assets employed tend to have a credit spread component and are discounted at the asset yields for valuation (as opposed to risk-free rates), leading to significant difference in interest rates sensitivities between the two sides of the balance sheet, and subsequently volatility in the CAR and FSR metrics when interest rates or credit spreads move. By referring to the actual assets held by the insurers, the MA aims to provide an appropriate adjustment that allows the liabilities to be further discounted by a rate similar to the credit spread of the assets, less an adjustment for possible defaults and downgrades. This effectively allows liabilities to mirror changes in the market value of assets that are not related to default or downgrades, dampening balance sheet volatility and providing a more meaningful representation of the economic position of the insurers.

Fig. 1. Illustration of how the MA spread is derived from the credit spread of the bonds

Source: Eastspring Investments. January 2025.

Portfolio construction for the Matching Adjustment portfolio

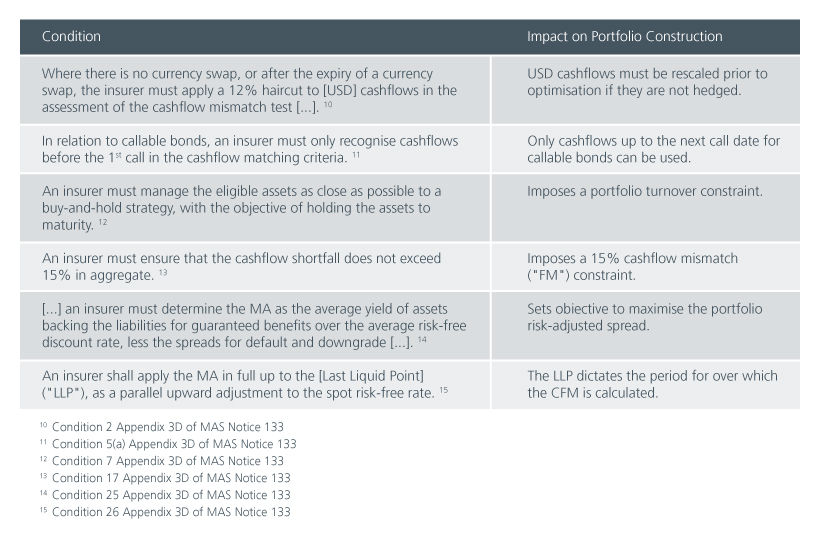

Through the lens of asset managers, the MA Portfolio is viewed as a portfolio construction problem. Insurers must meet a list of conditions9 to apply MA to their liabilities and these have a direct implication on the portfolio construction process:

Fig. 2. Impact on portfolio construction

Source: Eastspring Investments. January 2025.

Certain conditions stated in the framework have indirect impacts as well, leading to MA portfolios being naturally biased towards having diversified holdings16 (in terms of issuer, sector, country and credit concentrations), which shows up in the portfolio construction process as weight constraints.

The usage of the terms “constraints” and “objective” in the table above are very much deliberate as the cashflow matching portfolio construction process is an optimisation problem that can be formulated as a linear program17, which is an optimisation specification that contains linear objectives and constraints18. Put together, the aforementioned specifications allow one to solve for a minimum value portfolio that meets all of the requirements and gives the insurers an MA spread that can be applied to their liabilities with the least amount of capital allocated. However, like most things in life, the devil is in the details: the setup of the linear program requires significant amount of data – a challenge compounded by a potentially large asset universe, and a well-formulated problem that will be able to account for nuances such as turnover constraints, cashflow reallocation19, market impact and hedging can result in a solution space that grows quickly, making it difficult to solve.

Optimisation is a systematic portfolio construction method because it is completely rule and logic based, i.e. deterministic. The output of the process is a set of bonds that can, under ideal conditions, be turned into a portfolio. However, conditions are never ideal, and it is still prudent for the fund manager to re-evaluate the bonds considering market developments to assess whether it is suitable for inclusion in the portfolio.

The above is an extract of a whitepaper “Practical guide to Matching-Adjustment portfolio construction”. Please reach out to an Eastspring sales representative if you would like to have more information or if you would like to have a discussion on how a MA portfolio can be implemented to meet your specific needs.

Sources:

1 Insurance (Valuation and Capital) Regulations 2004

2 MAS Notice 133 Section 2: Supervisory Solvency Intervention Levels

3 MAS Notice 133 Section 4: Total Risk Requirement

4 Matching Adjustment by itself is not a new mechanism, first introduced in the European Union via the Solvency II regulatory framework in 2016. RBC 2 as a framework bears reference to Solvency II and standards

prescribed by the International Association of Insurance Supervisors (“IAIS”).

5 Risk-free discount rates are to be derived in accordance with Appendix 3C of MAS Notice 133

6 It is worth distinguishing that while the economic value of the liabilities has decreased for the insurer with the addition of the MA spread, the economic benefit of the insurance to its policyholders has

not.

