Executive Summary

- With tariff headlines expected to lift market volatility in 2025, the attractive yields and steady income stream from high quality Asian bonds should appeal to investors.

- The region’s stable macro fundamentals and net negative supply of corporate bonds in 2025 should underpin the Asian bond market. Credit selection will be key in driving alpha generation as tariffs produce winners and losers.

- Dispersion will remain high among local currency bond markets. Investors can unlock significant value by capitalising on market dislocations, leveraging Asian central banks’ rate cut cycles and navigating geopolitical risks.

Asian bonds, as measured by the JP Morgan Asia Credit Index (JACI), have delivered positive returns year to date, following strong returns in 20241. US and Asian bond yields had initially risen post the US election as the market focused on the prospects of stronger US economic growth, higher inflation and bigger US fiscal deficits. US 10-year Treasury yields hit a high of 4.8% in mid-January 2025.

The market narrative has shifted since Trump’s inauguration. Concerns about large-scale deportations potentially impacting US growth exceptionalism contributed to a decline in US Treasury yields. Additionally, the initial delay in implementing tariffs, along with a more universal application of tariffs beyond just targeting China, led to a relief rally in Asian bonds.

However, tariff risks are delayed, not eliminated. While equity and bond market volatility has been relatively subdued to date, higher volatility cannot be ruled out when markets refocus on tariffs in the coming months. High quality Asian bonds offer investors the opportunity to lock in attractive income streams that can help temper portfolio volatility. Given tight spreads and a shallower than expected US rate cutting cycle, carry would be key for bond returns in 2025.

Navigating tariffs in Asia

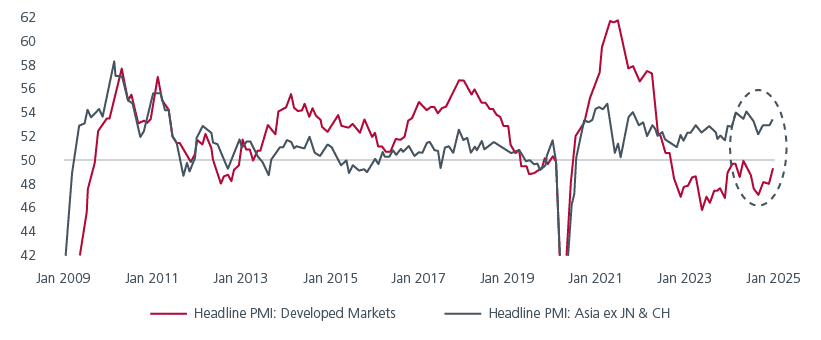

Asian economies, with the exception of China, have held up well despite rising geopolitical tensions and tariff uncertainty. See Fig. 1. The latest readings of headline manufacturing and new orders PMIs in most Asian countries are above 50, signalling expansion.

Fig. 1. Manufacturing PMIs: Developed markets vs Asia ex Japan & China

Source: S&P Global, CEIC, HSBC. CH refers to mainland China and DM refers to US, UK, Eurozone and Japan. 4 February 2025.

Tariffs will impact Asia by delaying capital spending decisions and dampening corporate confidence, potentially hurting economic growth. There are various ways to estimate tariff risk, such as the percentage of exports to the US, trade surpluses with the US, and net tariff rates. Secondary effects on economies closely tied to those in the US direct line of fire also matter. While many Asian economies might be affected, there will be nuances. For example, economies with Free Trade Agreements with the US could be less impacted. Strategic relationships with the US may also offer some countries (e.g. Japan and potentially India) greater leverage, and economies like Taiwan, Korea and Singapore, which produce complex exports, could enjoy more inelastic demand. In-depth credit research is necessary to understand the transmission mechanisms as well as direct and indirect implications on bond issuers. For now, Trump’s recent tariffs on steel and aluminium seem to have a limited impact on Asia.

Meanwhile, we would caution being overly bearish China. Its share of US imports has fallen since the first Trump administration, making it less vulnerable. Chinese policymakers also appear to be increasingly willing to provide stimulus and other supportive measures. With market pricing still reflecting extreme investor pessimism towards China, there could be opportunities for investors to position themselves for a recovery. Catalysts for a market turnaround include reduced tariff risks and increasing fiscal stimulus.

