Executive Summary

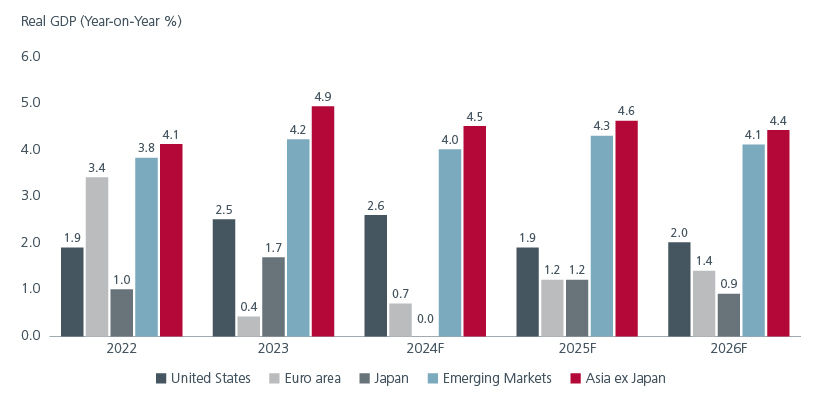

- Asia's economies are adapting to new challenges such as geoeconomic fragmentation and tech disruption, which will shape future growth and maintain the region's status as the world's fastest-growing area.

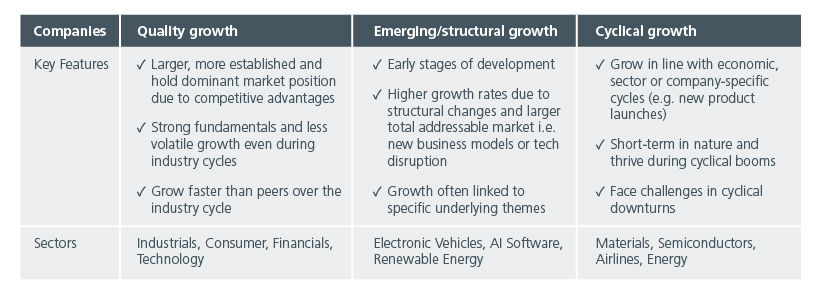

- The region's varied economic landscapes allow investors to balance risk and reward by investing in a mix of quality growth, emerging/structural growth, and cyclical growth opportunities.

- Despite its economic strengths, Asia is under represented in global financial indices and offers attractive entry points for investors to capitalise on the region's potential.

Asia has long been recognised as the world's fastest-growing region, with its growth model continuously evolving over the years. The region's diverse economies enable the rebalancing of existing growth models and the creation of new ones. Future growth will be shaped by geoeconomic fragmentation, tech disruption, demographics shifts and evolving consumption patterns. As Asia continues to transform, it is expected to contribute to 60% of global growth by 2030.1

Asia ex-Japan is expected to maintain moderate growth in 2025. However, this growth could be affected if the new US administration's trade policies are implemented earlier than expected. That said, in the near term, the outlook for most economies in the region remains relatively stable given benign inflation and healthy macroeconomic indicators.

Fig 1: Asia’s remains the world’s fastest growing region

Source: Bloomberg, as of 5 Nov 2024

Underappreciated strengths

The case for long-term investing in Asia is compelling. GDP growth aside, Asia stands out in many other areas. Asia is the world’s largest trading region; accounting for 53% of the global goods trade in 2021. Asian countries are involved in 49 of the world’s 80 largest trade routes2 .

Meanwhile, Asia’s status as a significant supply chain hub continues to grow post the pandemic with companies adopting the China plus one strategy. The ASEAN region and India are clear beneficiaries, and this shift is expected to further underpin the region’s growth. Multinationals will find it beneficial to diversify their manufacturing bases and build out more supply chains that can leverage the differentiated strengths across Asia.

Asia’s population accounts for approximately 59% of the world's total, and the region’s rapidly growing middle class has made domestic consumption an increasingly important growth driver, especially for India and the Southeast Asian economies. According to a report by McKinsey, Asia will account for one of every two of the world’s upper-middle-income and above households in the period to 2030. The varying income levels in Asia create demand for different types of goods and services. Research suggests that 78% of total consumption in Asia is made up of basic goods, with “special treat” and “first luxury” items accounting for the remaining 17% and 5%.

