Executive Summary

- A dividend-focused strategy can help investors capitalise on Asia’s attractive valuations while reducing volatility. This approach is particularly compelling as interest rates are poised to fall and markets likely to remain volatile.

- Asia is particularly suited for dividend investing given the wide universe of high dividend paying stocks and the growing emphasis on shareholder returns.

- A bottom-up stock picking approach as well as harvesting dividends at every stage of a company’s dividend journey should result in a diversified, style-agnostic portfolio that balances income and alpha potential.

Dividends never go out of favour. Benjamin Graham said, “The true investor…will do better if he forgets about the stock market and pays attention to his dividend returns and to the operation results of his companies”.

While dividends may never lose their appeal, a dividend-paying strategy is more compelling now than ever. For one, a lower rate regime makes dividend-paying stocks increasingly attractive as the traditional avenues for yield fall. Following the Federal Reserve’s (Fed) rate cut in December 2024, the futures market is still expecting further cuts in 2025 - the new Trump administration may slow but not necessarily derail the direction of rates. Companies can also potentially borrow at lower costs, potentially increasing their profitability and ability to maintain or increase dividend payments.

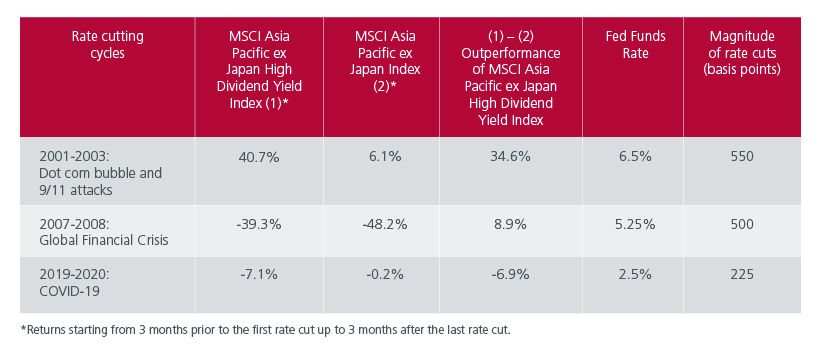

Over the last two decades and more, high dividend yielding stocks in Asia1 outperformed the broader market in 2 out of the 3 Fed rate cutting cycles. The exception was in 2019-2020, where rates were cut to mitigate the economic impact of COVID-19, high dividend stocks failed to outperform as the extraordinary situation also affected many companies’ ability to pay dividends. During that time, the starting level of the Fed Funds rate was also relatively low compared to prior rate cutting episodes and the magnitude of rate cuts was also much smaller.

Fig. 1. Relative performance of Asian high dividend stocks vs broader market

Source: Bloomberg. As of 17 December 2024. In USD. *Returns starting from 3 months prior to the first rate cut up to 3 months after the last rate cut.

In addition, as we highlighted in our 2025 Market outlook report, markets are likely to remain volatile amid geopolitical tensions and uncertain policy outcomes. The income stream from dividend paying stocks can help cushion market volatility. Historically, dividend-paying stocks tend to show lower volatility compared to non-dividend-paying stocks as companies that pay regular dividends are deemed to be more stable and hence viewed more favourably by investors. Over the long term, dividend-paying stocks have been shown to outperform non-dividend-paying stocks, providing both stability and growth.

Fig. 2. High dividend stocks outperform in the long term in Asia

Source: MSCI. December 2024. In USD.

Why Asia?

If dividend investing sounds appealing, an Asian-focused dividend strategy is even more attractive. This is because Asia lends itself well to dividend investing. The region boasts of a very high proportion of companies that pays dividends. Compared to the rest of the world, Asia Pacific ex Japan has the highest number of companies (>400) with dividend yields above 3%, reflecting a strong management culture that focuses on shareholder returns. This in turn offers rich pickings for dividend investors. Dividends account for a substantial part (>40%) of the total returns from Asian equities2 .