Opportunities in USD and local currency bonds

The credit fundamentals of Asian corporates have remained largely stable with the average debt to capital ratio on a downward trend. We are positive on the fundamental outlook for the internet, telecoms, transport and consumer sectors. We also like Australian and Japanese financials.

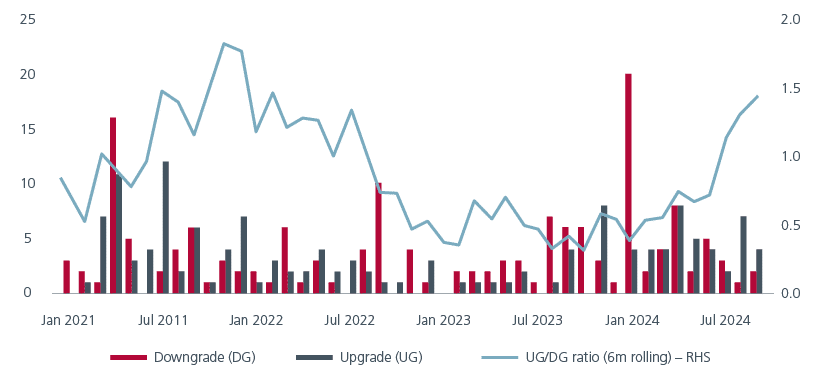

Within Asian USD-denominated bonds, we prefer to invest in investment grade (IG) bonds as tight credit spreads do not compensate investors adequately to take on more risk. We are staying defensive and we look to re-engage when spreads widen. Notably, there has been more upgrades than downgrades among Asian IG bonds in recent months. See Fig. 2.

Fig. 2. Asia IG has seen more upgrades than downgrades in recent months

Source: JPM. January 2025.

We look for opportunities to extend duration when yields spike, but for now, shorter duration credits pay us for waiting and they offer ample liquidity should risk aversion rises. Within Asian IGs, AA and BBB-rated bonds appear to offer better value.

On the supply front, higher for longer US rates are likely to curb USD bond issuances from Asian corporates. The net negative supply of USD-denominated Asian corporate bonds expected in 2025 will also be supportive of the market.

Within Asian local currency bonds, market dislocations, primarily driven by tariff-related uncertainties, have created rare valuation opportunities, although Asian currencies have also weakened. We believe that select Asian local bonds, hedged back into USD, offer attractive opportunities for professional investors to boost portfolio returns.

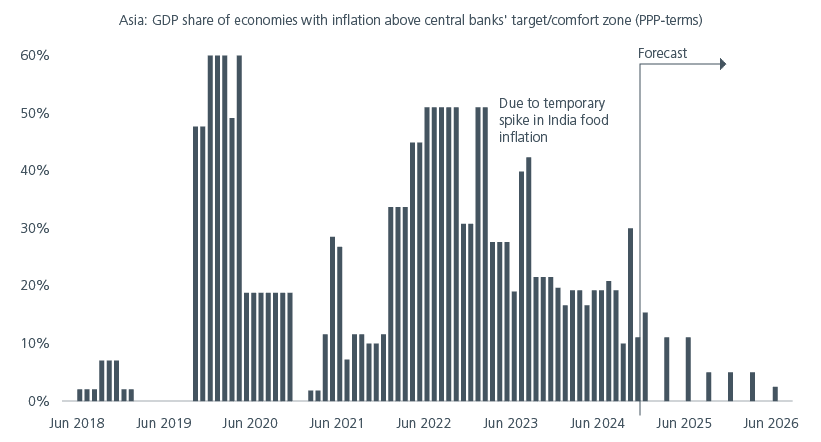

While inflation remains sticky in the US, inflation is trending towards central bank targets in most of Asia. See Fig. 3. With tariffs presenting downside risks to the region’s growth, we believe that Asian central banks are more willing to cut rates to support growth, even if the US Federal Reserve holds. On this note, central banks in India, Indonesia, Korea and Singapore have already cut rates or signalled further easing.

Fig. 3. Domestic inflation has already returned to central banks’ comfort zones

Source: Haver, Morgan Stanley Research. January 2025.

Some Asian central banks have also been deploying foreign exchange reserves to limit downside risks, providing a stable environment for high-yielding local bonds. Over the past three years, Asian high yielders like India and Indonesia have delivered strong returns, supported by central bank policies. The steep yield curves of these high-yielding local bonds offer opportunities before further rate cuts materialise.

