Executive Summary

- US policy unpredictability has reduced the ability to forecast the future with decent conviction.

- Adopting a multi-strategy approach and prioritising total portfolio risk management are essential to navigate the current landscape.

- Being nimble in securing profits helps mitigate risks and reallocate monies to emerging opportunities.

It has been a challenging year, to say the least, for multi asset portfolio managers. The US government’s policy announcements and backpedaling have reduced the ability to forecast the future with any decent conviction, and volatility and shifts in correlation and market leadership across all asset classes have driven investors to rethink their strategic asset allocations as well as risk management approaches.

More than ever, it has been important for absolute return fund managers to approach investing with a level head and not react to headline news and policy announcements that are then retracted a few days later. Long-only investors have also had to rethink the time horizon of their investments, as fundamental views may be eclipsed by news flow or market narrative and sentiment. In this article, we discuss the key pillars of Eastspring Multi Asset team’s investment approach in this Trump 2.0 era.

No single approach to alpha is working this year

During normal economic and market cycles, following a data-driven approach is helpful to separate trend from noise. With a large amount of data thrown at global investors daily, the team relies on a proprietary model that uses 10,000 data points to distill macroeconomic changes and systematically identify alpha opportunities. But that has changed somewhat since the start of Trump 2.0. Short-term alpha opportunities are now driven less by historical data and its implications on where we are in the economic cycle, and more by policy action and its implications.

We have seen that investors have begun to discount high frequency data as being stale and are focused on policy announcements instead. Even if macroeconomic data shows that US consumers continue to look strong, unemployment rate is low, and corporates are beating earnings estimates, risk assets are unfazed by it. They are focused not on past data, but on the impact of policy on future data. The market’s reaction to this year’s January 10th non-farm payrolls upside surprise drove yields 17 basis points higher, but on April 4th, a strong jobs data print had no impact to 10-year Treasury yields.

We believe that our multi-strategy approach that utilises various investment philosophies and implementation tools – systematic, fundamental, carry and convexity– therefore has the potential to strengthen and position portfolios for the uncertainty that is here to stay.

In particular, the market volatility presents itself several market dislocations that can be taken advantage of using options – what our convexity alpha pillar aims to do. While option prices have spiked significantly, derivative trades allow you to express your view while keeping downside capped. This convexity profile is attractive for total return portfolios, as they enable you to skew the risk/reward in your favour.

For instance, if the investment view is bullish equities, holding an outright overweight position in equities runs the risk of being significantly hit in case the US administration does not reach a deal with key trading partners, or the reciprocal tariffs are back. Instead of having an outright overweight position in equities, portfolios can use structures such as calls, call spreads, call ratios, and risk reversals to express the view in a more risk-aware manner.

Another example is when the volatility curve suggests a very low probability of a certain outcome occurring, versus what we forecast. Rapid movements in the spot market can sometimes present opportunities, enabling you to benefit from a convergence to mean with limited downside risk.

Prioritising risk management over seeking alpha is essential

Due to the unpredictable nature of the Trump administration's policies, even with sound asset allocation decisions, neglecting beta positions in total return portfolios can be risky. This year, prioritising risk management over seeking alpha is essential. The right risk management framework not only protects returns but also puts you on front foot to take risk and generate alpha when the opportunity arises.

In early March, several technical indicators, which have historically been reliable, were suggestive of a tactical bounce in the SPDR S&P 500 ETF Trust and were indicating it was in oversold territory. Even going into Liberation Day, indicators were suggesting that a lot of the bad news was in the price and therefore a bounce was likely. Despite that, we saw a significant leg lower in a short span of time, leaving investors with very little reaction window.

We expect this nature of environment to continue as US’ economic outlook remains hinged on economic policy announcements. We therefore prefer to hold hedges in the portfolio systematically through the market cycle, as timing risk-off episodes is going to be incredibly difficult. Being proactive risk managers increases the probability of meeting the end client’s target return over a 1–3-year period as we know from experience that recovering from a large drawdown is challenging for total return funds.

