Executive Summary

- Asia’s financial markets have been a gateway for investors to tap into the region’s rising prosperity. On average, a dollar invested in Asian equities would have yielded more than a five-fold return over the last 30 years.

- Asian equities continue to appeal with both capital and income potential. The region’s long-term growth prospects remain bright, underpinned by its expanding middle-income population, favourable demographics and increasing technological innovation.

- Asian equities offer investors diversified opportunities and exposure to both traditional and new economy sectors, as well as global and domestic trends.

This is the third instalment in our series of articles written to commemorate Eastspring’s 30th anniversary. The articles explore Asia’s transformation over the last three decades and share insights from our investment teams, gained through decades of investing in the region.

Asia’s financial markets have been a gateway for investors to tap into the region’s rising prosperity. On average, a dollar invested in Asian equities would have yielded more than a five-fold total return over the last 30 years1. Dividends are a big driver of total returns in Asia, accounting for more 60% of the MSCI Asia ex Japan’s total returns during this period.

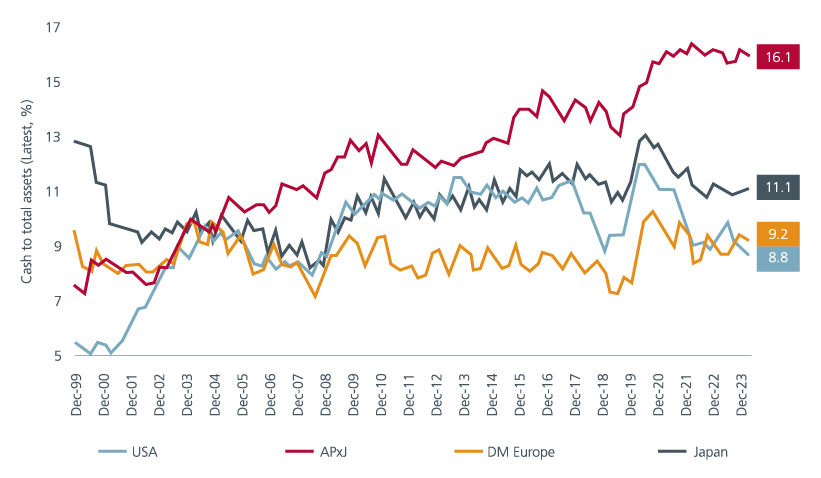

According to Christina Woon, Portfolio Manager, Eastspring Singapore, Asia is not just well suited for income strategies, but one that utilises a broader understanding of what income investing is. Asian companies have become more cash-rich over the past decades, and this is across most sectors and markets. See Fig. 1. Rather than focus on traditional definitions of what an income stock is, which might have been in certain sectors or markets historically, Asia gives investors a wide breadth of ideas to choose from. Taiwan, for example, has more than 50% of companies that are net cash with a market average payout above 50%, and is also home to a deep supply chain in technology. Asia is also the only region seeing buybacks recently, driven by Chinese internet names – not something investors would have expected a decade ago.

Fig. 1. MSCI regions (ex financials) – cash to total assets

Source: Jefferies, FactSet. Bottom-up aggregated with free float adjustments based on changing universe.