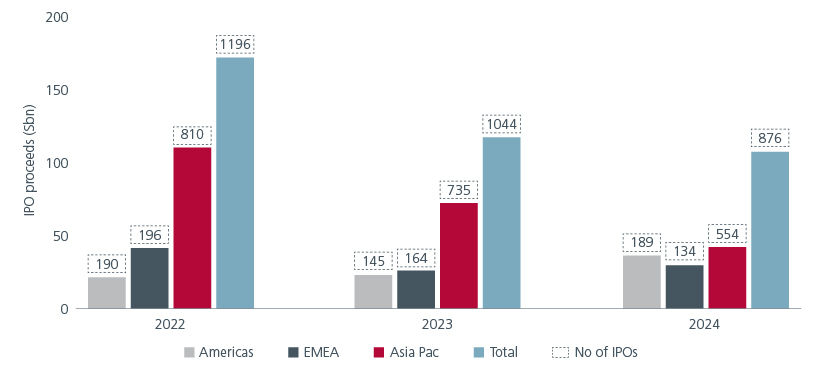

Asia is also becoming a hub for global technology and industrial innovation. For example, Asia’s fintech revenues are expected to be bigger than North America’s by 2030.3 This rapid growth in technological advances and innovation is driving the strong demand for growth capital. In 2024, the Asia Pacific region maintained its position as the largest region for initial public offerings (IPOs), both in proceeds and volume; India in particular was a standout.4

Fig 2: Asia Pacific maintains its IPO lead

Source: S&P Global Market Intelligence LLC, as of 30 Nov 2024, numbers in box refers to volume

Undervalued possibilities

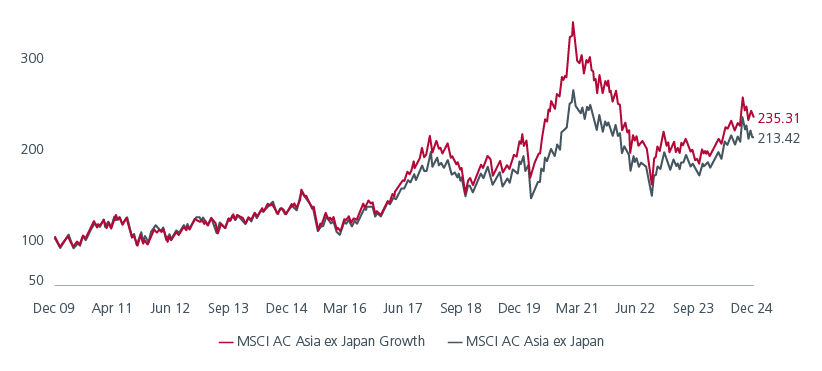

Despite being a powerhouse is many aspects, the region is under represented in global financial indices. As of June 2024, Asia ex-Japan equity markets comprised 9.38% of the MSCI AC World Index.5 Many of the Asian markets also offer attractive entry points at current valuations.

The MSCI AC Asia ex-Japan Index has close to 1,054 constituents while its growth subset i.e. the MSCI AC Asia ex-Japan Growth Index has close to 590 growth constituents. The three largest sectors in the growth index are the information technology, communication services and consumer discretionary sectors. Interestingly, the growth index has outperformed the broader index on a cumulative basis since 2017.

Fig 3: MSCI AC Asia ex-Japan growth outperforms the broader index

Source: MSCI indices as of 31 Dec 2024, Cumulative gross returns in USD (Dec 2009 – Dec 2024)

Varied choices

The region's diverse blend of mature, advanced economies and high-growth potential emerging economies offers dynamic and unparalleled opportunities. Investors can balance risk and reward by understanding the various economic landscapes and the growth profiles of companies, be it quality, emerging, or cyclical.

Fig 4: Companies fall into distinct growth buckets

Source: Eastspring Investments, Jan 2025

Quality growth companies tend to be the longest held, core positions within our portfolios as they provide stability in the underlying growth dynamics of the portfolios. That said, these companies may still be affected by idiosyncratic country economic cycles or industry specific cycles. In these cases, the actual active weights may vary depending on the timing of these cycles even though they are held as a core active position for extended periods. There is some overlap between this segment and cyclical growth companies as position sizes are determined by the timing of the cycle.

We strive to identify emerging/structural growth companies as early as possible in their growth cycle when there is the longest runway for growth and hence the highest appreciation potential. As a result, we typically hold the largest active positions in these companies earlier in their growth cycle as well and reduce them as these expectations are realised.

