Executive Summary

- Tariffs and rising protectionism have increased policy uncertainty, highlighting the need for defensive investment strategies

- A low volatility strategy has shown resilience during market turbulence, protecting against downside risks

- Active bets allow investors to capitalise on the market’s nature to distinguish between winners and losers during selloffs

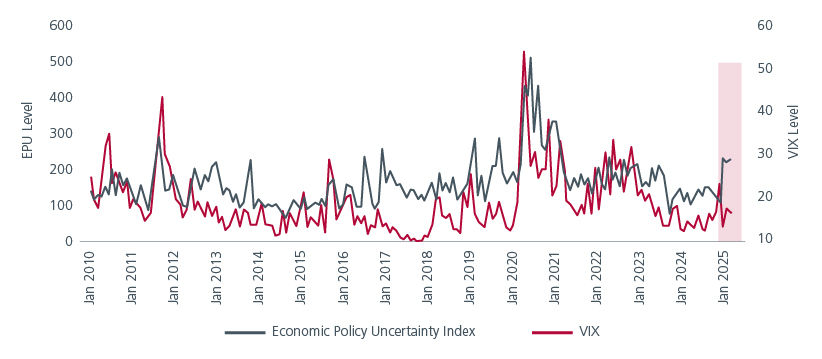

Recent tariffs, rising protectionism, and an uncertain inflation outlook all reflect the heightened policy uncertainty, as illustrated by the Economic Policy Uncertainty (EPU) Index. This index measures the frequency of articles in newspapers that contain terms related to economy, policy, and uncertainty, reflecting the growing concerns among businesses and investors. Interestingly, there is a notable disconnect between this uncertainty and financial market volatility. See Fig 1.

While there might be various reasons contributing to this, i.e. some investors still being in the “it’s just a negotiating strategy” camp or the market’s perception of Trump’s growth-friendly policies offsetting volatility, the fact remains that Trump's "weaponisation of uncertainty" has been dialled up in his second term. There is no doubt that the pain from tariffs will trigger a chain reaction at both the macroeconomic and corporate levels. Market volatility is thus likely to be a constant feature.

Fig 1: The disconnect between uncertainty and financial market volatility

Source: Bloomberg, Economic Policy Uncertainty, and Eastspring Investments, Feb 2025

Economists at Goldman Sachs have estimated that across-the-board tariffs on Canada and Mexico would result in a 0.7% increase in core inflation and a 0.4% reduction in gross domestic product1. The potential to drive up consumer prices is particularly concerning for investors, who fear a resurgence in inflation could prompt the US Federal Reserve (Fed) to halt its rate-cutting measures. As expected, the Fed paused its rate-cutting cycle in March, with Chair Powell stating that officials were 'waiting to see what policies are enacted' under the new president.

Enhancing portfolio resilience is key

To ensure resilience in an unpredictable economic environment, investors should diversify their investments and modify their portfolios to be more defensive. For example, adding a low volatility (low vol) strategy can enhance the defensiveness of an overall investment portfolio. A defensive portfolio typically aims to limit losses during market selloffs.

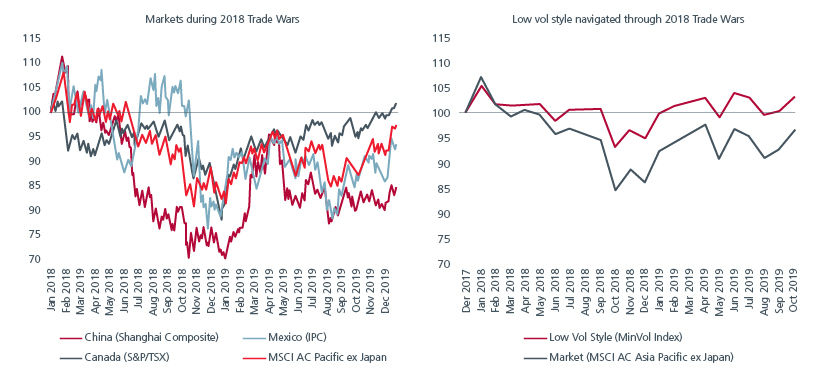

To understand it better, let’s look at how a low volatility style, using the MSCI AC Asia Pacific ex Japan Minimum Volatility index as a proxy, reacted during President Trump’s first term in office, when the administration imposed tariffs in 2018. Between Mar 2018 and Dec 2018, both the US and China engaged in a tit-for-tat move by imposing tariffs on a wide range of goods.