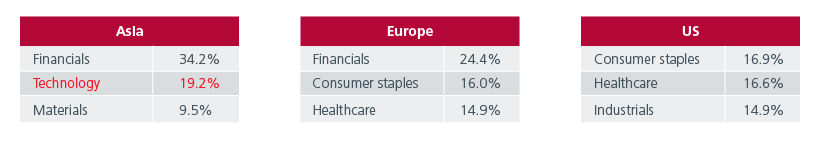

Asia also debunks the myth that dividends are the remit of low-growth stocks. In April 2024, Meta’s announcement of its first ever dividend, albeit modest, stirred considerable excitement in the US market. While Meta’s dividend may be one of the few from the US’s fast growth technology companies, Asian technology companies are no strangers to dividends. In fact, the technology sector is the second largest sector within the MSCI Asia Pacific ex Japan High Dividend Index. This implies that dividend stock investors in Asia can benefit from both income and potential capital growth.

Fig. 3. Top 3 sectors in the high dividend yielding index

Source: MSCI AC Asia Pacific ex Japan High Yield Index. MSCI Europe High Dividend Yield Index. MSCI US High Yield Index. December 2024.

Meanwhile, dividends are set to rise in the region as governments particularly in Japan, South Korea, China and India push for improved governance among listed companies and an increased focus on shareholder returns. In 2024, South Korea’s Financial Services Commission outlined a framework for the Value-Up Programme, which is designed to address the undervaluation of Korean stocks. The programme includes guidelines to incentivise better shareholder return policies. Over in China, the China Securities Regulatory Commission has issued a "cash dividend guidance for publicly listed companies," urging clarity in dividend policies and stabilization of investor expectations. The document also reiterated the importance of a 30% dividend payout ratio and encouraged companies to start paying interim dividends3.

The key to better dividend investing

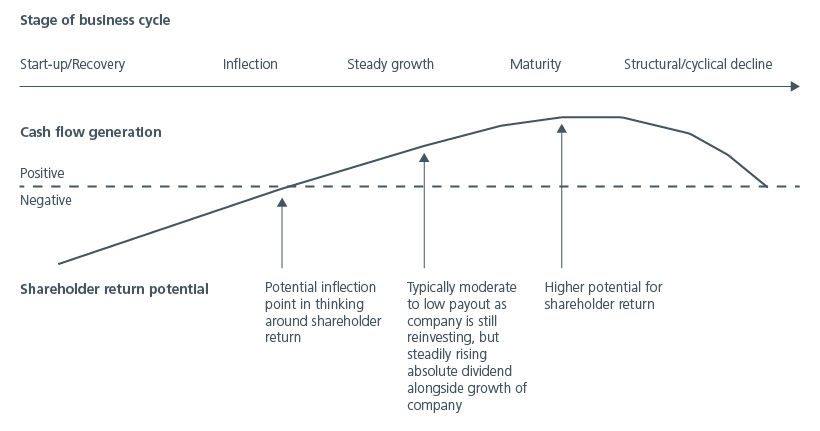

Beyond looking to high dividend yielding stocks, an approach that seeks to capture income across the dividend journey is likely to be more rewarding. Companies are at different stages of the dividend journey – from not paying a dividend at all to moving to a stage where company balance sheets can begin supporting dividend payments. This progresses to where management demonstrates greater commitment to dividends as balance sheets become more resilient and finally to a mature stage where companies generate sustainable dividends. This approach is likely to identify stocks that are currently not within the high dividend yield index and presents more room for upside.

Fig. 4. Harvesting income through the dividend journey

Source: Eastspring Investments. For illustration only. December 2024.

Many high dividend paying stocks are mature companies that have stable earnings and generate significant cash flows, typically a hallmark of value stocks. However, a focus on bottom-up stock picking and identifying stocks from early-stage dividend payers to late-stage dividend anchors, as described earlier, is likely to result in a style agnostic portfolio. A style agnostic approach widens the universe of available stocks and offers greater diversification. A bottom-up approach that harnesses ideas across styles should also lead to better return and risk outcomes.

Yielding compelling outcomes

Headline valuations for Asia Pacific ex Japan equities are currently attractive giving investors a good entry point. The backdrop of rising capital expenditure trends is supporting stronger earnings delivery across the region for the first time in a decade, while investor/business sentiment is improving with interest rate cuts expected across the region. That said, there is still uncertainty arising from potential trade tensions and policy uncertainty arising from the new US administration.