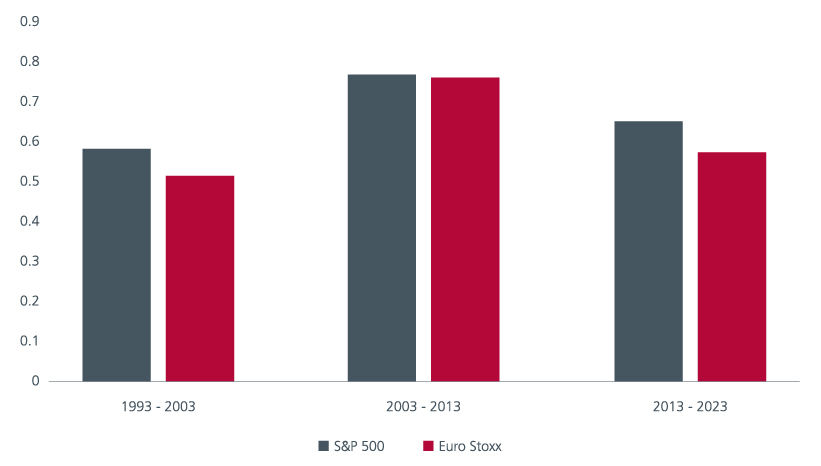

Asian equities have also historically provided US and European investors with attractive diversification benefits as different economic contexts and policies, as well as idiosyncratic factors have kept correlations between the markets relatively low. Correlations rose moderately between 2003-2013 on the back of deepening economic links from trade and international capital flows but fell in the recent 10 years (2013 to 2023), possibly due to lower globalisation, higher geopolitical tensions, and divergent growth paths.

Fig. 2. Correlation of MSCI Asia ex Japan Index

Source: Bloomberg. Monthly data. June 2024.

Asia’s growing markets

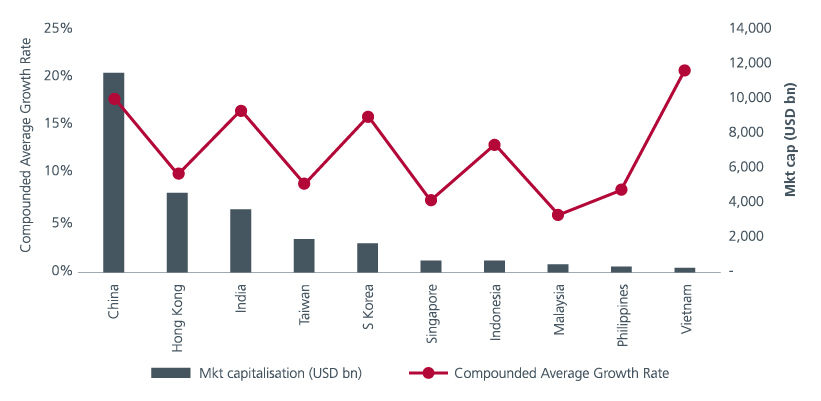

Asia’s market capitalisation has grown over the years, providing investors with greater diversity and more avenues to benefit from the region’s economic progress. The Shanghai Composite Index has the largest market capitalisation within Asia, a reflection of China’s sizeable economy. Meanwhile, India’s equity market has grown rapidly alongside rising investor interest as the economy expanded over the years on the back of transformative reforms. Fig. 3.

Fig. 3. Market capitalisation

Source: Worldbank, Bloomberg. Market capitalisation as of 2023. CAGR rates are based on available date. 14 years for Vietnam. 19 years for China, 20 years for India and 23 years for Taiwan. 25 years for the remaining markets.

The Vietnam equity market enjoyed the highest compounded average growth rate over the last 14 years2. Ngo The Trieu, CEO & Head of Investments, Eastspring Vietnam, points out that Vietnam’s economic prospects have brightened given its role as an alternative manufacturing hub to China. In the last couple of years, Vietnam had also introduced several reforms such as increasing transparency and shortening transaction times to improve accessibility for foreign investors.

Meanwhile, Indonesia’s economic transformation in recent years, fuelled by its abundant reserves in transition metals, has also attracted rising investor interest. From being the second smallest market in Asia in 2008, in terms of capitalisation, the Indonesian equity market is now bigger than that of Malaysia and Thailand.

Diversified opportunities

Asia’s equity market’s profile has also changed as its growth model evolved. Investors can now tap into both traditional and new economy sectors that drive the region’s growth. They can also get exposure to companies that benefit from both global and domestic trends.