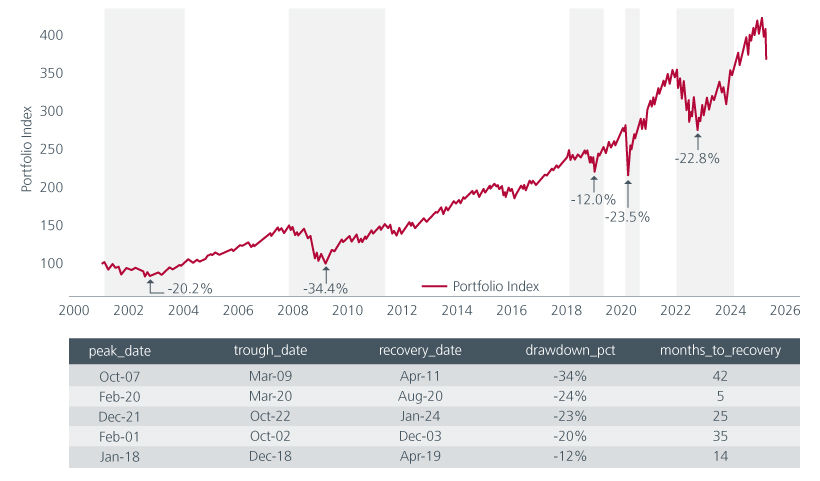

Using data from 2001, a 60/40 balanced portfolio has on average taken 24 months to recover its peak to trough drawdown. See Fig 1. While systematic risk management may imply a cost of carry, it will allow total return portfolios to cushion the absolute drawdown during significant risk-off episodes.

Fig 1: Total return portfolio with drawdowns

Source: Portfolio (60% MSCI ACWI and 40% Bloomberg Global Aggregate index) from LSEG Datastream as at 14 April 2025

Equally important are the risk models that the scenario profit and losses are based on. This year, equity/bond correlations turned negative, after being positive since July 2022. Risk models that have a lookback window of 2 years will give a very different portfolio risk profile, than those that use 20 years of data. See Fig 2. This complicates risk management as you are not only solving for the portfolio positions, but also the correlation matrix. It therefore becomes critical to assess portfolios across different assumptions, time periods, and ensure the resulting numbers are within the risk tolerance levels.

Fig 2: Sensitivity of equities to US treasury yield movements

Source: Portfolio (60% MSCI ACWI and 40% Bloomberg Global Aggregate index) from Aladdin as at 14 April 2025

Banking wins amid intense market shifts

As US growth and the Fed rate cut projections are still in flux and very dependent on unpredictable policymakers, long-only managers need to make a big mindset shift, balancing their buy and hold strategy with one that is more actively traded. Managers need to embrace the volatility and hold little conviction in any fundamental views for a long period of time as they can be upended by policies overnight. Banking your wins is important in this jarring environment. Securing profits when they arise helps mitigate the risks associated with sudden market downturns and helps maintain a portfolio’s long-term financial stability, allowing it to better navigate economic uncertainties.

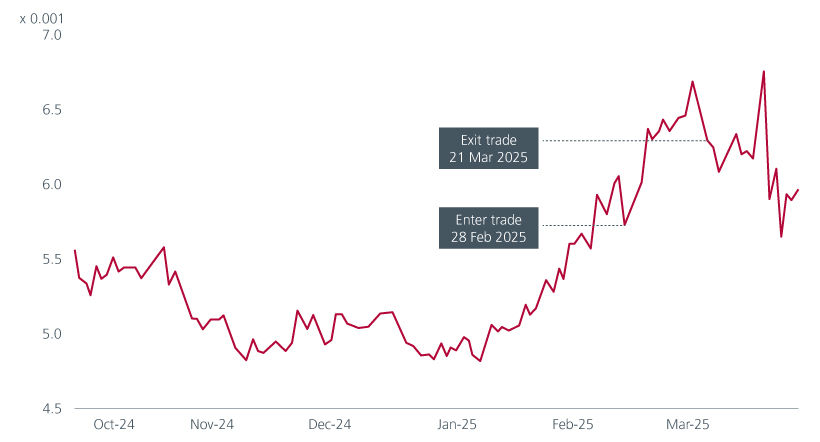

Our recent long position in China shares is one such example. As we noticed the shift in policymakers’ intention to take economic growth in China higher, we entered long China against the US. The trade moved quickly in our favour, but then positioning and technical indicators began to look stretched. Therefore, it was necessary to bank the wins and continuously manage the profit and loss, in case any policy announcements would change the fundamental picture substantially. At the time, it was the right thing to do, as market volatility meant that all of those gains would have otherwise been erased only 13 days later.