The imposition of tariffs on a wide range of goods led to increased uncertainty and volatility in the markets. Equity markets directly linked to the trade war experienced notable declines, particularly in the latter half of the year. See Fig 2. In contrast, the Asian low vol index provided downside protection and delivered resilient performance throughout this period.

Fig 2: Impact of tariffs during the 2018 US-China trade war

Source: LSEG DataStream, MSCI, S&P, Eastspring Investments, Feb 2025

A low vol strategy is inherently defensive

Given the evolving global economic landscape, we conducted a stress test to evaluate the potential impact of tariffs on a low vol portfolio. We utilised the Aladdin risk management systems' Global Trade Protectionism scenario to assess the impact of significant tariffs on global trade, inflation, interest rates, including retaliatory actions from affected countries. The test assumes that additional tariffs will result in higher domestic inflation, leading to increased interest rates and a stronger dollar, and considers potential selloffs in US companies which have supply chains heavily dependent on non-US inputs.

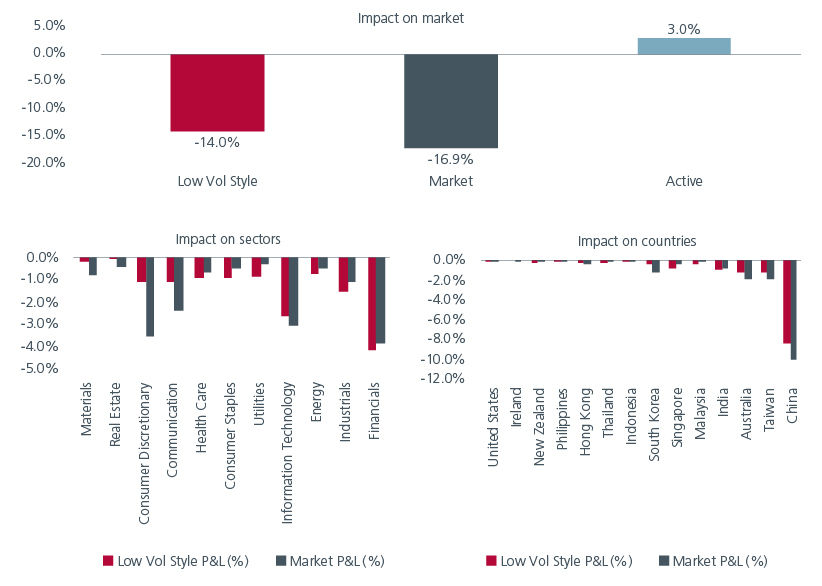

The results suggest that a low vol defensive style continues to protect the downside and deliver approximately 3% excess performance due to its defensive positions. See Fig 3. That said, we are fully aware that markets are forward-looking, and the macroeconomic and market impact from the Trump administration are likely to change from time to time.

Fig 3: Profit and loss impact from global trade protectionism

Source: BlackRock Aladdin, Eastspring Investments. Low vol style based on Min Vol Index, Feb 2025

Active bets can help navigate idiosyncratic risks

Besides policy uncertainty, markets have also been rattled by the sudden emergence of China's DeepSeek Artificial Intelligence (AI) model with technology stocks impacted the most. When the news broke on Jan 27th, the Nasdaq 100 index tumbled by 3% while Nvidia experienced a sharp drawdown of 17%, one of the largest losses in market history. This event is a black swan for the AI industry, as DeepSeek's open-source model presents a direct challenge to proprietary AI offerings from US-dominated major players like Google (Gemini) and Microsoft (OpenAI).

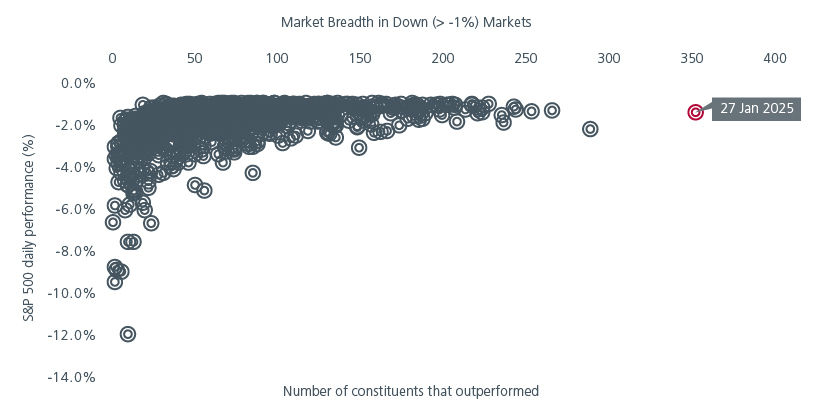

Apart from its disruptive nature to the AI industry, this idiosyncratic event ironically highlights the need for diversification. Despite the overall decline in major market indices, under the surface, 351 stocks within the S&P 500, or approximately 70% of the constituents, ended the day higher. This is the highest number of stocks delivering positive performance when the overall market, as measured by the S&P 500, declined more than 1% since 2000. It was unprecedented over the past 25 years!