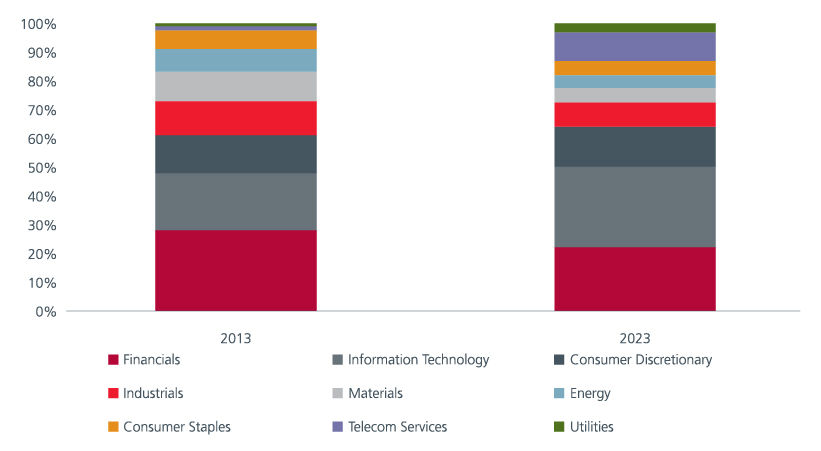

In 2013, the financials sector had the largest weighting in the MSCI Asia ex Japan Index. By 2023, it has since been displaced by the technology sector, which accounted for 26% of the index. Fig. 4.

Fig. 4. Comparison of sector weights (MSCI Asia ex Japan Index)

Source: MSCI. December 2023.

The rising prominence of the technology sector can also be seen in the Korean equity market. According to Paul Kim, Head of Equity, Eastspring Korea, the weighting of the technology hardware sector in the KOSPI almost doubled from 20.5% in 2000 to 40.2% in 2023, reflecting the explosive growth of South Korea’s semiconductor and chip-related industries.

Meanwhile, the Taiwan stock market historically has a strong technology bias where it is home to Tier one foundries, chip packaging and integrated design companies. It also has other listed small and mid-cap companies within the semiconductor ecosystem. While the recent AI phenomenon is largely seen as a US story, many AI applications rely on specialised sensors, integrated circuits, improved memory, and enhanced processors which are made in Asia. Increasing AI adoption globally will drive demand for these specialised chips and components. As such, investors can gain a unique exposure to the AI theme through the Taiwan and South Korean equity markets, and at more reasonable valuations.

Besides technology, Paul also noted that the weights of the consumer discretionary and industrials sectors in the KOSPI Index have increased as Korean auto makers and ship builders expanded their global reach over the years. Conversely, the weights of the financials, communications, and utilities sectors have declined due to the South Korean economy’s increasing export orientation and the relatively small size of its domestic market.

While the South Korean economy has a strong export focus, ASEAN’s favourable demographics have created a large and growing consumer market, which has in turn helped to support domestic-focused sectors. According to Bodin Buddhain, Team head of Investment Strategy, Eastspring Thailand, while the sector composition of the Thai stock market has remained relatively stable over the years, the consumer discretionary sector has become increasingly prominent. Likewise in Malaysia, Doreen Choo, Head of Investments, Eastspring Malaysia, noted that there are now more consumer plays in the Kuala Lumper Composite Index, including F&B, home improvement and healthcare services companies. At the same time, while the financials, utilities and telecommunications sectors remain market heavyweights over the last few decades, the weighting of the gaming sector has fallen, possibly due to investors’ rising ESG awareness. Change may be afoot for these markets. Bodin notes that the large incumbents in the SET Index are looking to reinvent themselves. Doreen also feels that Malaysia would need up move up the tech value chain.

Meanwhile, for investors looking to capitalise on the global EV theme, Ceasar Rugassi, Equity analyst, Eastspring Indonesia highlights that there are opportunities in Indonesia’s 2-wheeler and 4-wheeler EV supply chain listed companies. At the same time, the relaxation of IPO listing rules in Indonesia in 2021 had also opened doors for companies in new economy sectors – such as ride hailing, e-commerce, and fintech – to be listed on the stock exchange, creating a differentiated and diverse set of opportunities for investors.