Fig 3: Tactical long positioning in China vs US equities

Source: MSCI China and MSCI US indices from LSEG Datastream as at 15 April 2025

The CBOE volatility index started the year at a fairly benign level of 16 but surged to its third highest point since the late 1990s. As Trump 2.0 is primed to be exciting, volatile, and difficult for asset allocators, the team will be relying on three pillars to navigate the current market environment: adopting multi-strategy alpha opportunities, prioritising systematic risk management, and banking wins as they arise.

The information and views expressed herein do not constitute an offer or solicitation to deal in shares of any securities or financial instruments and it is not intended for distribution or use by anyone or entity located in any jurisdiction where such distribution would be unlawful or prohibited. The information does not constitute investment advice or an offer to provide investment advisory or investment management service or the solicitation of an offer to provide investment advisory or investment management services in any jurisdiction in which an offer or solicitation would be unlawful under the securities laws of that jurisdiction.

Past performance and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the strategies managed by Eastspring Investments. An investment is subject to investment risks, including the possible loss of the principal amount invested. Where an investment is denominated in another currency, exchange rates may have an adverse effect on the value price or income of that investment. Furthermore, exposure to a single country market, specific portfolio composition or management techniques may potentially increase volatility.

Any securities mentioned are included for illustration purposes only. It should not be considered a recommendation to purchase or sell such securities. There is no assurance that any security discussed herein will remain in the portfolio at the time you receive this document or that security sold has not been repurchased.

The information provided herein is believed to be reliable at time of publication and based on matters as they exist as of the date of preparation of this report and not as of any future date. Eastspring Investments undertakes no (and disclaims any) obligation to update, modify or amend this document or to otherwise notify you in the event that any matter stated in the materials, or any opinion, projection, forecast or estimate set forth in the document, changes or subsequently becomes inaccurate. Eastspring Investments personnel may develop views and opinions that are not stated in the materials or that are contrary to the views and opinions stated in the materials at any time and from time to time as the result of a negative factor that comes to its attention in respect to an investment or for any other reason or for no reason. Eastspring Investments shall not and shall have no duty to notify you of any such views and opinions. This document is solely for information and does not have any regard to the specific investment objectives, financial or tax situation and the particular needs of any specific person who may receive this document.

Eastspring Investments Inc. (Eastspring US) primary activity is to provide certain marketing, sales servicing, and client support in the US on behalf of Eastspring Investment (Singapore) Limited (“Eastspring Singapore”). Eastspring Singapore is an affiliated investment management entity that is domiciled and registered under, among other regulatory bodies, the Monetary Authority of Singapore (MAS). Eastspring Singapore and Eastspring US are both registered with the US Securities and Exchange Commission as a registered investment adviser. Registration as an adviser does not imply a level of skill or training. Eastspring US seeks to identify and introduce to Eastspring Singapore potential institutional client prospects. Such prospects, once introduced, would contract directly with Eastspring Singapore for any investment management or advisory services. Additional information about Eastspring Singapore and Eastspring US is also is available on the SEC’s website at www.adviserinfo.sec. gov.

Certain information contained herein constitutes "forward-looking statements", which can be identified by the use of forward-looking terminology such as "may", "will", "should", "expect", "anticipate", "project", "estimate", "intend", "continue" or "believe" or the negatives thereof, other variations thereof or comparable terminology. Such information is based on expectations, estimates and projections (and assumptions underlying such information) and cannot be relied upon as a guarantee of future performance. Due to various risks and uncertainties, actual events or results, or the actual performance of any fund may differ materially from those reflected or contemplated in such forward-looking statements.

Eastspring Investments companies (excluding JV companies) are ultimately wholly-owned / indirect subsidiaries / associate of Prudential plc of the United Kingdom. Eastspring Investments companies (including JV’s) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America.