A dividend-focused strategy can help investors capitalise on Asia’s attractive valuations while reducing volatility. This approach is particularly compelling given Asia’s large universe of high dividend paying stocks and the region's increasing emphasis on shareholder returns. Additionally, focusing on bottom-up stock picking and capturing yield at various stages of a company’s dividend journey can result in a diversified, style-agnostic portfolio that balances income and alpha potential.

Sources:

1 Proxied by the MSCI Asia Pacific ex Japan High Dividend Yield Index

2 Eastspring Investments. MSCI AC Asia Pacific ex Japan. In USD. As at 31 October 2024. 20 years of equity market returns to 31 October 2024 (Annualised).

3 Publicly Listed Company Regulation Guidance No.3 – Publicly Listed Companies Cash Dividend, CSRC on Dec.15, 2023.

The information and views expressed herein do not constitute an offer or solicitation to deal in shares of any securities or financial instruments and it is not intended for distribution or use by anyone or entity located in any jurisdiction where such distribution would be unlawful or prohibited. The information does not constitute investment advice or an offer to provide investment advisory or investment management service or the solicitation of an offer to provide investment advisory or investment management services in any jurisdiction in which an offer or solicitation would be unlawful under the securities laws of that jurisdiction.

Past performance and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the strategies managed by Eastspring Investments. An investment is subject to investment risks, including the possible loss of the principal amount invested. Where an investment is denominated in another currency, exchange rates may have an adverse effect on the value price or income of that investment. Furthermore, exposure to a single country market, specific portfolio composition or management techniques may potentially increase volatility.

Any securities mentioned are included for illustration purposes only. It should not be considered a recommendation to purchase or sell such securities. There is no assurance that any security discussed herein will remain in the portfolio at the time you receive this document or that security sold has not been repurchased.

The information provided herein is believed to be reliable at time of publication and based on matters as they exist as of the date of preparation of this report and not as of any future date. Eastspring Investments undertakes no (and disclaims any) obligation to update, modify or amend this document or to otherwise notify you in the event that any matter stated in the materials, or any opinion, projection, forecast or estimate set forth in the document, changes or subsequently becomes inaccurate. Eastspring Investments personnel may develop views and opinions that are not stated in the materials or that are contrary to the views and opinions stated in the materials at any time and from time to time as the result of a negative factor that comes to its attention in respect to an investment or for any other reason or for no reason. Eastspring Investments shall not and shall have no duty to notify you of any such views and opinions. This document is solely for information and does not have any regard to the specific investment objectives, financial or tax situation and the particular needs of any specific person who may receive this document.

Eastspring Investments Inc. (Eastspring US) primary activity is to provide certain marketing, sales servicing, and client support in the US on behalf of Eastspring Investment (Singapore) Limited (“Eastspring Singapore”). Eastspring Singapore is an affiliated investment management entity that is domiciled and registered under, among other regulatory bodies, the Monetary Authority of Singapore (MAS). Eastspring Singapore and Eastspring US are both registered with the US Securities and Exchange Commission as a registered investment adviser. Registration as an adviser does not imply a level of skill or training. Eastspring US seeks to identify and introduce to Eastspring Singapore potential institutional client prospects. Such prospects, once introduced, would contract directly with Eastspring Singapore for any investment management or advisory services. Additional information about Eastspring Singapore and Eastspring US is also is available on the SEC’s website at www.adviserinfo.sec. gov.

Certain information contained herein constitutes "forward-looking statements", which can be identified by the use of forward-looking terminology such as "may", "will", "should", "expect", "anticipate", "project", "estimate", "intend", "continue" or "believe" or the negatives thereof, other variations thereof or comparable terminology. Such information is based on expectations, estimates and projections (and assumptions underlying such information) and cannot be relied upon as a guarantee of future performance. Due to various risks and uncertainties, actual events or results, or the actual performance of any fund may differ materially from those reflected or contemplated in such forward-looking statements.

Eastspring Investments companies (excluding JV companies) are ultimately wholly-owned / indirect subsidiaries / associate of Prudential plc of the United Kingdom. Eastspring Investments companies (including JV’s) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America.