Enduring appeal

Asian equities continue to appeal with both capital and income potential. The region’s long-term growth prospects remain bright, underpinned by its expanding middle-income population, favourable demographics and increasing technological innovation. Asia’s growing equity markets offer investors exposure to a diverse range of economies and sectors. According to Sundeep Bihani, Portfolio Manager, Eastspring Singapore, Asian equity markets have underperformed most developed markets over the last decade as geopolitics and regulations and a slower re-opening post Covid-19 have weighed on company earnings. As a result, valuations of Asian equities are now very attractive on both a price to book and price to earnings basis. Following the success in Japan, various Asian governments are rolling out corporate reform programmes which can potentially raise dividends and share buybacks, increase return on equity and lift share prices, while reducing volatility.

Sources:

1 Based on total return of the MSCI Asia ex Japan Index from Jan 1993 to December 2023, daily prices.

2 World Bank. Many of the indices have undergone recalculations and revamps. CAGR calculated as of December 2022 and using earliest available data - calculated over 14 years for Vietnam, 19 years for China, 20 years for India and 25 years for the remaining countries.

The information and views expressed herein do not constitute an offer or solicitation to deal in shares of any securities or financial instruments and it is not intended for distribution or use by anyone or entity located in any jurisdiction where such distribution would be unlawful or prohibited. The information does not constitute investment advice or an offer to provide investment advisory or investment management service or the solicitation of an offer to provide investment advisory or investment management services in any jurisdiction in which an offer or solicitation would be unlawful under the securities laws of that jurisdiction.

Past performance and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the strategies managed by Eastspring Investments. An investment is subject to investment risks, including the possible loss of the principal amount invested. Where an investment is denominated in another currency, exchange rates may have an adverse effect on the value price or income of that investment. Furthermore, exposure to a single country market, specific portfolio composition or management techniques may potentially increase volatility.

Any securities mentioned are included for illustration purposes only. It should not be considered a recommendation to purchase or sell such securities. There is no assurance that any security discussed herein will remain in the portfolio at the time you receive this document or that security sold has not been repurchased.

The information provided herein is believed to be reliable at time of publication and based on matters as they exist as of the date of preparation of this report and not as of any future date. Eastspring Investments undertakes no (and disclaims any) obligation to update, modify or amend this document or to otherwise notify you in the event that any matter stated in the materials, or any opinion, projection, forecast or estimate set forth in the document, changes or subsequently becomes inaccurate. Eastspring Investments personnel may develop views and opinions that are not stated in the materials or that are contrary to the views and opinions stated in the materials at any time and from time to time as the result of a negative factor that comes to its attention in respect to an investment or for any other reason or for no reason. Eastspring Investments shall not and shall have no duty to notify you of any such views and opinions. This document is solely for information and does not have any regard to the specific investment objectives, financial or tax situation and the particular needs of any specific person who may receive this document.

Eastspring Investments Inc. (Eastspring US) primary activity is to provide certain marketing, sales servicing, and client support in the US on behalf of Eastspring Investment (Singapore) Limited (“Eastspring Singapore”). Eastspring Singapore is an affiliated investment management entity that is domiciled and registered under, among other regulatory bodies, the Monetary Authority of Singapore (MAS). Eastspring Singapore and Eastspring US are both registered with the US Securities and Exchange Commission as a registered investment adviser. Registration as an adviser does not imply a level of skill or training. Eastspring US seeks to identify and introduce to Eastspring Singapore potential institutional client prospects. Such prospects, once introduced, would contract directly with Eastspring Singapore for any investment management or advisory services. Additional information about Eastspring Singapore and Eastspring US is also is available on the SEC’s website at www.adviserinfo.sec. gov.

Certain information contained herein constitutes "forward-looking statements", which can be identified by the use of forward-looking terminology such as "may", "will", "should", "expect", "anticipate", "project", "estimate", "intend", "continue" or "believe" or the negatives thereof, other variations thereof or comparable terminology. Such information is based on expectations, estimates and projections (and assumptions underlying such information) and cannot be relied upon as a guarantee of future performance. Due to various risks and uncertainties, actual events or results, or the actual performance of any fund may differ materially from those reflected or contemplated in such forward-looking statements.

Eastspring Investments companies (excluding JV companies) are ultimately wholly-owned / indirect subsidiaries / associate of Prudential plc of the United Kingdom. Eastspring Investments companies (including JV’s) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America.