7 The cost of default is factored into the calculation of the MA spread using the methodology specified in Appendix 18, Technical Specifications for RBC 2

8 Assuming fixed coupon bonds, or a combination of securities that replicate a series of known, fixed and contractual cashflows.

9 The list of conditions is stated in Appendix 3D of MAS Notice 133

10 Condition 2 Appendix 3D of MAS Notice 133

11 Condition 5(a) Appendix 3D of MAS Notice 133

12 Condition 7 Appendix 3D of MAS Notice 133

13 Condition 17 Appendix 3D of MAS Notice 133

14 Condition 25 Appendix 3D of MAS Notice 133

15 Condition 26 Appendix 3D of MAS Notice 133

16 Condition 8 Appendix 3D of MAS Notice 133 describes increased monitoring and reporting of portfolios which show significant asset or liability movements. A diversified portfolio would reduce idiosyncratic,

segment specific risks and minimise such volatilities.

17 Cornuéjols, G., Peña, J., & Tütüncü, R. (2018). Ch.3, Optimization Methods in Finance (2nd ed.). Cambridge: Cambridge University Press.

18 In some special cases where there are quadratic constraints, the cashflow matching portfolio can be derived using a second-order cone program (SOCP).

19 Cashflow reallocation is a process specified in Condition 21 Appendix 3D of MAS Notice 133, which allows the reallocation of excess cashflows or premium income at risk-free rates.

The information and views expressed herein do not constitute an offer or solicitation to deal in shares of any securities or financial instruments and it is not intended for distribution or use by anyone or entity located in any jurisdiction where such distribution would be unlawful or prohibited. The information does not constitute investment advice or an offer to provide investment advisory or investment management service or the solicitation of an offer to provide investment advisory or investment management services in any jurisdiction in which an offer or solicitation would be unlawful under the securities laws of that jurisdiction.

Past performance and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the strategies managed by Eastspring Investments. An investment is subject to investment risks, including the possible loss of the principal amount invested. Where an investment is denominated in another currency, exchange rates may have an adverse effect on the value price or income of that investment. Furthermore, exposure to a single country market, specific portfolio composition or management techniques may potentially increase volatility.

Any securities mentioned are included for illustration purposes only. It should not be considered a recommendation to purchase or sell such securities. There is no assurance that any security discussed herein will remain in the portfolio at the time you receive this document or that security sold has not been repurchased.

The information provided herein is believed to be reliable at time of publication and based on matters as they exist as of the date of preparation of this report and not as of any future date. Eastspring Investments undertakes no (and disclaims any) obligation to update, modify or amend this document or to otherwise notify you in the event that any matter stated in the materials, or any opinion, projection, forecast or estimate set forth in the document, changes or subsequently becomes inaccurate. Eastspring Investments personnel may develop views and opinions that are not stated in the materials or that are contrary to the views and opinions stated in the materials at any time and from time to time as the result of a negative factor that comes to its attention in respect to an investment or for any other reason or for no reason. Eastspring Investments shall not and shall have no duty to notify you of any such views and opinions. This document is solely for information and does not have any regard to the specific investment objectives, financial or tax situation and the particular needs of any specific person who may receive this document.

Eastspring Investments Inc. (Eastspring US) primary activity is to provide certain marketing, sales servicing, and client support in the US on behalf of Eastspring Investment (Singapore) Limited (“Eastspring Singapore”). Eastspring Singapore is an affiliated investment management entity that is domiciled and registered under, among other regulatory bodies, the Monetary Authority of Singapore (MAS). Eastspring Singapore and Eastspring US are both registered with the US Securities and Exchange Commission as a registered investment adviser. Registration as an adviser does not imply a level of skill or training. Eastspring US seeks to identify and introduce to Eastspring Singapore potential institutional client prospects. Such prospects, once introduced, would contract directly with Eastspring Singapore for any investment management or advisory services. Additional information about Eastspring Singapore and Eastspring US is also is available on the SEC’s website at www.adviserinfo.sec. gov.

Certain information contained herein constitutes "forward-looking statements", which can be identified by the use of forward-looking terminology such as "may", "will", "should", "expect", "anticipate", "project", "estimate", "intend", "continue" or "believe" or the negatives thereof, other variations thereof or comparable terminology. Such information is based on expectations, estimates and projections (and assumptions underlying such information) and cannot be relied upon as a guarantee of future performance. Due to various risks and uncertainties, actual events or results, or the actual performance of any fund may differ materially from those reflected or contemplated in such forward-looking statements.

Eastspring Investments companies (excluding JV companies) are ultimately wholly-owned / indirect subsidiaries / associate of Prudential plc of the United Kingdom. Eastspring Investments companies (including JV’s) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America.