Executive Summary

- The rising risks to the US growth narrative from Trump’s tariffs and immigration policy potentially warrant a rethink of the earlier playbook favouring US assets.

- The recent wobble in US AI stocks, triggered by Chinese AI lab Deepseek, also highlights the risks of crowded trades and concentrated positions.

- With their relatively low valuations, Asia and Emerging Markets have the potential to exceed expectations and provide genuine diversification benefits for investors, although active investing would be key to harnessing the alpha opportunities.

Investors entered the Trump 2.0 era positioned for more tariffs (especially targeted at China), higher inflation and a stronger US dollar (USD). Against this backdrop, investors had viewed US equities and the USD more favourably than Asian and Emerging Markets (EM) assets.

Although Trump has since imposed 10% tariffs on imports from China, the rising risks to the US growth narrative potentially warrant a rethink of the earlier playbook. The recent wobble in US AI stocks, triggered by Chinese AI lab Deepseek, also highlights the risks of crowded trades and concentrated positions. Analysis by our quantitative equity strategies team showed that despite the overall decline in the S&P 500 and sharp falls experienced by AI-related stocks on 27 January, about 70% of the S&P 500 constituents ended the day higher, demonstrating the importance of diversification in portfolios.

Rising risks to US exceptionalism

The US has enjoyed a period of tremendous growth and although the US economy is likely to remain the strongest within the G10 in 2025, risks to the highly consensus view of “US exceptionalism” is rising. Much of the US’ strong growth has been driven by productivity gains, of which imported labour played an important role. As such, the Trump administration’s plans to restrict immigration could constrain US growth over the medium term. Tariffs will also be an additional burden on the US consumer if they ignite inflationary pressures. If President Trump’s 25% tariffs on Mexico and Canada with a 10% rate for energy imports are followed through, these tariffs along with the 10% tariff on China could reduce US growth by 0.3% to 0.8% and increase US inflation by 0.4% to 0.8% on an annual basis.

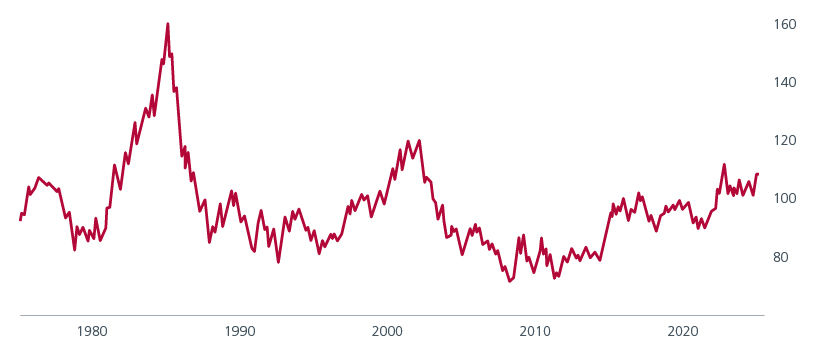

Following Trump’s re-election, expectations of US tax cuts and deregulation, which are seen as stimulatory for US growth and inflation, had driven US assets and the dollar higher. The dollar index is near record highs not seen since 1985 and 2002. See Fig. 1. Although the Federal Reserve (Fed) kept interest rates on hold in January, further rate cuts cannot be ruled out in 2025 if the US unemployment rate rises. This could weaken the dollar, albeit not too drastically, as other central banks are also expected to cut rates. A peak in the dollar has historically been favourable for Asian and EM assets.

Fig. 1. Dollar Index

Source: Tradingeconomics.com. January 2025.

Embracing volatility

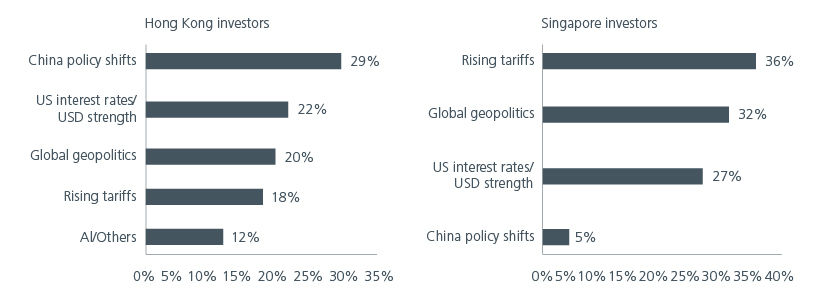

Besides tariffs, geopolitics, USD strength and China policy shifts are among the many other factors that could drive the markets this year. See Fig. 2.

Fig. 2. What do you think will be the key market driver in 2025?

Source: Eastspring Investments. Poll was taken at Eastspring Investments’ 2025 Market Outlook events in Singapore and Hong Kong in January which were attended by more than 100 institutional investors.

Given that markets are likely to stay volatile, there are several key considerations for investors. Firstly, US equities and the US dollar are expensive; historically, buying undervalued assets has proven more beneficial in the long run. Secondly, while the dominance of momentum trading over the past three years has reduced diversification in common indices, our multi-asset team stresses the importance of diversification and risk management even more during periods of high policy uncertainty. Equities that pay dividends and exhibit low volatility can help to reduce overall portfolio risk. Meanwhile, the relatively low valuations of EM equities present a stark contrast to the high prices of US equities. As Asia and EMs have the potential to exceed expectations, they can provide genuine diversification benefits for investors.

Active investing will be even more critical for investors in 2025. With tariff uncertainty looming at the regional/country level, the environment would be challenging for index returns and passive investing.