The key to doing well with cyclical growth companies is to time the industry cycle for their specific industries. This requires close monitoring of industry and company fundamentals and leverages our previous experience investing in these companies and sectors. We typically try to exit these companies in the upturn and not hold on to them in a downturn.

As growth investors, we seek to identify and invest in underappreciated growth opportunities that are trading at fair valuations. Where possible, we look for idiosyncratic growth ideas that are not well known or well understood by the public equity markets.

Sources:

1 https://www.weforum.org/agenda/2019/12/asia-economic-growth/

2 https://www.mckinsey.com/mgi/our-research/asia-on-the-cusp-of-a-new-era

3 https://www.weforum.org/stories/2024/06/why-asia-s-time-is-now-whats-fueling-asian-growth-and-what-does-it-mean-for-the-rest-of-the-world/

4 https://www.pwc.co.uk/services/audit/insights/global-ipo-watch.html

5https://www.msci.com/research-and-insights/visualizing-investment-data/acwi-imi-complete-geographic-breakdown

The information and views expressed herein do not constitute an offer or solicitation to deal in shares of any securities or financial instruments and it is not intended for distribution or use by anyone or entity located in any jurisdiction where such distribution would be unlawful or prohibited. The information does not constitute investment advice or an offer to provide investment advisory or investment management service or the solicitation of an offer to provide investment advisory or investment management services in any jurisdiction in which an offer or solicitation would be unlawful under the securities laws of that jurisdiction.

Past performance and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the strategies managed by Eastspring Investments. An investment is subject to investment risks, including the possible loss of the principal amount invested. Where an investment is denominated in another currency, exchange rates may have an adverse effect on the value price or income of that investment. Furthermore, exposure to a single country market, specific portfolio composition or management techniques may potentially increase volatility.

Any securities mentioned are included for illustration purposes only. It should not be considered a recommendation to purchase or sell such securities. There is no assurance that any security discussed herein will remain in the portfolio at the time you receive this document or that security sold has not been repurchased.

The information provided herein is believed to be reliable at time of publication and based on matters as they exist as of the date of preparation of this report and not as of any future date. Eastspring Investments undertakes no (and disclaims any) obligation to update, modify or amend this document or to otherwise notify you in the event that any matter stated in the materials, or any opinion, projection, forecast or estimate set forth in the document, changes or subsequently becomes inaccurate. Eastspring Investments personnel may develop views and opinions that are not stated in the materials or that are contrary to the views and opinions stated in the materials at any time and from time to time as the result of a negative factor that comes to its attention in respect to an investment or for any other reason or for no reason. Eastspring Investments shall not and shall have no duty to notify you of any such views and opinions. This document is solely for information and does not have any regard to the specific investment objectives, financial or tax situation and the particular needs of any specific person who may receive this document.

Eastspring Investments Inc. (Eastspring US) primary activity is to provide certain marketing, sales servicing, and client support in the US on behalf of Eastspring Investment (Singapore) Limited (“Eastspring Singapore”). Eastspring Singapore is an affiliated investment management entity that is domiciled and registered under, among other regulatory bodies, the Monetary Authority of Singapore (MAS). Eastspring Singapore and Eastspring US are both registered with the US Securities and Exchange Commission as a registered investment adviser. Registration as an adviser does not imply a level of skill or training. Eastspring US seeks to identify and introduce to Eastspring Singapore potential institutional client prospects. Such prospects, once introduced, would contract directly with Eastspring Singapore for any investment management or advisory services. Additional information about Eastspring Singapore and Eastspring US is also is available on the SEC’s website at www.adviserinfo.sec. gov.

Certain information contained herein constitutes "forward-looking statements", which can be identified by the use of forward-looking terminology such as "may", "will", "should", "expect", "anticipate", "project", "estimate", "intend", "continue" or "believe" or the negatives thereof, other variations thereof or comparable terminology. Such information is based on expectations, estimates and projections (and assumptions underlying such information) and cannot be relied upon as a guarantee of future performance. Due to various risks and uncertainties, actual events or results, or the actual performance of any fund may differ materially from those reflected or contemplated in such forward-looking statements.

Eastspring Investments companies (excluding JV companies) are ultimately wholly-owned / indirect subsidiaries / associate of Prudential plc of the United Kingdom. Eastspring Investments companies (including JV’s) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America.