Unlocking income and enhancing returns

Asian economies excluding China have been relatively resilient to date and Asian central banks appear willing to cut rates to support growth if needed. Supportive macroeconomic conditions and a negative net supply of Asian corporate bonds in 2025 should help underpin the Asian bond market. With tariff headlines expected to lift market volatility in 2025, the attractive yields and steady income stream from high quality Asian bonds should appeal to investors.

Given tight spreads and a shallower than expected US rate cutting cycle, carry would be a key component of total returns. With tariffs likely to produce winners and losers, credit selection will be important to drive alpha generation. Investors will need to stay agile and disciplined to navigate the year successfully.

The idiosyncratic drivers across the region suggest that dispersion will remain high among the local currency bond markets. By taking advantage of market dislocations, leveraging Asian central banks’ rate cut cycles and managing geopolitical risks, investors can unlock significant value and enhance portfolio returns.

Sources:

1 19 February 2025. JACI returns in USD. Bloomberg.

The information and views expressed herein do not constitute an offer or solicitation to deal in shares of any securities or financial instruments and it is not intended for distribution or use by anyone or entity located in any jurisdiction where such distribution would be unlawful or prohibited. The information does not constitute investment advice or an offer to provide investment advisory or investment management service or the solicitation of an offer to provide investment advisory or investment management services in any jurisdiction in which an offer or solicitation would be unlawful under the securities laws of that jurisdiction.

Past performance and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the strategies managed by Eastspring Investments. An investment is subject to investment risks, including the possible loss of the principal amount invested. Where an investment is denominated in another currency, exchange rates may have an adverse effect on the value price or income of that investment. Furthermore, exposure to a single country market, specific portfolio composition or management techniques may potentially increase volatility.

Any securities mentioned are included for illustration purposes only. It should not be considered a recommendation to purchase or sell such securities. There is no assurance that any security discussed herein will remain in the portfolio at the time you receive this document or that security sold has not been repurchased.

The information provided herein is believed to be reliable at time of publication and based on matters as they exist as of the date of preparation of this report and not as of any future date. Eastspring Investments undertakes no (and disclaims any) obligation to update, modify or amend this document or to otherwise notify you in the event that any matter stated in the materials, or any opinion, projection, forecast or estimate set forth in the document, changes or subsequently becomes inaccurate. Eastspring Investments personnel may develop views and opinions that are not stated in the materials or that are contrary to the views and opinions stated in the materials at any time and from time to time as the result of a negative factor that comes to its attention in respect to an investment or for any other reason or for no reason. Eastspring Investments shall not and shall have no duty to notify you of any such views and opinions. This document is solely for information and does not have any regard to the specific investment objectives, financial or tax situation and the particular needs of any specific person who may receive this document.

Eastspring Investments Inc. (Eastspring US) primary activity is to provide certain marketing, sales servicing, and client support in the US on behalf of Eastspring Investment (Singapore) Limited (“Eastspring Singapore”). Eastspring Singapore is an affiliated investment management entity that is domiciled and registered under, among other regulatory bodies, the Monetary Authority of Singapore (MAS). Eastspring Singapore and Eastspring US are both registered with the US Securities and Exchange Commission as a registered investment adviser. Registration as an adviser does not imply a level of skill or training. Eastspring US seeks to identify and introduce to Eastspring Singapore potential institutional client prospects. Such prospects, once introduced, would contract directly with Eastspring Singapore for any investment management or advisory services. Additional information about Eastspring Singapore and Eastspring US is also is available on the SEC’s website at www.adviserinfo.sec. gov.

Certain information contained herein constitutes "forward-looking statements", which can be identified by the use of forward-looking terminology such as "may", "will", "should", "expect", "anticipate", "project", "estimate", "intend", "continue" or "believe" or the negatives thereof, other variations thereof or comparable terminology. Such information is based on expectations, estimates and projections (and assumptions underlying such information) and cannot be relied upon as a guarantee of future performance. Due to various risks and uncertainties, actual events or results, or the actual performance of any fund may differ materially from those reflected or contemplated in such forward-looking statements.

Eastspring Investments companies (excluding JV companies) are ultimately wholly-owned / indirect subsidiaries / associate of Prudential plc of the United Kingdom. Eastspring Investments companies (including JV’s) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America.