This type of price action further emphasises the importance of having a diversified portfolio. Making active bets across more than 350 positions allow investors to benefit from the fact that the selloff has not been indiscriminate, with markets distinguishing between winners and losers. Furthermore, a portfolio that diversified across sectors, countries, and importantly, investment styles, can ultimately deliver a resilient performance. Enhancing portfolio buffers with low volatility equity strategies can help cushion against downside risks and contribute to more stable returns in 2025.

Fig 4: Number of stocks that outperformed in down markets

Source: Bloomberg, S&P and Eastspring Investments, Jan 2025

Sources:

1 Global Markets Comment: Market Thoughts on Trade War 2.0. www.gs.com/research/

The information and views expressed herein do not constitute an offer or solicitation to deal in shares of any securities or financial instruments and it is not intended for distribution or use by anyone or entity located in any jurisdiction where such distribution would be unlawful or prohibited. The information does not constitute investment advice or an offer to provide investment advisory or investment management service or the solicitation of an offer to provide investment advisory or investment management services in any jurisdiction in which an offer or solicitation would be unlawful under the securities laws of that jurisdiction.

Past performance and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the strategies managed by Eastspring Investments. An investment is subject to investment risks, including the possible loss of the principal amount invested. Where an investment is denominated in another currency, exchange rates may have an adverse effect on the value price or income of that investment. Furthermore, exposure to a single country market, specific portfolio composition or management techniques may potentially increase volatility.

Any securities mentioned are included for illustration purposes only. It should not be considered a recommendation to purchase or sell such securities. There is no assurance that any security discussed herein will remain in the portfolio at the time you receive this document or that security sold has not been repurchased.

The information provided herein is believed to be reliable at time of publication and based on matters as they exist as of the date of preparation of this report and not as of any future date. Eastspring Investments undertakes no (and disclaims any) obligation to update, modify or amend this document or to otherwise notify you in the event that any matter stated in the materials, or any opinion, projection, forecast or estimate set forth in the document, changes or subsequently becomes inaccurate. Eastspring Investments personnel may develop views and opinions that are not stated in the materials or that are contrary to the views and opinions stated in the materials at any time and from time to time as the result of a negative factor that comes to its attention in respect to an investment or for any other reason or for no reason. Eastspring Investments shall not and shall have no duty to notify you of any such views and opinions. This document is solely for information and does not have any regard to the specific investment objectives, financial or tax situation and the particular needs of any specific person who may receive this document.

Eastspring Investments Inc. (Eastspring US) primary activity is to provide certain marketing, sales servicing, and client support in the US on behalf of Eastspring Investment (Singapore) Limited (“Eastspring Singapore”). Eastspring Singapore is an affiliated investment management entity that is domiciled and registered under, among other regulatory bodies, the Monetary Authority of Singapore (MAS). Eastspring Singapore and Eastspring US are both registered with the US Securities and Exchange Commission as a registered investment adviser. Registration as an adviser does not imply a level of skill or training. Eastspring US seeks to identify and introduce to Eastspring Singapore potential institutional client prospects. Such prospects, once introduced, would contract directly with Eastspring Singapore for any investment management or advisory services. Additional information about Eastspring Singapore and Eastspring US is also is available on the SEC’s website at www.adviserinfo.sec. gov.

Certain information contained herein constitutes "forward-looking statements", which can be identified by the use of forward-looking terminology such as "may", "will", "should", "expect", "anticipate", "project", "estimate", "intend", "continue" or "believe" or the negatives thereof, other variations thereof or comparable terminology. Such information is based on expectations, estimates and projections (and assumptions underlying such information) and cannot be relied upon as a guarantee of future performance. Due to various risks and uncertainties, actual events or results, or the actual performance of any fund may differ materially from those reflected or contemplated in such forward-looking statements.

Eastspring Investments companies (excluding JV companies) are ultimately wholly-owned / indirect subsidiaries / associate of Prudential plc of the United Kingdom. Eastspring Investments companies (including JV’s) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America.