Diversified set of active opportunities

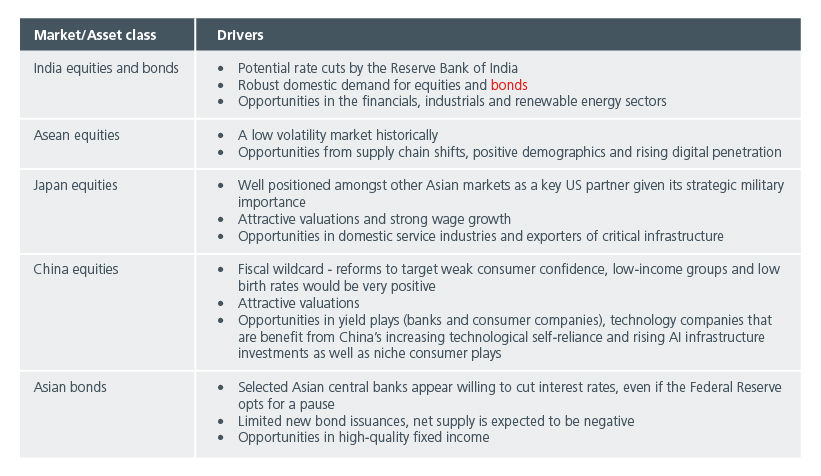

Despite the potential challenges at the country and regional levels in Asia and the EMs, our investment teams are leveraging on the following idiosyncratic drivers to uncover alpha opportunities at the security level:

Fig. 3. Idiosyncratic drivers and opportunities

Source: Eastspring Investments. January 2025.

The path forward for Asia and EMs will depend on the interplay between Fed policy, regional dynamics, and evolving investor sentiment. Incoming data on US unemployment will play a pivotal role in shaping the Fed's decisions. While the Federal Open Market Committee’s (FOMC) January statement and Chair Powell’s press conference included significant changes that the market perceived as slightly hawkish, leading to reduced expectations for rate cuts this year, we interpret Chair Powell's stance as still leaning towards a dovish outlook. The Fed is closely monitoring data to decide its next move, particularly showing sensitivity to any potential weaknesses in the labour market. This suggests that even if a rate cut in March is unlikely, a cut in May remains a possibility. Asia and EMs are well positioned to benefit from a shift to US lower rates and a weaker USD.

This commentary leverages on some of the key insights that were shared during Eastspring’s 2025 Market Outlook events held in Singapore and Hong Kong in January.

The information and views expressed herein do not constitute an offer or solicitation to deal in shares of any securities or financial instruments and it is not intended for distribution or use by anyone or entity located in any jurisdiction where such distribution would be unlawful or prohibited. The information does not constitute investment advice or an offer to provide investment advisory or investment management service or the solicitation of an offer to provide investment advisory or investment management services in any jurisdiction in which an offer or solicitation would be unlawful under the securities laws of that jurisdiction.

Past performance and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the strategies managed by Eastspring Investments. An investment is subject to investment risks, including the possible loss of the principal amount invested. Where an investment is denominated in another currency, exchange rates may have an adverse effect on the value price or income of that investment. Furthermore, exposure to a single country market, specific portfolio composition or management techniques may potentially increase volatility.

Any securities mentioned are included for illustration purposes only. It should not be considered a recommendation to purchase or sell such securities. There is no assurance that any security discussed herein will remain in the portfolio at the time you receive this document or that security sold has not been repurchased.

The information provided herein is believed to be reliable at time of publication and based on matters as they exist as of the date of preparation of this report and not as of any future date. Eastspring Investments undertakes no (and disclaims any) obligation to update, modify or amend this document or to otherwise notify you in the event that any matter stated in the materials, or any opinion, projection, forecast or estimate set forth in the document, changes or subsequently becomes inaccurate. Eastspring Investments personnel may develop views and opinions that are not stated in the materials or that are contrary to the views and opinions stated in the materials at any time and from time to time as the result of a negative factor that comes to its attention in respect to an investment or for any other reason or for no reason. Eastspring Investments shall not and shall have no duty to notify you of any such views and opinions. This document is solely for information and does not have any regard to the specific investment objectives, financial or tax situation and the particular needs of any specific person who may receive this document.

Eastspring Investments Inc. (Eastspring US) primary activity is to provide certain marketing, sales servicing, and client support in the US on behalf of Eastspring Investment (Singapore) Limited (“Eastspring Singapore”). Eastspring Singapore is an affiliated investment management entity that is domiciled and registered under, among other regulatory bodies, the Monetary Authority of Singapore (MAS). Eastspring Singapore and Eastspring US are both registered with the US Securities and Exchange Commission as a registered investment adviser. Registration as an adviser does not imply a level of skill or training. Eastspring US seeks to identify and introduce to Eastspring Singapore potential institutional client prospects. Such prospects, once introduced, would contract directly with Eastspring Singapore for any investment management or advisory services. Additional information about Eastspring Singapore and Eastspring US is also is available on the SEC’s website at www.adviserinfo.sec. gov.

Certain information contained herein constitutes "forward-looking statements", which can be identified by the use of forward-looking terminology such as "may", "will", "should", "expect", "anticipate", "project", "estimate", "intend", "continue" or "believe" or the negatives thereof, other variations thereof or comparable terminology. Such information is based on expectations, estimates and projections (and assumptions underlying such information) and cannot be relied upon as a guarantee of future performance. Due to various risks and uncertainties, actual events or results, or the actual performance of any fund may differ materially from those reflected or contemplated in such forward-looking statements.

Eastspring Investments companies (excluding JV companies) are ultimately wholly-owned / indirect subsidiaries / associate of Prudential plc of the United Kingdom. Eastspring Investments companies (including JV’s) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America.